YNAB and Empower are two of the most popular budgeting tools today.

The right budgeting tool can help you achieve your financial goals. While You Need A Budget (YNAB) and Empower are both worthwhile options, the right choice will depend on your preferences and the tools you care about the most.

In this breakdown of YNAB vs. Empower, we cover the features and user experience of both platforms. We also highlight the differences to help you decide which budgeting tool is the right fit for your situation.

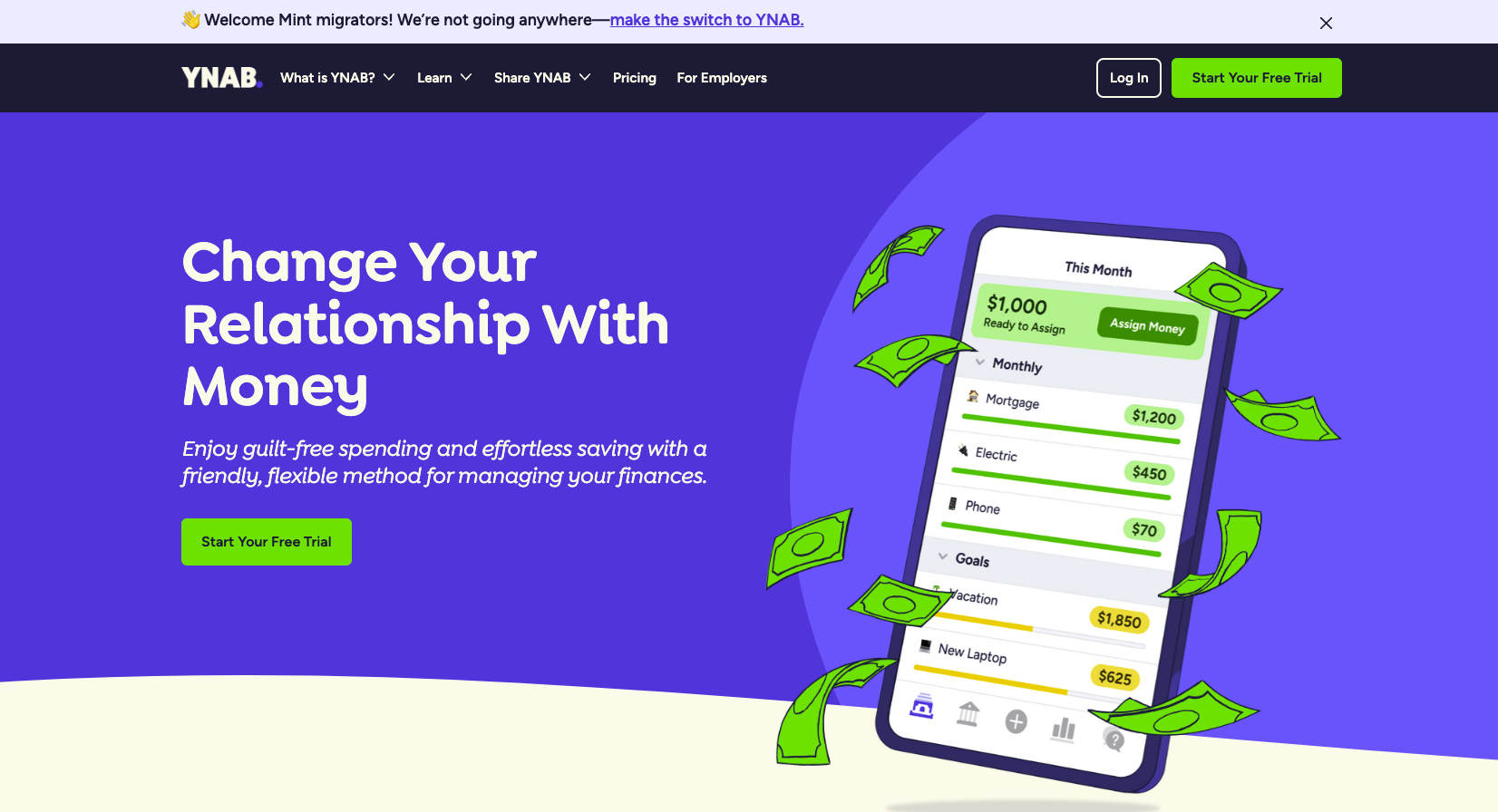

Overview Of YNAB (You Need A Budget)

You Need A Budget, or YNAB, is one of the best budgeting apps on the market today. The tool can help you create a budget and optimize your spending to push toward your financial goals. We take a look at what YNAB has to offer below. But if you want a more in-depth look, read our full YNAB review.

History And Philosophy

Since launching in 2014, YNAB has built a reputation as a powerful zero-based budgeting tool for those who want to keep a close eye on their spending.

The budgeting philosophy behind YNAB’s software is based on the following rules:

- Give Every Dollar A Job. When money comes into your account, you should have a plan for how to use every single dollar.

- Embrace Your True Expenses. It’s important to be honest about what your life really costs. Hidden expenses might include vacations, holidays, and expected car repairs. YNAB advocates planning for all of your known expenses.

- Roll With The Punches. Life can throw you an unexpected expense. Instead of letting it stop you in your tracks, YNAB advocates moving funds from another spending category and moving forward quickly.

- Age Your Money. The ultimate goal when using YNAB is to reach a point where you're using the income you earned last month to cover this month’s expenses. You can achieve this by being purposeful with your money and consistently spending less than you earn. Aging your money gives you more breathing room.

Core Features

YNAB’s key features include the following:

- Give every dollar a job. As mentioned above, the key tenant of YNAB is to give every dollar a job. This message permeates through the platform.

- Goal setting. YNAB makes it easy to set up financial goals, like paying off debt or building an emergency fund. You can then use the platform to track your progress in your personal finance journey.

- Real-time expense tracking. YNAB makes it easy to track your expenses in real time. If you activate this feature, the platform will pull in your expense data automatically.

Notably, YNAB doesn’t offer any investment features.

User Experience

- Educational resources. YNAB offers daily online classes to help you beef up your financial literacy. With a better understanding of money management, you can make efficient financial decisions.

- iOS and Android apps. You can download the mobile app to make it easier to stay on top of your money at any time.

- Make progress toward goals. YNAB facilitates cutting down on financial waste to make progress toward your financial goals.

- Customization is easy. Everyone has a unique financial situation. But YNAB makes it easy to customize your budget to suit your life.

- Share with other users. You can share your budget with up to 5 other users, making it easy to include your entire household in your budget.

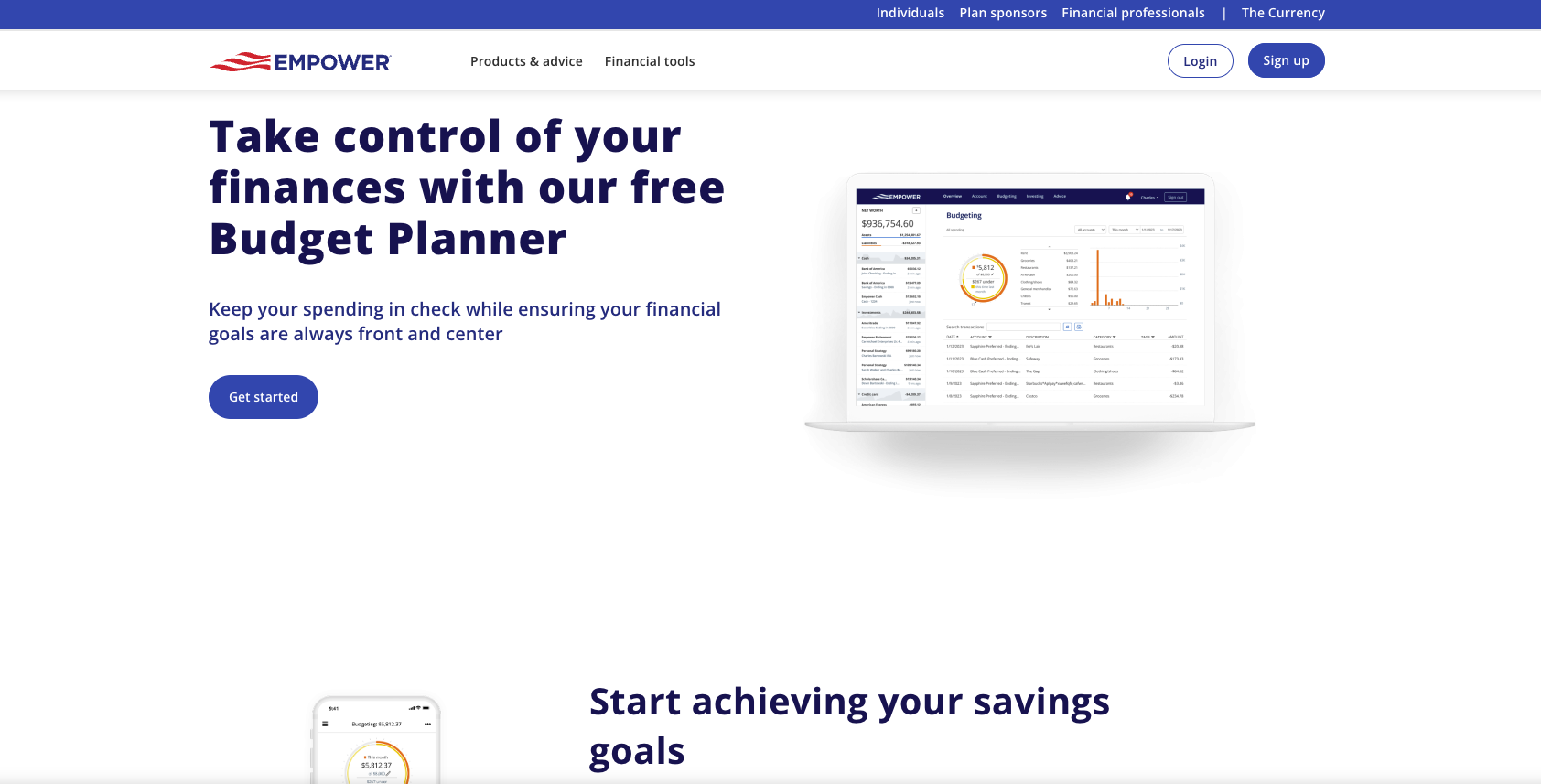

Overview Of Empower

Empower is a free financial management app that was initially founded under the name Personal Capital in 2010. It was rebranded to Empower in 2023. Serving more than 18 million customers, Empower allows you to view and track your budget and net worth, and even invest through its platform.

Here's a closer look at Empower, but if you want even more details, check out our full Empower review.

History And Philosophy

Empower (formerly Personal Capital) was founded by Bill Harris, former Intuit and PayPal CEO, and Rob Foregger, co-founder of EverBank. They've succeeded on their goal to create a "better money management experience for consumers."

Empower places its primary focus on building your investments and tracking your net worth. However, you can also keep tabs on your budget.

Notably, it’s entirely free to use Empower. The "catch" is that the company is an investment management provider, which means they’ll try to upsell you investment management services, which is how Empower makes money. But you don’t have to use the management services to avail yourself of the free budgeting and investing tools. However, some people find the telephone calls to speak to a financial advisor annoying. They become fewer and father between as time goes on.

Core Features:

Empower’s key features include:

- Investing tools. Empower’s key offerings center around investing. For example, you can track the value and performance of your portfolio, see an overview of your holdings, and determine your asset allocation.

- Expense tracking made easy. You can automate your expense tracking with Empower.

- Personalized approach. Empower uses an algorithm to analyze your spending patterns and look for ways to improve based on your financial goals. But notably, you have limited ways to personalize your budget.

- Highlights bills to negotiate. It’s easy to accidentally overpay for something. But Empower highlights which ongoing bills you should try to negotiate for savings.

- Cash flow. This analysis can help you determine where your money is coming from and where it’s going. With this information, you can make more efficient financial decisions.

- Automated saving. You can set up automatic savings transactions to make saving for your future easier.

User Experience

- Centralized dashboard. You can take a look at your entire financial picture in a single dashboard. That’s a useful feature for anyone trying to build wealth and stick to their budget.

- Customer support. You can get help from Empower support around the clock via phone or email.

- Empower Cash. This high-yield savings account offers a safe place to stash your cash with an attractive interest rate.

Key Differences Between YNAB And Empower

Empower and YNAB both offer budgeting tools. But their offerings vary. Here’s a look at some key differences:

- Customizable budgets. YNAB offers more manual control over your budgeting setup than Empower.

- Investment tools. Empower offers a suite of investment tools. YNAB doesn’t offer any investment tools.

- Educational resources. YNAB offers a wider range of educational resources for its users. Empower offers investment management services, but it’s missing a library of educational resources to lean on when setting up a budget.

- Customer service. You can get in touch with Empower support anytime over the phone or email. YNAB offers support via email and in-app chats

Pricing And Plans

YNAB costs $14.99 per month or $98.99 per year. Before paying for the tool, you’ll get a 34-day free trial to decide if it’s the right fit for your situation. College students can claim a free year of YNAB (we love student discounts).

In contrast, Empower is free to use. As mentioned above, Empower earns its money through investment management services. When you hit $100,000 in assets, you should expect a call from Empower’s advisors trying to sell you on their investment management services, for which you would pay a fee. You are free to decline their help and continue using the free tools offered by Empower.

YNAB Pros And Cons

Pros | Cons | ||

|---|---|---|---|

In-depth budgeting tool gives you maximum control | Price will be a turn-off for some | ||

Easy to track spending | No bill tracking | ||

34-Day free trial period | Can be difficult to learn |

Empower Pros And Cons

Pros | Cons | ||

|---|---|---|---|

100% free budgeting and net worth tracking | Lacks the in-depth budgeting features offered by YNAB | ||

App is easy to use | Some users have complained of bank connectivity issues. | ||

High-yield savings with attractive APY is available | Upsell phone calls to use their investment advisory services. |

User Reviews And Testimonials

YNAB has received thousands of user reviews. It earned 4.7 out of 5 stars on Trustpilot, 4.7 out of 5 stars in the Google Play Store, and 4.8 out of 5 stars in the Apple App Store. Overall, customers seem to report a bit of a learning curve when getting up to speed on the YNAB tools. But from there, most seem to have a great experience getting their finances under control with YNAB.

Empower has fewer reviews overall. But several thousand users have left their feedback. It earned 3.3 out of 5 stars on Trustpilot, 4.1 out of 5 stars in the Google Play Store, and 4.7 out of 5 stars in the Apple App Store.

Many of the negative reviews stem from bank connection issues. Overall, people seem to like the ability to budget for free. But the limited number of features is an issue for some.

Which App Is Right For You?

Both YNAB and Empower are useful platforms. But which one is right for you?

If you don't mind paying for an in-depth budgeting app that offers you maximum control over how your budget is set up, YNAB is the way to go. Between the two platforms, it offers more tools to help you get your spending within your control.

It’s an especially good choice for anyone struggling to manage their finances. For example, if your debt is increasing, you're having trouble saving, or you simply don’t know where your money is going, YNAB’s framework can be incredibly helpful.

Click here to get started with YNAB.

If you are looking for a free tool that will allow you to monitor your spending and overall net worth, Empower is the perfect choice. The ability to view your budget, investments, and net worth in a single dashboard is undeniably convenient. And the fact that it's free is a bonus.

The downside is that you’ll have to field some calls about Empower’s investment management services if and when your assets hit the $100,000 mark.

Click here to get started with Empower.

Final Thoughts

If you are having trouble deciding between Empower and YNAB, consider signing up for both to take a closer look. Empower is free to use anyways.

And you’ll have a 34-day free trial to decide if YNAB is a good fit for you. If neither feels like a good fit, check out some other top budgeting apps.

I've used and tried both of these tools many times over the years. They both have great features, but they are designed for different styles and uses of tracking money.

When you know which platform gels with your finances the best, don’t hesitate to jump in. Taking action to manage your finances now can help you make progress toward your financial goals.

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Colin Graves Reviewed by: Robert Farrington