Key Points

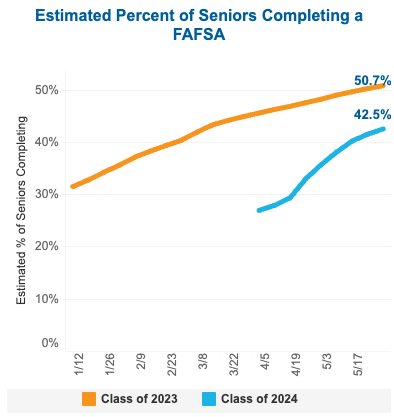

- Only 42.5% of high school seniors have competed the FAFSA, a decrease of 14.4% compared to the prior year

- Nevada, Florida, Utah, Arizona, and Alaska are the states with the lowest completion rates

- Lower FAFSA completions means that fewer families will receive need-based financial aid for college (or even attend college to being with)

Only 42.5% of the high school class of 2024 has completed the FAFSA as of May 24, according to the latest data from the National College Attainment Network. This is 14.4% below the completion rate of the class of 2023 at this same time last year.

This huge decline can be attributed to the Department of Education's failed FAFSA rollout and continuous delays even after it launched. The Department of Education has been pushing to increase FAFSA completions through various outreach initiatives, but as summer approaches for seniors, FAFSA completions have plateaued.

NCAN FAFSA Tracker as of May 24, 2024

Even though many colleges have extended their financial aid deadlines, by not completing the FAFSA, families are potentially missing out on financial aid - including Pell Grants. Furthermore, without receiving financial aid, many experts worry that college enrollment will decline as families decide they cannot afford it.

FAFSA Delays And Botched Rollout

The FAFSA typically opens for completion in October, and families can being the financial aid process well before deciding on college enrollment (which happens the following May).

However, this year, the FAFSA opening was delayed until the last days of December, and processing was delayed all the way until late-March (through May). Even once FAFSA submissions were opened, families faced issues of inaccurate data requiring reprocessing, and a myriad of other errors.

The end result is that families were flying blind into college admissions season - potentially having to make enrollment decisions without even knowing the cost of college.

Related: Most Expensive Colleges In 2024

States With The Highest And Lowest Completion Rates

Based on the latest data from NCAN, here are the states with the highest and lowest FAFSA completion rates:

Highest FAFSA Completion Rates

- Tennessee - 56%

- Louisiana - 53.8%

- Illinois - 53.2%

- Washington D.C. - 51.8%

- Texas - 51.3%

Lowest FAFSA Completion Rates:

- Alaska - 22%

- Utah - 27.4%

- Arizona - 29.2%

- Florida - 29.9%

- Nevada - 31.2%

What This Means For Families

While the FAFSA submission deadline has passed for many states and colleges, that doesn't mean you shouldn't apply.

The FAFSA can unlock both federal Pell Grants and student loans, which can be valuable options for students to pay for college.

Furthermore, some colleges may still be able to award scholarship and grant money for eligible students. However, they will need that FAFSA to validate financial need.

Finally, some merit scholarships, even though they are merit-based, require the FAFSA to be completed.

The bottom line is that families should still fill out the FAFSA if they are planning to attend college this fall.

Don't Miss These Other Stories:

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves