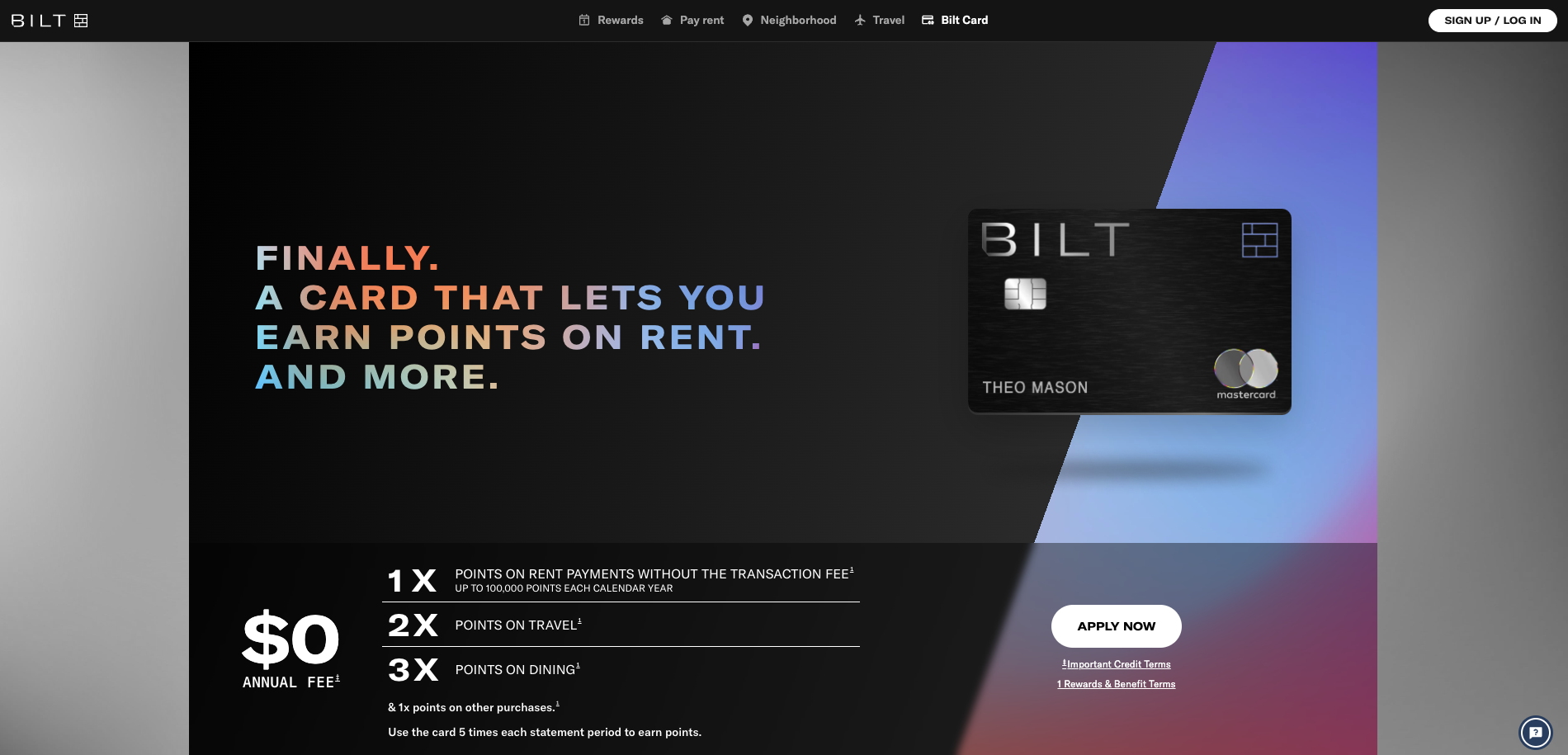

Wouldn't it be nice to earn rewards on your monthly rent payments? The Bilt Mastercard might be the solution. It's a credit card designed to reward you for purchases, including your rent payments.

Your monthly rent is likely one of, if not your largest, monthly expense. We explore the Bilt Mastercard in detail, and let you know how it can benefit renters, to help you decide if it’s a good fit for your budget. We also compare Bilt to other popular rewards credit cards.

Quick Summary

- Bilt Rewards offers benefits for rent payments, including no transaction fees.

- If your property only accepts checks, Bilt can send a check, which still allows you to tap into rewards.

- The card also rewards spending on travel, dining, and more.

- FSA/HSA savings program in partnership with Walgreens

Bilt Rewards Details | |

|---|---|

Product Name | Bilt Mastercard |

Annual Fee | $0 |

Rewards |

|

Purchase APR | 21.49%, 24.49%, or 29.99% |

Promotions | None |

What Is Bilt Rewards?

Bilt is a membership program and credit card that allows you to earn rewards for purchases, including your rent payments. Its credit card—the Bilt World Elite Mastercard—is issued and administered by Wells Fargo Bank, N.A. If you're a renter looking to earn rewards on your monthly rent payments, Bilt might be the solution you’ve been waiting for.

What Does It Offer?

Let’s take a closer look at what Bilt Rewards has to offer.

Earn Rewards For Rent Payments

When it comes to earning rewards, Bilt has plenty of options to choose from. But the most unique reward offering is the ability to earn rewards on your rent payment. You can earn 1 point for every dollar you spend on rent. Plus, Bilt will waive the transaction fee for this purchase.

Not all property management companies allow you to pay rent with a credit card. Bilt offers to send a check to properties that only accept checks. When you write a check and send it through Bilt, you still earn rewards. In order to get points for rent, you’ll need to make at least five transactions per statement period. Rent rewards are capped at 100,000 points annually.

Neighborhood Rewards

Bilt's Neighborhood Rewards program aims to treat its members like VIPs in the areas where they live. It does this by allowing members to earn rewards and access special perks in their neighborhood by using any debit or credit card linked to their Bilt account.

In addition to earning points on rent payments, you can also earn points for travel and dining purchases. You’ll earn 2 points for every dollar you spend on travel. You’ll earn 3 points for every dollar you spend on dining.

Plus, you’ll earn one point for every other dollar you spend with the card.

On the first of the month, you can take advantage of a Rent Day promotion. You’ll earn six points for every dollar spent on dining, four points for every dollar spent on travel, and two points for all other purchases.

New! Bilt Partners With Walgreens For Additional Benefits

In August 2024, Bilt announced an expansion of its Neighborhood Rewards program with a one-of-a-kind collaboration with Walgreens, a leading retail pharmacy. The new partnership adds three key components to the Neighborhood Rewards program:

1. Automatic FSA/HSA Savings: Did you know? Over $4 billion in FSA funds go unused due to the confusion around what items qualify, and the fact that you need to carry a separate payment card to receive benefits. Now, when Bilt members shop at Walgreens using their linked debit or credit card, Bilt can identify FSA or HSA eligible items automatically, and can apply benefits with a single click.

2. Enhanced Rewards: In addition to travel and dining rewards, Bilt members can now earn 2x Bilt points on Walgreens-branded merchandise, 1x Bilt points on all purchases made at Walgreen, and 100 Bilt points on many prescription refills. This means that by linking any rewards credit card you wish to use to your Bilt account, you can stack your rewards points earning.

3. Complimentary Photo Prints: Bilt also announced that members will soon be able to access free photo prints at their local Walgreens location, a nice additional benefit.

Additional Perks

Beyond the ability to earn points, Bilt offers several perks for cardholders. Some of these include:

- Trip cancellation and interruption protection

- Trip delay reimbursement

- Auto rental collision damage waiver

- No foreign currency conversion fee

- World Elite Mastercard Concierge

- Cell phone protection

- Theft and damage protection for some purchases

Most renters can find extra value in the perks tied to this credit card. If you live in a Bilt Rewards Alliance property, you can get extra perks as a cardholder. Some of the extra benefits include access to rent giveaways, status matches, transfer bonuses, and more.

Flexible Redemption Options

As you accumulate points, you can use them to pay for travel, shopping through Amazon, future rent payments, a future down payment on a home purchase, and statement credit redemptions.

Are There Any Fees?

The Bilt Mastercard doesn’t have an annual fee or foreign transaction fees attached. However, there are other costs to keep in mind.

As with any credit card, you will pay interest on your balance owing if its not paid in full each month. This means you could face an interest rate north of 20%.

How Does Bilt Rewards Compare?

Bilt Rewards is not the only credit card option out there for rewards seekers. Here’s how it stacks up to two popular cash back credit cards.

The Chase Freedom Unlimited card offers 3% cash back on dining, 3% cash back on drugstore purchases, 5% cash back on travel purchased through Chase Travel, and 1.5% cash back on all purchases with no annual fee.

And for a limited time, you can earn 1.5% additional cash back on all card purchases for the first year, up to a $20,000 spending limit. Depending on your landlord, you might be able to use the card to pay for rent. However, expect a transaction fee.

The Citi Double Cash Back card offers 2% cash back on all purchases. It’s broken down into 1% as you make the purchase and 1% as you pay it off. If you are looking for a simplified way of earning rewards without an annual fee, this card could be a good fit.

Header |  |  | |

|---|---|---|---|

Rating | Not Yet Rated | Not Yet Rated | |

Annual Fee | $0 | $0 | $0 |

Earning Rates | Up to 3x points | Up to 5% Cash Back | 2% Cash Back |

Rent Rewards | Yes | No | No |

Purchase APR | 21.49%, 24.49%, or 29.99% | 20.49% to 29.24% | 19.24% to 29.24% |

Cell |

How Do I Open An Account?

If you want to open a Bilt Rewards credit card, the process starts by providing your email address. You’ll also need to share your name, birthday, phone number, Social Security number, and more to apply.

Is It Safe And Secure?

The Bilt Mastercard comes with all of the protection that Mastercard has to offer. Bilt uses encryption to keep your information safe. Also, the card is issued by Wells Fargo, which might give you more peace of mind.

How Do I Contact Bilt Rewards?

If you need to connect with Bilt Rewards, you can reach out via the chat feature on the company’s website. They have live agents available between the following hours: Mon-Fri: 8am-10pm EST, and Sat-Sun: 9am-5pm EST. You can also email support@biltrewards.com or call the number on the back of your Bilt Mastercard

Bilt's average Trustpilot reviews (2.9 out of 5 stars) indicate some enjoy their experience, but others don’t. However, its mobile app has earned positive ratings in both the Apple App Store and Google Play Store.

Is It Worth It?

Renters looking to maximize the value of their rent payments through point accumulation can find a lot to like about Bilt Rewards. If you happen to live on a Bilt Alliance property, you might be able to stretch your points even further. If you live in close proximity to a Walgreens pharmacy, you can also take advantage of Bilt's new FSA/HSA Savings program, and earn points for your Walgreens purchases.

However, if you aren’t interested in paying your rent through BIlt and don't shop at Walgreens, there are better no annual fee rewards cards available. Homeowners or others who don’t have a rent payment to contend with won’t get too much value out of this credit card.

Bilt Rewards Features

Product | Bilt Mastercard |

Annual Fee | $0 |

Rewards |

|

Purchase APR | 21.49%, 24.49%, or 29.99% |

Foreign Transaction Fees | None |

Other Card Benefits |

|

Customer Service Email | support@biltrewards.com |

Customer Service Hours (Live Chat) | Mon-Fri: 8am-10pm EST, and Sat-Sun: 9am-5pm EST |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | None |

Bilt Rewards Review

-

Pricing and Fees

-

Ease of Use

-

Products And Features

-

Customer Support

Overall

Summary

Tired of paying your monthly rent and getting little in return? Bilt allows you to earn points on your rent payments.

Pros

- Earn points for paying rent

- No annual fee

- FSA/HSA savings benefits

- Many redemption options

Cons

- No welcome bonus

- Not ideal for homeowners

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Colin Graves Reviewed by: Robert Farrington