Ever since Quicken stopped supporting Quicken 2005 for Mac, there hasn’t been another Quicken release that’s been as good. Mac users haven’t been left high and dry by Quicken, though. They can still use Quicken for Mac but it is an inferior experience compared to Quicken for Windows.

If you don’t want to use Quicken for Mac or run a virtual machine for Quicken for Windows, you’ll need to find some alternative personal financial software. That’s where Moneydance comes in.

Moneydance is a Quicken alternative with a strong Macs app that also works on Windows and Linux, as well as iOS and Android mobile devices. There are some differences between Quicken and Moneydance. But many Mac users who have tried it like it. In this article, we’ll look at what Moneydance offers and some differences between it and Quicken.

Quick Summary

- Top challenger to Quicken, especially for Mac users

- Offers budgeting, bill pay, investment tracking, and more

- One-time fee after free trial (up to 100 transactions)

- 90-day money back guarantee

Moneydance Details | |

|---|---|

Product Name | Moneydance |

Price | $49.99 (One-Time Fee) |

Platforms | Mac, Windows, Linux, iOS, Android |

Promotions | Free trial of up to 100 transactions |

Who Is Moneydance?

Moneydance was developed by a company called The Infinite Kind, which is based in Edinburgh, Scotland. They also created SyncSpace and SketchTo.

What Do They Offer?

If you’re familiar with Quicken, you’ll be familiar with the features in Moneydance. The interfaces are different but both apps have the same goal — to help you manage your personal finances. Some of the major features of Moneydance include:

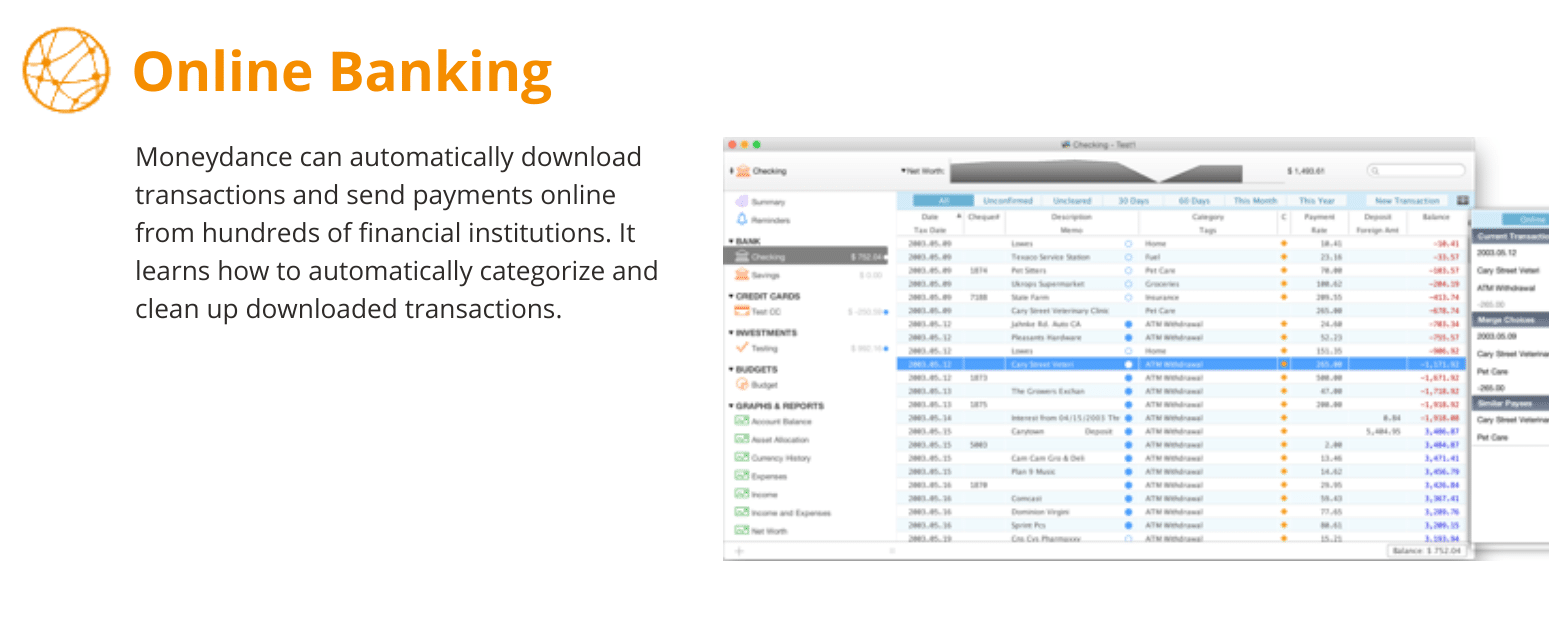

Online Banking And Bill Payment

Moneydance let’s you connect to your online financial institution and download transactions automatically. Hundreds of banks are supported.

After transactions are downloaded, Moneydance will try to automatically categorize and clean them up as well. Or, if you prefer the manual route, you can download an import a OFX, QFX, or QIF file.

Bill payment is available as well. Some financial institutions require you to complete a bill pay application before integrating bill pay with a third-party app.

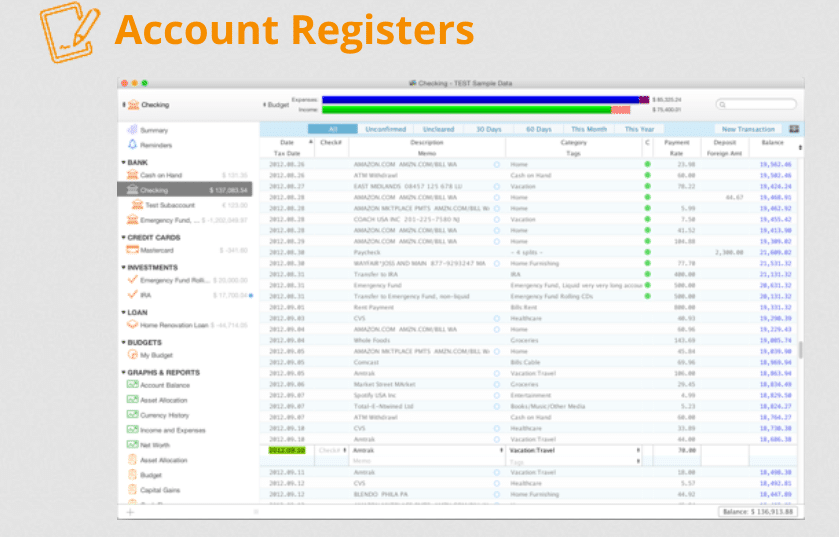

Interface And Account Management

The Moneydance interface is based on an account register. It is made to look like a checkbook. The summary page left pane contains all of your accounts, reports, graphs, and budgets. Accounts are categorized by type, such as bank accounts, credit cards, loans, and investments.

The middle pane is the register and the right pane is the calendar. The calendar is where you can see reminders, upcoming bills, and expenses for the month. Expenses and income are displayed at the top, so you always know where you stand with overspending.

Budgeting

With a budget in place, Moneydance will alert you as you get close to the limit for certain categories. You can also create multiple budgets. Compare Moneydance with other top-rated budgeting tools.

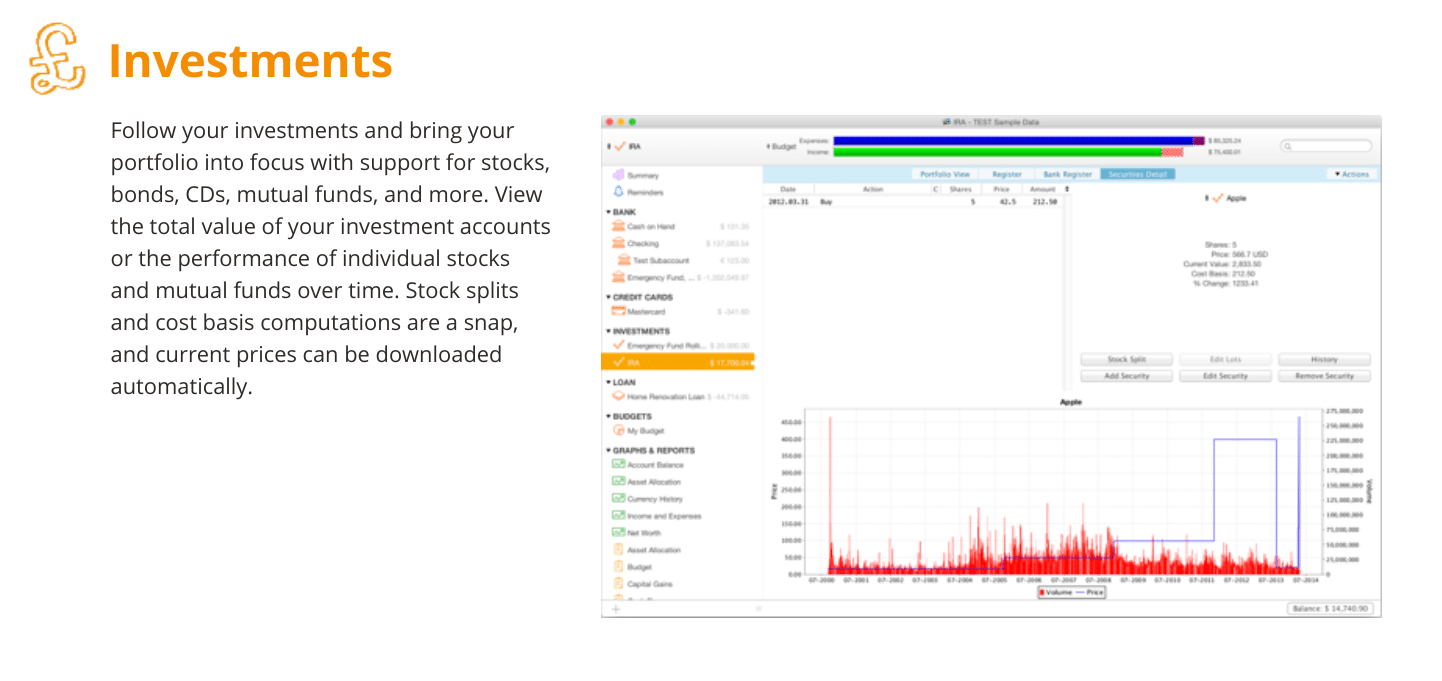

Investment Tracking

Moneydance will automatically download the latest prices for your investments. It supports stocks, bonds, CDs, mutual funds, and more. Stock splits and cost basis computations are easy to manage with Moneydance.

Quicken Vs. Moneydance

What are some of the main differences between these two financial management apps? Let’s go through them.

- Credit score monitoring: This is a Quicken only feature.

- Business transactions: Quicken has a version of its software that is oriented towards rental properties and businesses.

- Interface: Some people have mentioned that Moneydance’s interface looks outdated. However, this doesn’t negatively affect or limit its functionality.

- Foreign currencies and financial institutions: Moneydance wins here. It supports multiple currencies conversions and integrates with foreign financial institutions.

- Experience for Mac users: This one also goes to Moneydance. Quicken’s Mac version is not as good as its Windows version or Moneydance's Mac software.

- One-time fee: Unlike Quicken, Moneydance is a one-time purchase.

Switching From Quicken To Moneydance

After exporting your data from Quicken, you can import it into Moneydance. This is not a flawless experience, however. Expect some issues along with ongoing clean up for a few days or weeks after the import. This generally means re-categorizing some transactions and removing duplicates.

Header |  | ||

|---|---|---|---|

Rating | |||

Cost | $49.99 (One-Time) | $71.88 to $131.88/yr | Free |

Web Access | |||

Budgeting | |||

Bill Pay | |||

Cell | Cell |

Are There Any Fees?

Yes, Moneydance costs $49.99. It’s a one-time charge so you don’t have to worry about monthly subscriptions. There is also a free trial. You can enter in 100 transactions before the trial ends. Additionally, you get a 90-day money back guarantee.

How Do I Open An Account?

Moneydance is a desktop/mobile app. Visit https://moneydance.com to purchase, download, and install the software.

Chromebook users should no that there is currently no browser-based experience on the web. However, there is a Linux app which could be a workaround if you're willing to jump through a few hoops.

Is My Money Safe?

Yes, Moneydance uses high-grade encryption when communicating with financial institutions and its mobile app.

Is It Worth It?

If you’ve tried Quicken for Mac but found it lacking, Moneydance might be the alternative that fits all of your financial management needs. With Moneydance, you get access to all the same features regardless of your operating system of choice.

Moneydance is also cheaper than Quicken since it doesn’t charge an annual fee. And given that there’s a 100-transaction free trial (plus a 90-day money back guarantee), there's really no downside to giving it a whirl to see if it has what you're looking for.

But if you're looking for a free personal finance tool that also offers web access, an online-based budget and investment tracker, like Personal Capital, may be a better fit. Check out the five FREE financial tools everyone needs.

Moneydance Features

Price | $49.99 (One-Time Fee) |

Platforms |

|

Budgeting | Yes |

Bill Pay | Yes |

Credit Score Monitoring | No |

Investment Tracking | Yes |

Import Data Files | Yes, QFX and QIF files |

Foreign Currency Support | Yes (multiple currencies) |

Paper Check Printing | Yes |

Reminders | Yes |

Graph Types |

|

Report Types |

|

Customer Service Number | N/A |

Web Access | No |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | 35546 |

Promotions | None |

Moneydance Review

-

Product Cost

-

Ease of Use

-

Tools and Features

-

Customer Service

Overall

Summary

Moneydance is personal finance software that offers online banking, bill pay, budgeting, and investment tracking on Mac, Windows, and mobile.

Pros

- Fully functional and well-designed Mac interface

- Also supports Windows, Linux, iOS, and Android

- One-time fee

- Supports multiple currencies and financial institutions

Cons

- Requires local download (no web access)

- No phone-based customer support

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor