Source: The College Investor

This Halloween’s most terrifying stories have more to do with your money than goblins and zombies.

In light of this spooky season, we’re sharing some scary financial statistics and facts about money that could happen to you. But no need to run screaming, we give you a few recommendations to help you if you’re ever caught in any of these situations.

1. The Government Can Garnish Your Social Security Checks For Unpaid Student Loans

Most Federal student loan repayment plans lead to loan cancellation after 20 or 25 years. This means that most student loan borrowers will not have the chains of student debt going into retirement.

However, parents who want to help their kids through school may sign Direct PLUS or Parent PLUS loans. These forms of extra debt are debt in parent’s names, and can easily follow the borrower into retirement. If you default on your PLUS loans, the government can garnish up to 15% of your Social Security Benefits to offset the payments.

Luckily, it is possible to rehabilitate Parent PLUS loans and even get onto certain forms of Income Contingent Repayment Plans. These can be crucial to keeping more of your Social Security Check for your living expenses.

2. Inflation Is Rising Faster Than Wages

Whether you’re at the grocery store or the gas pump, you know that prices are rising across the board. What pundits called “transitory” inflation several years ago has stuck around, and now we're feeling it everywhere.

Unfortunately, the high rate of inflation means that most people have less spending power. Wages are increasing, but not as fast as inflation. According to the Bureau of Labor Statistics, the real value of wages and salaries increased just 0.9% for the 12 months ending June 2024.

The decline in spending power is having real effects across the economy. While high-income workers can weather the climbing prices through a bit of belt-tightening, those with lower wages spend a huge proportion of their income on needs rather than wants.

Figuring out ways to meet needs and stay out of debt is becoming more difficult. In fact, the Federal Reserve Bank of New York recently noted, “The...cumulative increase in credit card balances...represents the largest in more than 20 years.”

If you’re currently staring down large credit card balances, these types of debt relief may help.

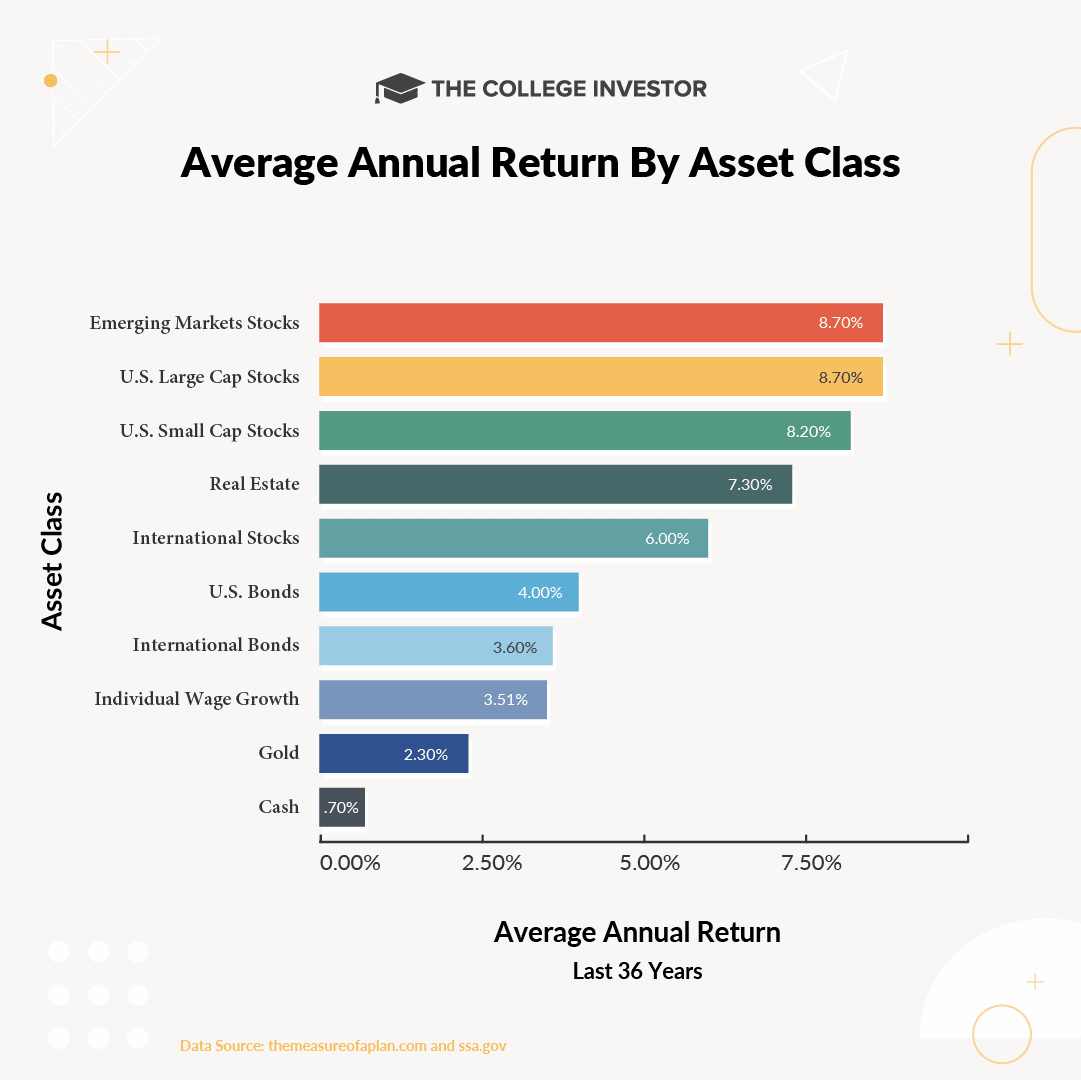

Remember, even in good times, individual wage growth only averages about 3.51% per year. That still lags most investments:

3. Nearly A Quarter of Adults Have Nothing Saved For Retirement

According to the Planning & Progress Study by Northwestern Mutual, 22% of all adults have less than $5,000 saved for retirement. While student loans and stagnating wages account for some of the low savings rates, another factor is that many people rely too much on their future willpower.

It’s always difficult to stick with long-term savings goals, but you can automate your savings using an app or by contributing to your workplace retirement plan. Saving $100 to $200 per month can help you get your retirement savings on track.

4. Banks Collected More Than $15 Billion In Bogus Fees

Banks collected more than $15.5 billion in these overdraft and Non-Sufficient Fund (NSF) fees, according to this study. These massive fees account for an overwhelming majority of all banking fees collected by banks (who, by the way, also make money on the deposits in accounts). For example, banks only collected $4 billion in maintenance fees and less than $1.5 billion in ATM fees.

Modern banking places a huge financial burden on the people who can least afford it. If you’re someone who lives paycheck to paycheck, it is critical to find a bank that won’t charge you $35 whenever you run out of cash.

For fee-free banking, we recommend Chime which offers paycheck advances, Varo which offers low-cost cash advances, or Current which has no monthly charges and offers a solid interest on your balance.

Header |  | ||

|---|---|---|---|

Rating | |||

Top APY | 5.00% | 2.00% | 4.00% |

Monthly Fees | $0 | $0 | $0 |

ATM Access | 55,000 Free ATMs | 38,000 Free ATMs | 40,000 Free ATMs |

FDIC Insured | |||

Cell |

5. A $400 Emergency Will Send More Than A Third Of Americans Scrambling

While 64% of adults can easily handle a $400 emergency, more than a third of Americans don’t have adequate savings to cover this expense, according to the Economic Well-Being of U.S. Households, a report released by The Board of Governors of the Federal Reserve.

To cover the expense, 15% would put the expense on a credit card, and 9% would borrow from family or friends. Among those surveyed, 12% said they could not cover the expense at all, even with debt.

Ready to build your emergency fund? See our guide to Emergency Funds here.

Are You A Part Of These Chilling Statistics?

Plenty of people fall into difficult financial situations through no fault of their own. Many hardworking people get caught living check to check or slipping into debt for necessities.

In some cases, the key to avoiding these problems is earning more money. Negotiating a raise, finding a higher-paying field, or earning promotions tend to help increase your income. Side hustles (especially those that require a high skill level) can boost your earnings too.

30 Passive Income Ideas To Build Wealth

You can’t earn residual income without an upfront monetary investment, or an upfront time investment.

Passive income is not your job, freelancing, or working online.

Passive income is doing something once, then earning rewards from it into the future.

Check out 30 passive income ideas to start building your wealth.

It's important to put the extra dough to work by investing or paying off debt quickly so you don’t have to live the horror of these unnerving money statistics.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington