Buying life insurance can be a time-consuming and confusing experience. Shopping around for plans, talking to insurance agents, and learning as you go doesn’t instill too much confidence that you’ll get a good deal.

During 2020, so many businesses moved the bulk of their operations online. Customers became used to getting everything done efficiently through their web browsers. Everyday Life Insurance is another great online life insurance option.

It allows you to get life insurance quotes and apply for a plan online. Once you purchase a life insurance policy with Everyday Life, it will automatically adjust so that you’re always only paying for what you need. If this sounds appealing to you, read on as we review Everyday Life Insurance.

Everyday Life Insurance Details | |

|---|---|

Product Name | Everday Life Insurance |

Term Lengths | 10, 15, 20 and 30 years |

Coverage Limits | $100,000 to $5 million |

Age Limits | 18 to 70 |

Promotions | Get a $25 Amazon gift card for referring a friend |

Who Is Everyday Life Insurance?

Everyday Life Insurance (Everyday Life, Inc) is a insurtech company that provides technology-driven life insurance plans. Its CEO and co-founder is Jake Tamarkin. It was founded in June 2018 and is based in Boston, MA. The company has raised $785,000 through seed funding.

“People’s coverage needs change over time, often quite predictably, and smart financial planners know that consumers can save a lot of money if their life insurance is designed around this simple truth. However, traditional insurance policies and the agents who sell them -- even the cool new online ones -- are not designed to support that kind of approach," said Tamarkin to ITA PRO magazine.

What Do They Offer?

Rather than providing a static quote based on a potential customer's responses, Everyday Life Insurance uses technology to crunch the numbers of similar profiles. Including such data provides Everyday with a level of confidence in the accuracy of its offerings to customers.

Additionally, Everyday can adjust its policies based on life changes. It calls this Predictive Protection. Predictive Protection is meant to provide the right amount of insurance so that customers are not overpaying for insurance they don't need.

Everyday Life Plans

Everyday insurance plans are customized to your needs. This helps to avoid paying for insurance that isn't needed. For example, you might purchase a 30-year term life insurance plan from a traditional insurance company, while you only need maybe a 20-year plan. Don't expect a traditional insurance company to ring you up and let you know you have too much insurance.

You might purchase that same 30-year plan, and five years into it, you may only need a 20-year plan. Through the use of policy-stacking, Everyday can automatically adjust your policy to the shorter term to lower your monthly rate. Everyday says that the typical customer saves 50% over the life of the policy when compared to flat coverage options.

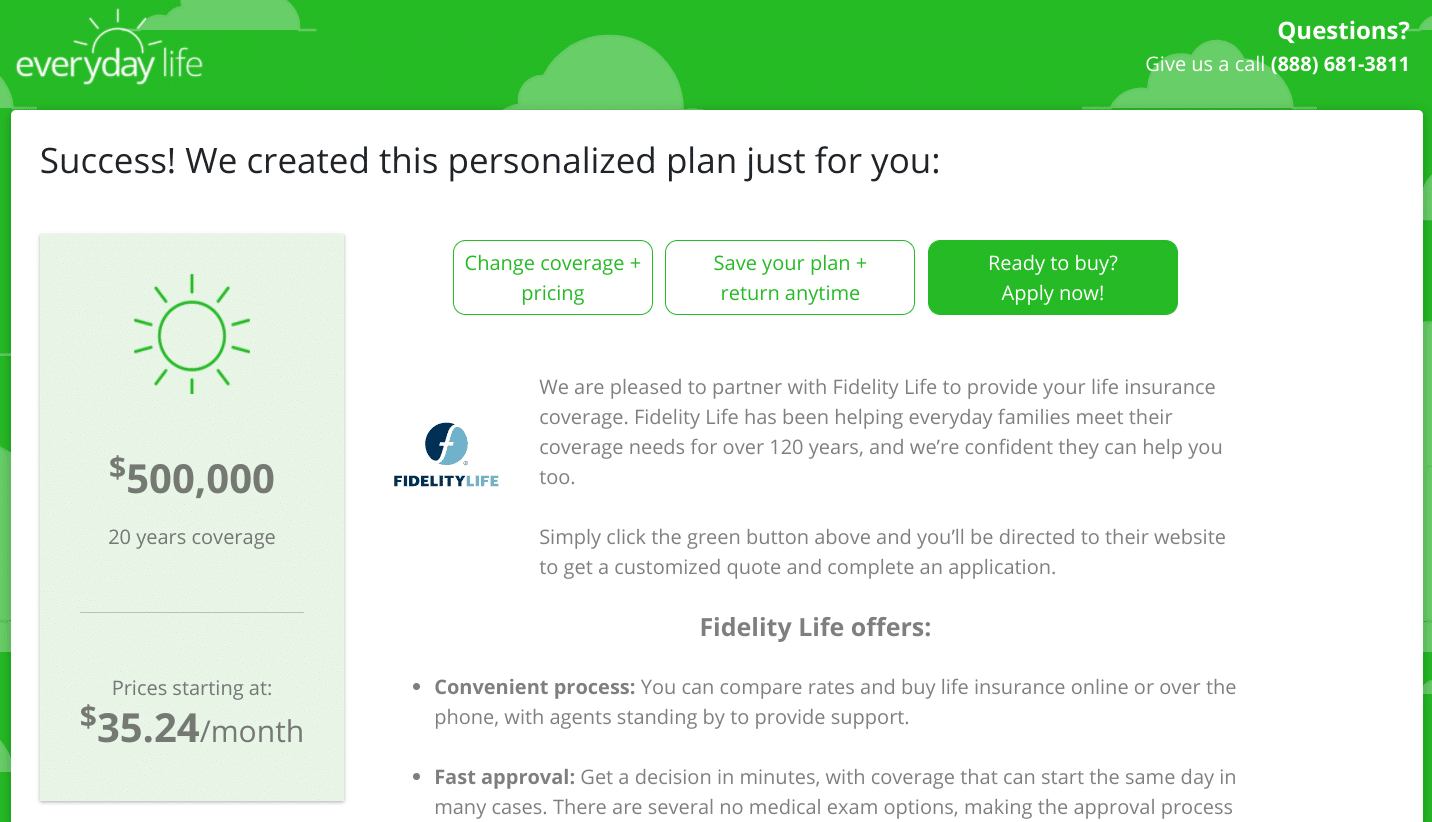

The potential for long-term savings is great, but you'll still want your starting premiums to be competitive. We ran a sample quote with Everyday and other life insurers for a 30-year-old male in excellent health who needs $500,000 of coverage for 20 years. For these parameters, Everyday Life Insurance provided a rate quote of $35.24 per month.

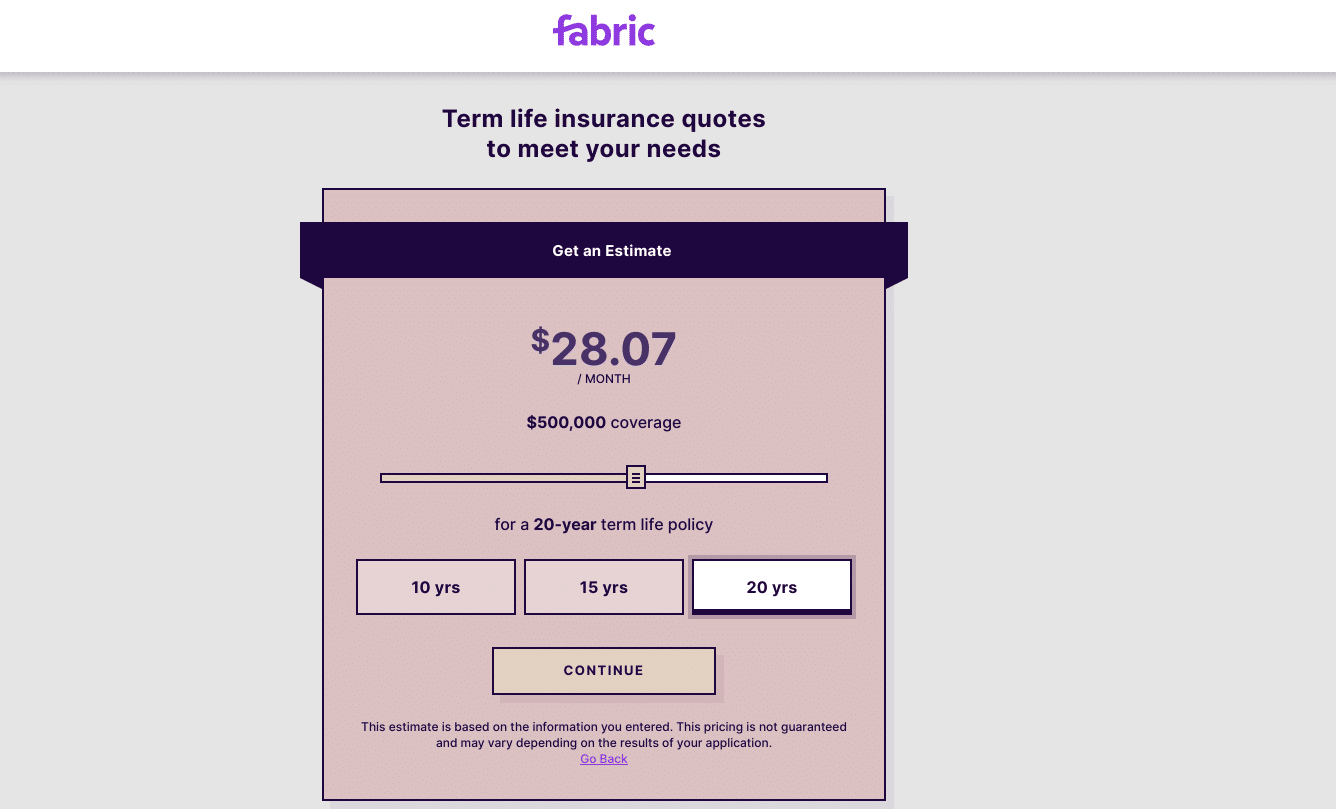

Next, we ran a rate quote with Fabric Life Insurance. For the criteria listed above, Fabric's best rate was a few dollars cheaper at $28.07 per month.

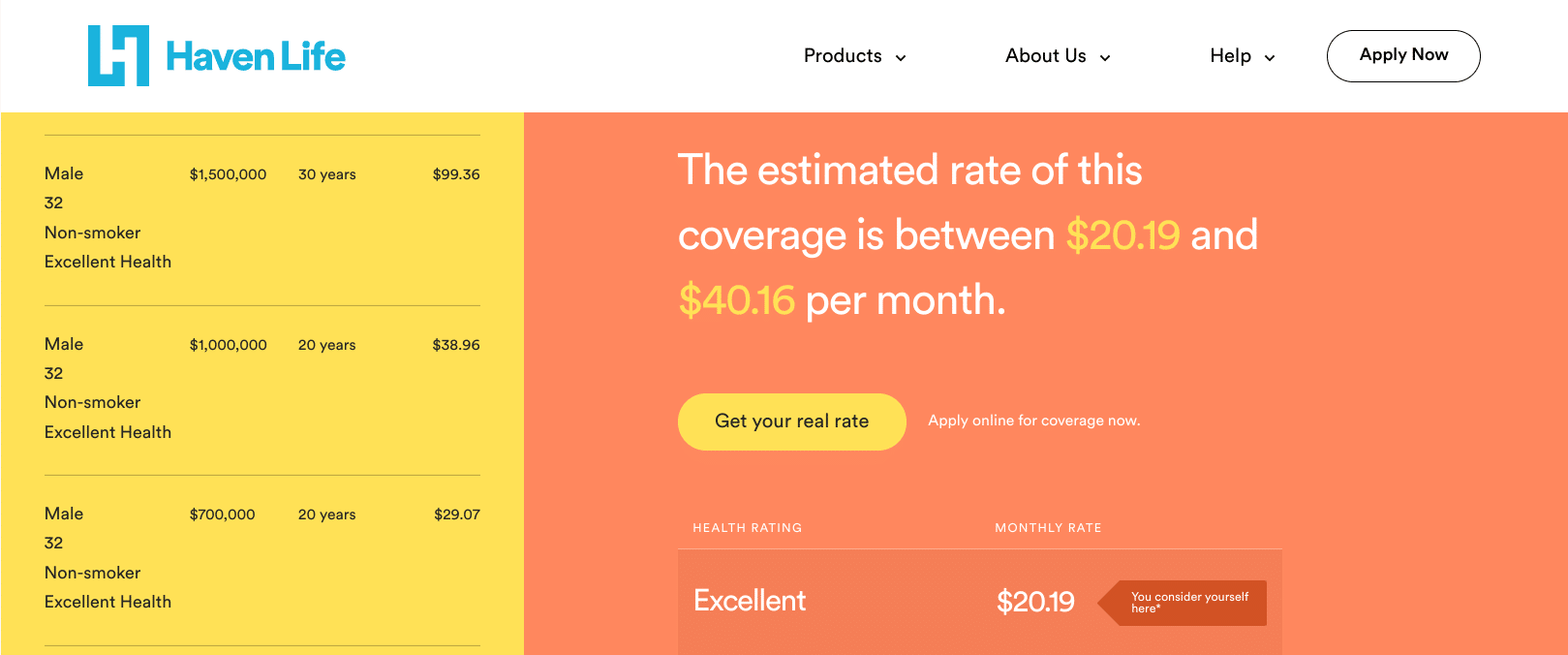

Finally, we checked with Haven Life. Instead of giving a single rate, it provided a rate range. For a 30-year-old male needing a 20-year, $500,000 policy, Haven Life's premium range was $20.19 to $40.16.

In this one example, it appears (based on premiums alone) that Fabric presents the best value. But for your age and health, Everyday Life Insurance or another insurer may be able to offer you the lowest premiums. Make sure that you get rate quotes from several of the top life insurance companies before you sign any policy paperwork.

How Do I Apply For A Policy?

There are three parts to the Everyday Life application process and each can be completed online. There's less paperwork than a traditional insurance provider and a doctor's visit is not required. In fact, you could receive an approval response in less than 15 minutes. Get started here >>>

1. Fill Out A Questionnaire

Everyday's questionnaire doesn’t require your personal information. But it will ask about your family, dependents, salary, where you live, date of birth, along with other basic information. You should be able to fill out all the information and start comparing policy options in less than two minutes.

2. Review Suggested Plans

Different plans may be suggested based on any adjustments. All plans will be customized to your profile (you can also update your initial profile at any time). Amounts dependents receive and monthly rates will be displayed as well.

3. Choose And Adjust Your Plan

You’ll see the monthly rate change in real-time, depending on your adjustments. Once you’re satisfied with the adjustments, you’ll complete the application with one of Everyday’s underwriting partners (Legal & General and Fidelity Life).

During this phase, you can ask the underwriter any questions. In rare cases, a medical exam may be required. This final step should take less than 10 minutes. Start the Everyday Life application process here >>>

Header |  |  | |

|---|---|---|---|

Rating | |||

Terms | 10, 15, 20, 30 years | 10, 15, 20 years | 5, 10, 15, 20, 30 years |

Coverage Limits | $100,000 to $5 million | $100,000 to $5 million | $5,000 to $ 3 million |

Age Limits | 18 to 70 | 18 to 60 | 18 to 65 |

Cell |

Is It Worth It?

For those who like to do everything online, yes, Everyday Life Insurance is worth checking out. However, others may be hesitant since Everyday has only been around since 2018.

Everyday is backed by Legal & General (a 184-year-old company with an A+ A.M. Best rating) and Fidelity Life (a 125-year-old insurer with an A- A.M Best rating), so financial strength shouldn't be a major concern.

However, Everyday is the one you'll go through for any issues. And it's unclear how well it's "Predictive Protection" will really work over the long haul. If you'd prefer to find a company with a longer track record, you can compare online life insurance options here.

Everyday Life Insurance Features

Term Lengths | 10, 15, 20, and 30 years |

Coverage Limits | $100,000 to $5 million |

Age Limits | 18 to 70 |

Medical Exam Required | No, but it may be requested under certain circumstances |

Same-Day Approvals | Yes, if no additional information is requested by the underwriter |

Renewable Plans | Yes |

Early Access to Benefits | Yes |

Anonymous Quotes | Yes |

Convertible to Permanent Insurance | Yes |

Available Riders | None publicly listed |

Coverage Partners |

|

Customer Service Number | 1-888-681-3811 |

Customer Service Email | info@everydaylifeinsurance.com |

Mobile App Availability | None |

Promotions | Get a $25 Amazon gift card for referring a friend |

Everyday Life Insurance Review

-

Pricing

-

Ease of Use

-

Products and Services

-

Customer Service

Overall

Summary

Everyday Life Insurance uses its technology to automatically adjust your policy when you reach different life milestones.

Pros

- Completely online application process

- Coverage automatically adjusts to life changes

- Medical exams rarely required

Cons

- New company with short track record

- Few customer reviews to be found online

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Chris Muller Reviewed by: Clint Proctor