Source: The College Investor

Greenlight is a debit card and investing app for kids and their parents.

Many parents want to teach kids about money. But cash is quickly going the way of the dinosaur.

Most kids prefer to spend money on digital downloads, in-app purchases, and online stores. So as our world becomes increasingly “touch-free,” parents need a tool to teach their children about managing money in the modern economy.

Greenlight, a debit card for kids, promises to help parents with this endeavor. The debit card is accompanied by an app, and several money management features that equip parents with the tools they need to help their kids. Here’s what you need to know about Greenlight.

Greenlight Details | |

|---|---|

Product Name | Greenlight debit card and app |

Min Initial Load | $1 to $20 |

Monthly Fee | $5.99/mo to $14.98/mo |

Savings Reward | 1% to 2% |

Promotions | None |

What Is Greenlight?

Founded in 2014, Greenlight is a debit card and app designed for kids, teens, and their parents. At this time, the app has been downloaded more than 4 million times.

The card works like a regular checking account. Parents and kids can deposit funds into the account and kids spend using the debit card. However, the Greenlight card and app offer additional features to help parents teach their kids about money.

For example, the account offers 1-2% interest on savings. And parents can boost that with parent-paid interest. Parents can monitor their kids' spending, automate allowance payments, and even place store-specific limits on spending.

The card never charges ATM fees, overdraft fees, or over-limit fees either. So kids can make financial mistakes without getting dinged.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Greenlight is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

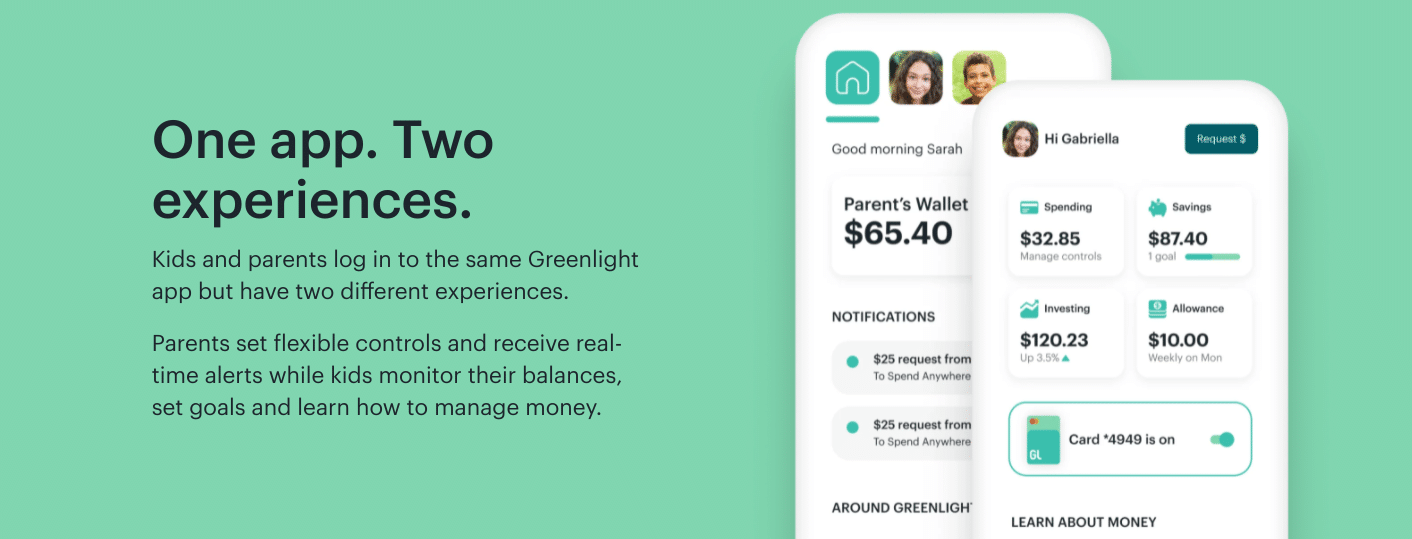

Greenlight is a conventional prepaid debit card with a twist. The app gives parents more information and more control of their children’s spending. Parents who are interested in teaching kids about money may find these features valuable.

Instant Transfers To Kid Accounts

Money transfers from a parent account to a child account are instant and free. And that's something that not many other payment tools offer right now.

For example, while Venmo does support instant transfers, it does charge a fee for them. And while instant transfers are free with Zelle, your child would need a bank account for you to use that service to send money to them. CashApp does support instant transfers at no cost, you just need an account.

Savings Rewards And Cash Back

Greenlight offers every kid a 2% interest on savings, 3% with Greenlight Max, and 5% with Greenlight Infinity. This is a turbo-charged savings rate in today’s low-interest-rate environment. Greenlight calls these earnings "Savings Rewards" rather than "interest."

There are other ways that the app encourages savings. For example, kids can round-up purchases to the next dollar and automatically save the change. The app also makes it easy to set savings goals and track their progress over time.

In addition to Savings Rewards, kids on the Greenlight Max and Infinity plan earn 1% cash back on their debit card transactions. There are no category restrictions for the cash back, but only Greenlight Max kids receive this benefit.

Greenlight Savings Rewards. Screenshot by The College Investor.

Parent-Paid Interest

Parents who want to further reward their children's saving habits can pay additional interest to them. Greenlight automatically calculates the interest and pays it to the kid accounts once per month.

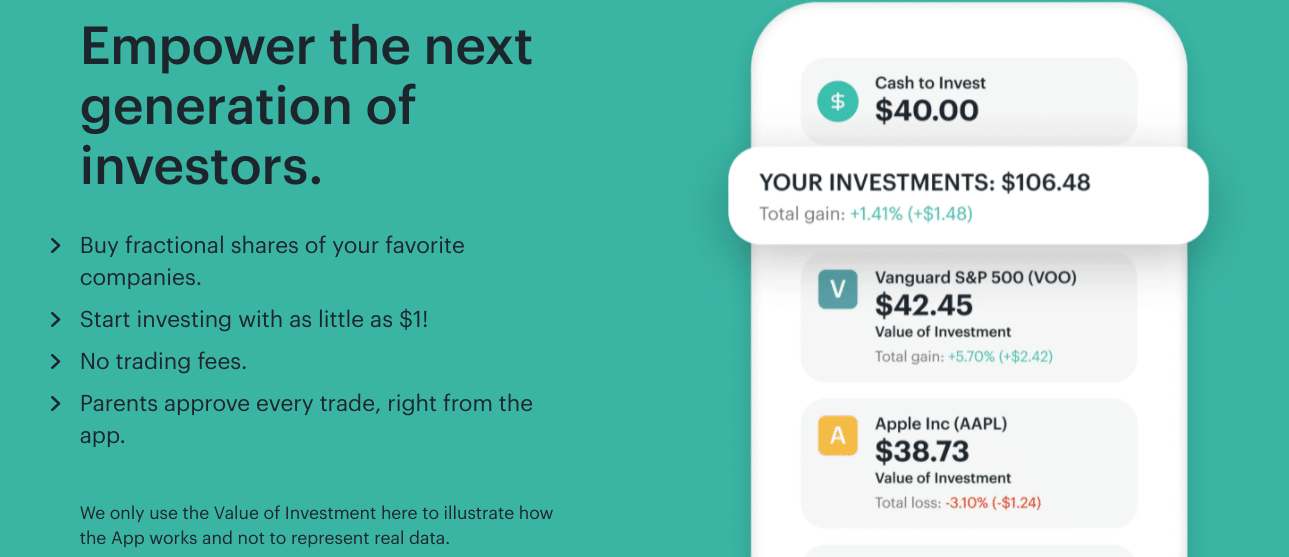

Teach Kids About Investing

Greenlight allows kids to buy fractional shares of stocks and ETFs (as little as $1) with no trading fees.

Greenlight Investing. Screenshot by The College Investor.

Parents who don’t have much experience with investing can learn alongside their kids. But note that like all investments accounts, Greenlight Invest accounts are not FDIC insured and may lose value.

Store-Specific Spending Controls

Parents can set spending limits on stores and ATMs. If your kids struggle with mindless spending on their phone's app store or at a certain fast-food restaurant, you can set restrictions that only apply to those specific merchants. To raise the limit, kids will have to talk with you first.

Educational App

Greenlight’s app is designed to help kids learn about money. Kids can set personal savings goals, and Greenlight will help them track towards that goal.

The app also provides visibility to balances and spending habits. Parents have visibility to the app too; so they can have data-driven discussions about spending if needed.

Greenlight App. Screenshot by The College Investor.

Are There Any Fees?

You can try Greenlight for free for one month. After the one-month trial, users are charged a monthly fee. The monthly fee is family-based and entitles the family to up to five debit cards.

Greenlight | Greenlight Max | Greenlight Infinity | |

|---|---|---|---|

Price | $5.99 per month | $9.98 per month | $14.98 per month |

Yield | 2% | 3% | 5% |

Cash Back | N/A | 1% | 1% |

Other Benefits | Option to invest with no-fee trades Black card Cell phone and purchase protection | Everything in the other tiers. Driving reports and crash notifications. Location sharing. |

The card also has a few miscellaneous fees such as a $3.50 card replacement fee (after the first replacement), and a custom card fee of $9.99 which is optional. Expedited replacement is $24.99.

The cards limit the entire family to $5,000 per month for all “loads” including direct deposit. This makes it a poor choice for teens or later adults who want to use this account to fund college expenses or other major purchases.

How Does Greenlight Compare?

Greenlight is one of the top family debit cards available today. Unlike most prepaid debit cards, it focuses on adding value for teens and parents. Parents can use the app to teach kids about money. And teens can use the debit card for most of their expenses. It’s also great to see that Greenlight allows teens to dabble in investing.

Another strong contender in this space is FamZoo. FamZoo offers similar functionality, but is more tightly focused on teaching kids how to manage money. Unlike Greenlight, FamZoo doesn't support investing. However, FamZoo helps kids set their money into “save,” “spend,” and “give” sub-accounts and has several teaching tools designed to prompt money conversations. It's also less expensive (if you pay in bulk).

Finally, if your child is a teen, you may want to consider GoHenry. GoHenry offers teen banking that encourages financial education and parental involvement. Here's a closer look at how Greenlight compares:

Header |  |  | |

|---|---|---|---|

Rating | |||

Pricing | $5.99 to $14.98/mo | $5.99/mo $25.99 for 6 months $39.99 for 12 months $59.99 for 24 months | $5 to $10/mo |

APY On Savings | Up to 5% | N/A | N/A ("Parent Paid") |

Pays Cash Back | Yes, but only with Greenlight Max and Infinity | No | No |

Fee-Free ATMs | None | None | 55,000+ |

Cell |

How Do I Open An Account?

To start with Greenlight, you can visit its website and enter your mobile phone number to download the app. Once downloaded, you’ll need to provide the following personal information:

- Your email address

- Your mobile phone number

- Your child’s/children’s name(s)

- Your legal first and last name

- Your physical address

- Your date of birth

- Your Social Security Number

Parents must also have a valid bank account to fund the accounts and to pay the monthly fee.

Once all this information is provided, Greenlight will send the appropriate number of cards to you in the mail. After the account is set up, your teens can download the app to check their balance, and start learning.

Is It Safe And Secure?

Greenlight is a debit card issued from Community Federal Savings Bank. The bank is FDIC insured. But as noted earlier, FDIC insurance does not apply to investments.

Information on the Greenlight app is stored using bank-level encryption. Of course, hackers may still find a way to steal personally identifiable information from Greenlight. But your information is as safe as it would be with another bank.

How Do I Contact Greenlight?

Greenlight makes it easy for customers to contact the company via phone, text, or email. The customer support number is 888-483-2645.

Customers who prefer to text can send questions to 404-974-3024. You can also email support@greenlight.com for more information.

Greenlight is headquartered in Atlanta, Georgia, and the debit cards are issued through Community Federal Savings Bank, a virtual bank based out of Queens, New York.

Why Should You Trust Us?

I have been writing and researching banking and personal finance products since 2009. At The College Investor, we've been comparing and reviewing banks since 2018, and track the best banks for savings and money market accounts daily from a list of over 50 major banks and credit unions.

Furthermore, our compliance team reviews our rates every weekday to ensure that we are accurately showing the correct rates and terms so you can make an informed decision about where to open a savings account.

Who Is This For And Is It Worth It?

Greenlight offers a compelling product for parents who want to teach kids about money. The investing feature is particularly impressive, since opening a brokerage can be challenging for kids.

Families that won’t use the investing functionality, however, may find that FamZoo offers a better price and a better user experience. However, Greenlight is still an excellent option overall.

Greenlight Features

Account Types |

|

Minimum Initial Load | $1 to $20 |

Savings Rewards | 2% to 5% |

Cash Back | 0% to 1% |

Monthly Fees |

|

Card Replacement Fee |

|

Custom Card Fee | $9.99 |

Stock/ETF Trade Fees | None |

Fractional Shares | Yes, as little as $1 |

Branches | None (online-only bank) |

ATM Availability | Debit cards can be used at ATMs, but there's no fee-free ATM network |

Customer Service Number | 888-483-2645 |

Customer Service Hours | Monday-Friday, 8 AM-11 PM (EST) Saturday-Sunday 8 AM-9 PM (EST) |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | No |

Direct Deposit | Yes |

Bill Pay | No |

FDIC Certificate | 57129 (through Community Federal Savings Bank) |

Promotions | None |

Greenlight Review

-

Pricing & Fees

-

Features & Options

-

Ease of Use

-

Customer Service

Overall

Summary

Greenlight is a debit card and app designed for kids and parents. It offers instant transfers, savings rewards, investing access, and more.

Pros

- Transfer money to kids instantly

- Use the app to teach kids about money

- Trade fractional shares with no fees

- Earn Saving Rewards (and cash back with Greenlight Max)

Cons

- Monthly fee

- No fee-free ATM access

- $5,000 monthly load cap (not appropriate for expenses like funding college).

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett