If you have had to pay for medical school, pharmacy school, law school, or graduate school, then you know that student loan debt climbs very quickly for people who pursue these paths.

It’s not uncommon to meet a medical resident or new pharmacy graduate who has at least $250,000 in student loan debt.

With such high amounts of debt — and usually, high interest rates — the answer to paying off debt is not simple.

What’s someone with over six figures in student loan debt to do? Should you pursue student loan forgiveness? Should you refinance your loans? Can you save money on your loans even if you’re a high earner? How about your tax situation? How will that factor into your journey to debt freedom?

What if you could get someone to look closely at your numbers and give you a plan tailored to your specific situation? That’s what Student Loan Planner — a consulting service to help people in the exact situation I’ve described above — does. They help people come up with a plan to get out of debt faster. And as they say on their website, “Ditch Your Student Loan Anxiety For Good.”

Today’s post is a review of Student Loan Planner and whether or not using this consulting service will be good for you.

About Student Loan Planner and Reviews

Student Loan Planner was founded by Travis Hornsby (Editor’s Note: See his and his team’s credentials here). He started the service in 2016 after he helped his wife and her friends figure out how to get rid of their six-figure student loan debts.

According to the Student Loan Planner website, Travis and his team of credentialed professionals have worked with 8,300+ professionals. Student Loan Planner estimates that they have helped their clients save a projected $156 million.

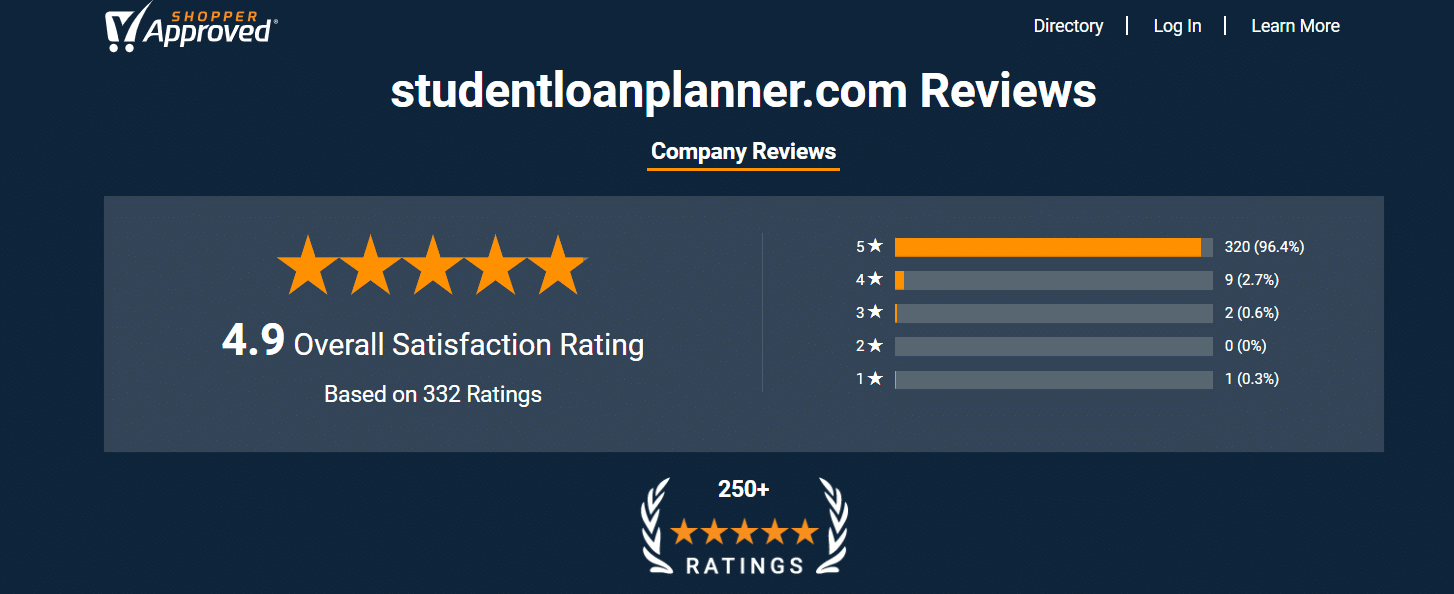

Student Loan Planner currently has 1859 reviews on Shopper Approved with 97% of users rating them at 5 out of 5.

So how can you work with Student Loan Planner and what will you get out of the experience?

Who Is This Service For?

Student Loan Planner can help you regardless of how much debt you owe. However, as I mentioned before, Student Loan Planner is especially helpful for people who have six-figure student loan debt amounts and/or have complex finances and repayment plan possibilities.

If pursuing a postgraduate degree in medicine, law, nursing, pharmacy, or any of those professions that are notorious for hefty debt has you anxious, you want to talk to the professionals at Student Loan Planner.

Because most of the professions listed above tend to be high-paying, a common misconception is that because they are high earners, they don’t qualify for any programs or avenues that reduce their student loan debt. This is not necessarily true.

Figuring out the details of what you might qualify for is daunting and time-consuming. Chances are you’re a busy professional and don’t have that type of time. And so, you spend years missing out on opportunities that could have gotten you out of debt faster.

This is where Student Loan Planner comes in handy. Because they’ve worked with so many people who have situations similar to yours, you can work with them to come up with the best plan for taking care of your debt.

On the Student Loan Planner website, they state that if you owe between $50,000 and $1 million, they can help you in one of two ways:

- They will create a custom student loan plan with details on how to get out of your debt.

- They will connect you with private lenders so you can refinance your loan at a lower interest rate.

How Much Does It Cost?

Student Loan Planner charges a $595 flat fee for a 1-hr consult. If you need more time, you can book an additional consult for a $495 flat fee.

Student Loan Planner sends out the invoices for their consulting service after the call.

How Does Student Loan Planner Compare?

Student Loan Planner is the industry-leader in financial planners that specialize in student loan debt. However, there is one other company that compares, and that's Student Loan Advice by the White Coat Investor.

Both of these companies offer financial plans by Certified Student Loan Professionals (CSLPs). Student Loan Advice focuses specifically on doctors with student loan debt, but they can help everyone. Student Loan Planner has helped more customers overall.

Header |  |  |

|---|---|---|

Rating | ||

Pricing | $595 | $559 |

Spouse Can Join Consult? | ||

Ongoing Email Support | 6 Months | 6 Months |

Cell |

My Thoughts

First of all, Travis Hornsby, the founder of Student Loan Planner, is well known in the personal finance community and had built up his credibility over the years. It’s kind of like knowing that local shop owner who has been in your community for years. He used to be a bond trader with Vanguard and he has a sharp financial mind.

So if I would recommend someone to consult with to get your high student loan debt down, I would recommend him and his team.

With that being said, who benefits most from a consultation? While this isn't all-encompassing, I've found that those who benefit most include:

- Individuals in high earning professions that should balance debt repayment with investing and other goals

- Small business owners who want to maximize their own retirement savings while paying the debt

- Couples who need to tackle their loans together and weigh their options for repayment strategically

I'm sure there is more - but where Travis and his team specialize is in the complex situations.

I’m always on the lookout for the best services and products to help you win at your financial life. One of those services is Student Loan Planner. If you think a do-it-yourself option is better, check out LoanBuddy for DIY student loan help.

Student Loan Planner Review

-

Ease of Use

-

Tools and Services

-

Pricing and Fees

-

Customer Service

Overall

Summary

The Student Loan Planner is a financial planning practice that specializes in student loan debt assistance. The team is comprised of CFAs and CFPs that have a fiduciary duty to their clients.

Pros

- Financial planning for student loan debt

- Fiduciary duty

- Can help figure out how to best handle your debt with your entire financial picture

Cons

- Price increases based on loan debt amount

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller