The Solo 401(k) auto-contribution tax credit can earn you $1,500 over three years by just enabling automatic contributions to your solo 401(k) plan.

Solo 401(k) plans are a type of retirement plan that allow solo business owners to save on taxes while putting away funds for retirement.

While most people associate 401(k) plans with larger businesses, even the smallest businesses with a single employee can create a 401(k) plan for their business.

The Solo 401(k) auto-contribution credit regulations are quite complex, so we're sharing what you need to know to receive up to $1,500 in tax credits. In partnership with My Solo 401k Financial, we break down what the auto-contribution tax credit is, and how you can take advantage of it with your Solo 401k plan.

What’s A Solo 401(k) Plan?

A Solo 401(k) can also be called a Self-Employed 401(K), Individual 401(k), or another name. What’s most important to know is that it’s a 401(k) but designed for just one person.

If you’re new to the concept, Solo 401(k) plans are the exact same as 401(k) plans offered by large employers, but with only a single member. You can open and run a Solo 401(k) for free at major brokerages like Schwab and Fidelity, however, specialty providers like My Solo 401k Financial make opening and running a Solo 401(k) easier in many cases, for a fee.

Most free solo 401k plans don’t offer all the features that you could have if you open your own solo 401k. For example, some don’t allow Roth contributions or after-tax contributions. And currently, no free plan provider has the auto-contribution feature to enable the tax credit.

If you open your own plan with a company like My Solo 401k Financial, you can still hold your stocks and exchange-traded funds (ETFs) at Fidelity or Schwab.

Understanding the Solo 401k Auto Contribution Tax Credit

As part of SECURE Act 2.0, Congress passed a law encouraging businesses to offer 401(k) plans with automatic contributions. Businesses can earn $1,500 in tax credits, broken down to $500 per year for three years.

Freelancers and other business owners with no employees are not excluded from the credit. While other parts of the 401(k) credit program are a bit more dubious, the general consensus is that Solo 401(k) plans are eligible for the $1,500 automatic contribution credit.

For example, if you start a new Solo 401(k) plan in 2024, you could earn the following tax credits:

2024 | 2025 | 2026 |

|---|---|---|

$500 | $500 | $500 |

Remember, tax credits are not the same as deductions. While a tax deduction lowers your taxable income, credits directly reduce your taxes. That makes this program worth essentially $1,500 in free money for solo entrepreneurs who choose to take advantage.

To get the credit, you can create a new Solo 401(k) plan with automatic contributions or update your existing Solo 401(k) plan to include automatic contributions. On a personal note, after researching what’s possible, that’s exactly what I’m going to do.

It’s also important to remember that just because your plan has automatic contributions doesn’t mean it’s a feature that you personally have to enable. You can opt-out of your own plan’s auto contribution feature and still receive the tax credit.

Providers like My Solo 401k Financial will help you both ensure your plan has the appropriate auto contribution setup, and ensure that you opt-out if you so desire.

Eligibility Requirements

Determining which businesses are eligible for the 401(k) automatic contribution credit is a bit complicated. When I first asked my accountant, he indicated that I might not be eligible. But after a little back-and-forth, we decided that my business, where I’m the only employee, is eligible. I verified this with several sources.

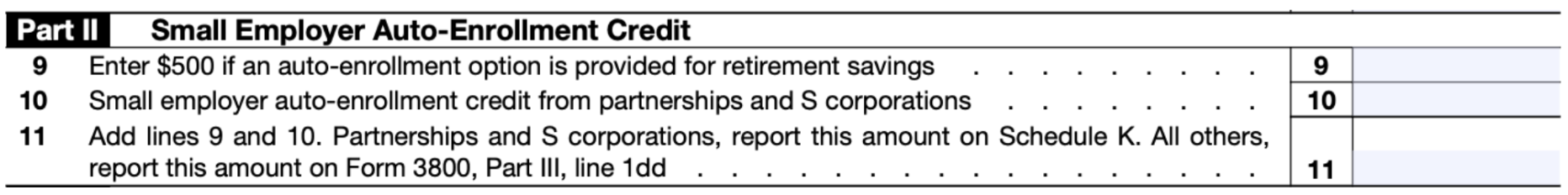

The instructions for Form 8881, the form you must use to get the credit, mentions several types of retirement plan credits. Not all solo businesses can get all credits included on this form, but Solo 401(k) plans qualify for Section II, which is dedicated to the automatic contribution credit.

If you already have a 401(k) plan with automatic contributions enabled, you may not qualify. If you are new to automatic contributions, you probably do qualify. If you’re unsure, consult with a trusted tax professional.

Your Solo 401(k) must have specific language stating that new employees are automatically enrolled for auto contributions to qualify for the credit.

Benefits Of Automatic Contributions

Many workers in large companies don't participate in 401(k) plans. A recent survey found that about 40% of employees aren't set up. But with automatic signup for contributions, nearly 100% of employees participate.

Social Security alone is typically not enough to maintain the same standard of living during retirement. Most experts suggest that Americans save at least 15% of their income for retirement to maintain their standard of living. With automatic enrollment and auto contributions to a 401(k) plan, they’re more likely to stay on track for retirement.

Setting an automatic 3% contribution is somewhat of an industry standard. After your enrollment, you can increase or decrease your contribution level at any time.

Claiming The Tax Credit

To claim the tax credit, you’ll need to complete and submit Form 8881. It’s a simple, one-page form that you or your accountant can complete in just a few minutes.

The Small Employer Auto-Enrollment Credit is calculated in Part II of the form. You'll enter the $500 credit amount in Box 9.

According to IRS guidelines, “An eligible employer that adds an auto-enrollment feature to their plan can claim a tax credit of $500 per year for a 3-year taxable period beginning with the first taxable year the employer includes the auto-enrollment feature.”

Again, if you have any doubts or questions, it’s best to consult with a licensed tax professional.

Is The Auto-Enrollment Credit For Solo 401(k) Plans Worth It?

If you don’t already have an automatic enrollment feature in a Solo 401(k) plan, the credit is absolutely worth the effort. While it takes some time to complete the forms, there’s a lot to gain and little to lose by setting up this plan feature and receiving the credit.

In many ways, it’s like the government is subsidizing you $1,500 to make tax-advantaged contributions for your own retirement. That’s a big win for your finances if you’re self-employed.

Companies like My Solo 401k Financial can help you with this. Whether you’re open an new Solo 401k for the first time, or you have an existing plan you need to update (called recharacterization), they can help.

Check out My Solo 401k Financial here >>

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington