Real estate and stocks are two of the biggest asset classes that investors choose to invest in. But most don’t do both - many either stick to the stock market or stick to real estate. Sometimes, speaking to real estate investors, they think stock market investors are silly. And vice versa.

The truth is, there are pros and cons to both real estate and stocks. But when thinking about real estate vs. stocks - it’s not an either/or game. It should probably be an “and” game.

We’re partnering with Roofstock to show why you should consider investing in both real estate and paper assets (like stocks and bonds). And why, especially given the current economic conditions, this could be a smart move for your money.

Let’s break it down.

The Four Main Asset Classes (Not What Your Parents Taught You)

First, it’s essential to have a conversation about asset classes. I’m not talking about the asset classes of paper assets (i.e., stocks), but the bigger asset classes.

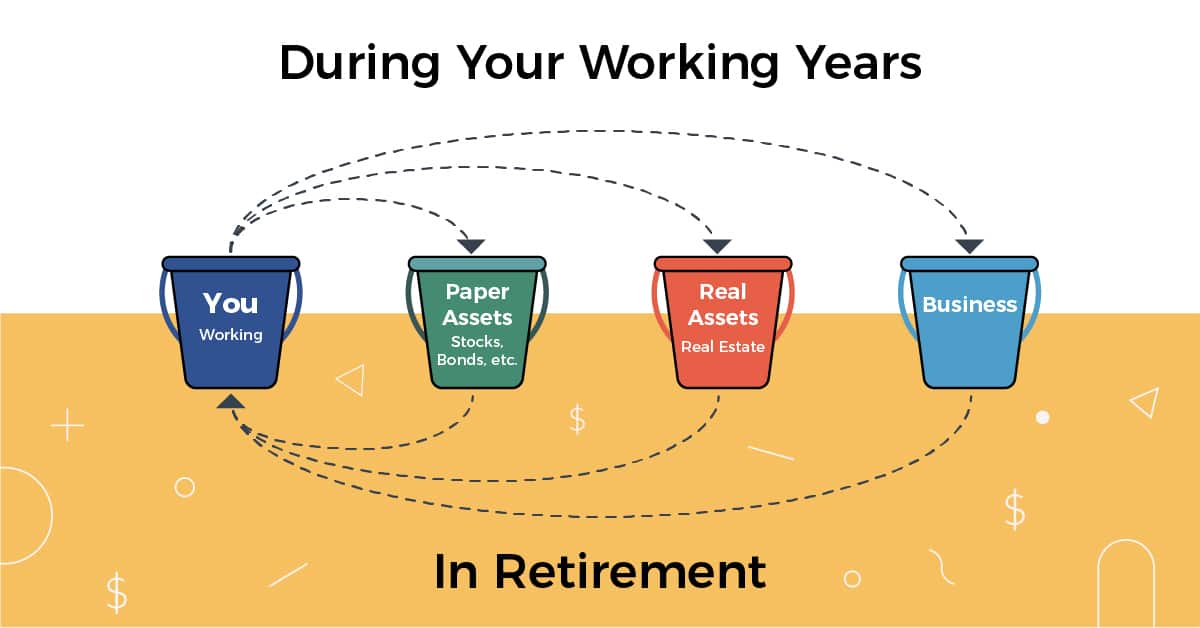

There are four main asset classes:

- You

- Business

- Paper Assets (stocks, bonds, mutual funds)

- Real Estate

When you’re just getting going as an adult, you are probably your biggest asset. It’s what brings in the cash each month that you can live off of (and maybe invest). Your goal should be to take as much excess money as you can out of the “You” bucket, and deploy it to other asset classes - a business, paper assets, or real estate.

Many people do this instinctively by using tools like a 401k. But those that hit the upper levels of net worth are usually much more purposeful about saving and investing in other assets.

That’s where both real estate and paper assets come into play. They both have pros and cons. And we recommend that savvy investors invest in both paper assets and real estate, especially when today’s technology makes it so easy to do both!

The Pros and Cons of Real Estate

First, let’s dive into real estate. Real estate investors tout physical real estate as one of the best ways to invest, and it has some great benefits.

If you already have a good feeling about real estate, jump over to Roofstock and check out what you can buy to start building wealth.

So, let’s start with the pros:

Pro: Real Estate Is A Physical Asset

When you buy real estate, you’re purchasing an actual “thing” - whether a house, duplex, commercial, etc. That’s pretty easy to understand, and by being real, you have some intrinsic value. Unlike stocks, you really can’t have it go to $0 (in most cases).

Plus, the management of real estate is also pretty easy to understand - you rent it out, collect rent, pay for maintenance and expenses, profit the difference.

With real estate, since it’s a physical asset, and has some intrinsic value, it’s also an excellent hedge against inflation. If future inflation is something you’re concerned about (especially with all of the money the Federal Reserve is printing), then this could be a stable asset to help hedge against inflation.

Finally, people will always need a place to live in. This simple truth isn’t going anywhere.

Pro: You Can Use Leverage In A Safer Manner

Leverage is debt - and debt can be scary. But when you buy real estate, it’s much safer to use debt than it would be for stocks (which you can also do, it’s just called margin).

Using debt to buy real estate is a great way to use a small down payment, and buy a property that you couldn’t afford without the debt.

But the debt is safer because real estate prices don’t typically fluctuate widely (like stocks do). As such, you can use this to your advantage.

Pro: There Are Tax Benefits To Real Estate Investing

Finally, there are significant tax benefits to investing in real estate. You only pay taxes on your net income when you rent a property. As such, your mortgage interest, insurance, and more are all tax-deductible expenses.

Your renters can pay off a property for you over time, and your tax bill may be minimal or even nothing!

But… there are cons to investing in real estate, and that does hold people back.

Cons: Real Estate Is Work

First, real estate is work - and it can be a lot of work. One aspect of real estate to consider is that you can either put in money or your time to get things done. And the more money you put in, the less you earn.

That’s why many real estate investors choose to do a lot of work themselves - from fixing clogged toilets to full renovations. But, you can pay for these things as well. It does still require oversight and management, though.

So, if you’re thinking about investing in real estate, be aware it will take some work.

Con: It's More Expensive To Start

Even with today’s technology and services, real estate is still more expensive to invest in than stocks.

Services like Roofstock are trying to change that, with not only being able to purchase single-family homes but also with innovative offerings like Roofstock One, where you can buy fractional shares of a property.

However, even these investments are more expensive than buying stocks or fractional shares of an ETF. You can get started investing for $5-10. Where you typically need at least $500 to start with real estate.

Con: It's Harder To Buy And Sell (Illiquid)

Real estate is harder to buy and sell (especially compared to stocks). With real estate, transactions take time, and there is a lot of work required to close a deal (think inspections, insurance, paperwork, and more). And there are a lot of fees.

If you’re buying real estate, you can expect to pay a few thousand dollars to close the deal. If you’re selling real estate, you can expect to pay upwards of 5-6% in commissions and fees.

That’s a lot of money, time, and effort to invest.

But don’t let the cons scare you. Real estate can still be an excellent investment. Check out Roofstock and see if any properties excite you to get started >>

The Pros and Cons of Stocks and Mutual Funds

After reading that list of cons for real estate, you might think that stocks, bonds, and mutual funds are great investments. But they also have their pros and cons!

Pro: Easy To Buy And Sell

Compared to real estate, paper assets like stocks and bonds are easy to buy and sell. You can invest in minutes, do it from your mobile phone, and not think twice about it. Just check out our list of investing apps.

There’s no real paperwork involved, and you can invest as little as $5.

Pro: Lots Of Information

When you invest in the stock market, there seems to be limitless information. There are tons of research reports, analysis, charts, history, and more. Plus, there’s usually lots of price history as well - so you know what people will pay for a share of stock.

You get little of that when it comes to real estate. Information in real estate is very opaque. It requires appraisals and inside knowledge to know the pricing. Negotiation is a part of every deal.

And one property is never like another. Each one is different.

Pro: Low Or No Fees

When it comes to investing in stocks and ETFs, the price is $0 at most major stockbrokers. If you invest in mutual funds, you may have some minor fees. But the transaction costs are zero or almost zero.

And ongoing fees (known as expense ratios) are low in the best funds - less than 0.1%.

When you contrast that to real estate, there’s a big difference!

Pro: Some Tax Benefits For Certain Accounts

Finally, there are some tax benefits for investors in paper assets. You can use a an IRA or 401k and see your investments grow tax-deferred or even tax-free. That’s amazing.

Note: You can also set up a self-directed IRA or solo 401k and invest in real estate. It’s just typically not a feature offered by the majority of employers.

But stocks do have issues as well...

Con: Volatility

One of the biggest cons of stocks is that the value can fluctuate widely - even during a single day. Individual stocks are known to go to $0 when a company declares bankruptcy or goes out of business.

And plenty of investors have lost it all investing in the stock market.

This is a considerable risk, especially when you contrast it to real estate, which is much less volatile.

Con: Some Tax Issues

While you can invest in an IRA or 401k, your contributions to these accounts are limited. If you want to invest beyond that, it’s taxable. And taxable investments are subject to capital gains tax rates.

This tax treatment is less appealing than real estate.

Why You Should Invest In Both Real Estate And Stocks

Now that you have a good understanding of the pros and cons of both real estate and paper assets, I hope you can see how they complement each other and would BOTH make solid choices for your portfolio.

Paper assets are easy and low cost, and a great “starter” investment beyond the “You” bucket. Once you get a little capital, it makes sense to start to diversify into real estate.

By having both paper assets and real estate, you get diversification across asset classes, and they can both serve as a hedge against the other.

Final Thoughts

When you hear that the average millionaire has seven streams of income, it’s because they’ve diversified their assets. They have the “You” bucket, and they take their money and invest it.

And 90% of millionaires own real estate!

If you’re looking for a way to get started in real estate, check out Roofstock here. They make it easy to get started in owning rental properties.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller