NorthOne is an online business bank account.

As a small business owner, it can be a challenge to find a bank that is designed with your needs in mind. You want to set up your account and allow it to run in the background without racking up extra fees along the way.

This is especially true if you run a business that involves dozens of bank transactions each month. After all, you don’t want to be nickel and dimed each and every time you handle a business transaction.

Luckily, NorthOne Bank offers online business banking solutions that were designed with you in mind. Let’s that a closer look at what NorthOne Business Banking has to offer.

NorthOne Details | |

|---|---|

Product Name | NorthOne |

Min Deposit | $50 |

Monthly Fee | $0-$20 |

ATM Access | 2 Million+ Fee-Free ATMs |

Promotions | None |

What Is NorthOne Business Banking?

NorthOne was founded in 2017 with the goal of providing better banking solutions for small business owners of all kinds. Throughout the first year of the bank, the team interviewed thousands of small business owners to pinpoint exactly what was needed.

With that detailed information, NorthOne built an online bank experience that is designed to help small business owners, freelancers, and startups manage their banking needs efficiently. And the intention of the bank’s founders shines through its wide selection of features that are genuinely helpful to small business owners everywhere.

⚠︎ This Is A Banking Service Provider, Not A Bank.

NorthOne is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

NorthOne offers a deposit account to small business owners. Here’s how this offering stands apart from the crowd.

Unlimited Fee-Free Transactions (North One Plus)

Any small business owner knows that transaction fees can quickly eat into your bottom line (and some banks have super-low limits on transactions before you pay). While you will be subject to a $20 monthly fee, you won’t have to worry about additional transaction fees with NorthOne's Plus service plan.

That’s right, you can make payments, deposits, transfers, and purchases with your debit card without any fees. Plus, you won’t be charged for any ACH payments or mobile check deposits. All in all, you’ll be able to avoid a wide minefield of fees that you’d normally have to navigate at a traditional bank.

Digital Tools

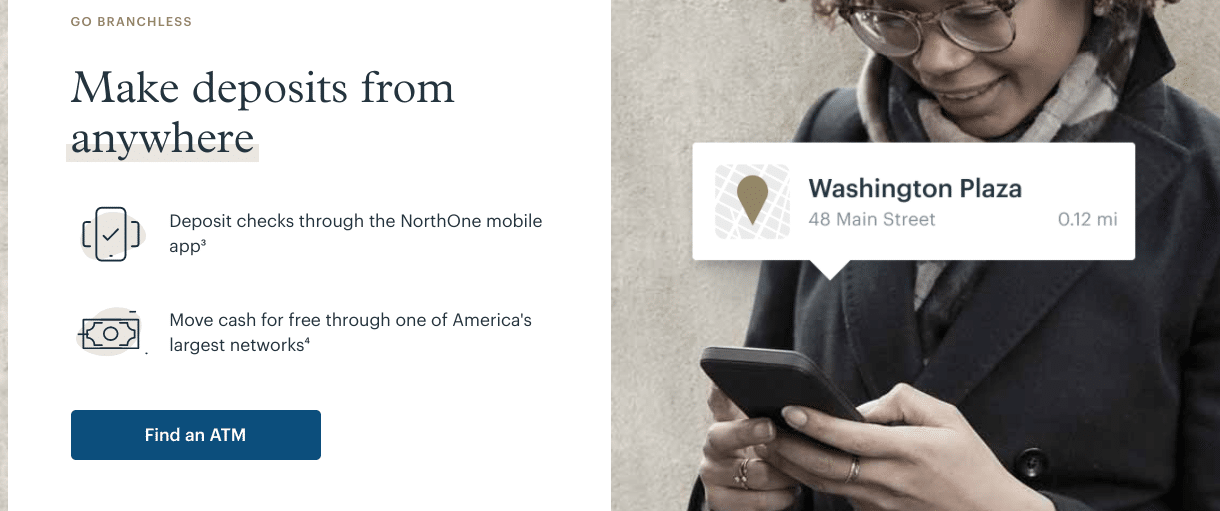

NorthOne gives you the power to seamlessly manage your business bank account online. You won’t have to check in with a physical branch to handle anything. Instead, you can pull out your phone and tackle banking tasks quickly. You can even manage and pay your invoices directly from your NorthOne account.

Nationwide ATM Access

Need physical cash to run your business? With NorthOne, you can withdraw cash fee-free at any Cirrus® branded ATM location (2 million+ worldwide). You can also load cash at over 90,000 Green Dot® locations across the U.S. That can come in handy.

Compatible With Multiple Third-party Apps

If you already have an accounting system or important business tool in place, you can likely connect it to NorthOne. You’ll be able to integrate your NorthOne bank account with payroll tools and accounting software like PayPal, Gusto, Expensify, Xero, Etsy, Stripe, QuickBooks, Wave, Shopify, and more.

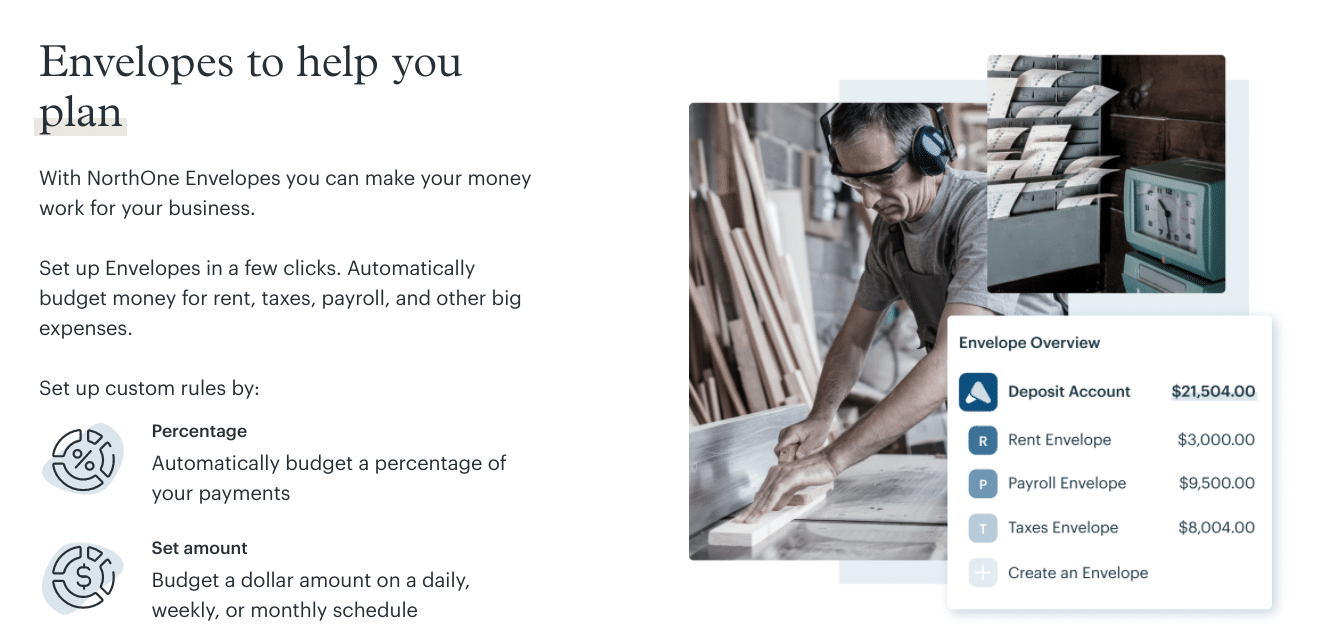

Unlimited Budgeting Envelopes

Many people swear by the envelope budgeting system for their personal finances. And some companies even offer digital versions of the envelope system. But what if you'd like to use envelopes for your business budget too? With NorthOne, you can!

NorthOne provides all of its customers with unlimited digital Envelopes to simplify planing for major expense categories like payroll, taxes, and rent. You can also quickly set up rules to have NorthOne automatically sort your paychecks into your Envelopes for you.

Are There Any Fees?

North One has two service plans: North One Standard has no monthly fee, but it does charge transaction fees, including 1.5% same day ACH payments and $1 physical checks. It's kind of like a pay-as-you-go model. For $20 monthly, you can upgrade to North One Plus. Doing so gives you access to $0 same day ACH payments, $0 physical checks, and a discount on domestic wire sends.

Although there are cheaper options than North One Plus, you won’t be dealing with any other transaction fees that could run up the total cost of other available options.

NorthOne claims that their monthly fee is actually a benefit to most small businesses - saving them money over the long term versus "free" bank accounts - simply due to not having any hidden fees. Depending on how you bank and what services you use, your mileage may vary.

How Do I Contact NorthOne?

If you need to get in contact with NorthOne, you will need to make a phone call to 332-205-9253 or email support@northone.com. Additionally, you can take advantage of the chatbox on the NorthOne website.

Although the company operates four offices, there are no physical bank locations to work with an in-person customer service representative.

How Does NorthOne Compare?

If you're looking for a business banking experience, NorthOne isn't the only game in town. You can find other business banking experiences that provide a stellar experience without any monthly fees.

For example, Novo offers a business checking account without any monthly fees. Plus, Novo provides the option to send and manage invoices.

Another worthy competitor is Radius Bank’s Tailored Checking account. You may still run into a monthly fee. But this account provides cash back opportunities. Plus, the monthly fee is waived if you meet certain requirements. Check out this quick comparison here:

Header |  | ||

|---|---|---|---|

Rating | |||

Cash Back | N/A | N/A | 1.00% |

Monthly Fees | $0-$20 | $0 | $0 |

Min Deposit | $50 | $0 | $100 |

ATM Access | 2 Million+ Free ATMs | Unlimited | Unlimited |

FDIC Insured | |||

Cell |

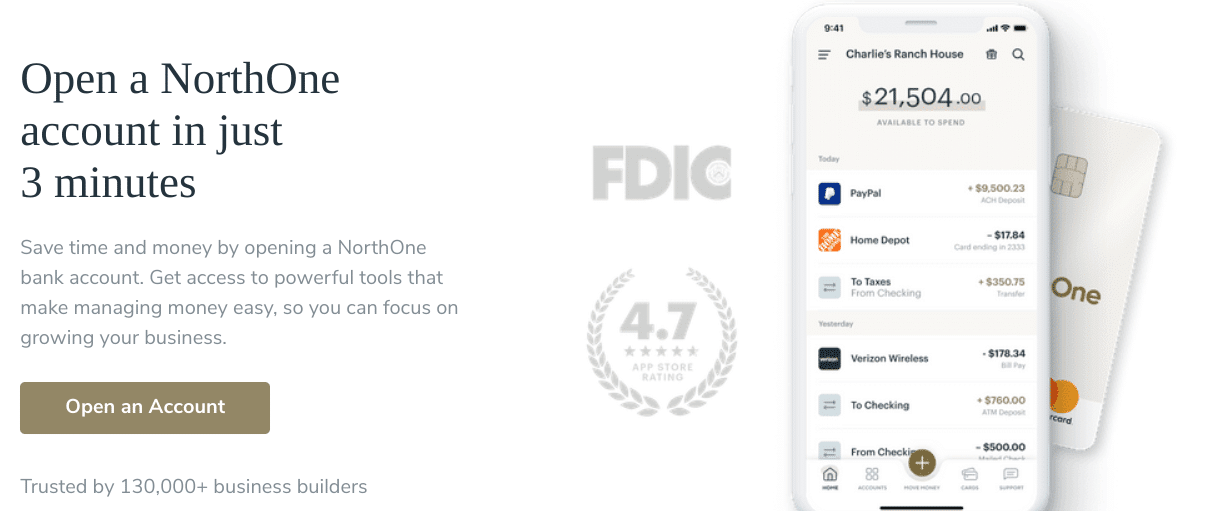

How Do I Open An Account?

Want to move forward with NorthOne? You can start by heading to their website. Next, select the "Apply for an Account" button in the upper-righthand corner.

At that point, you’ll be asked a short series of questions. Depending on how quickly you answer the questions, it should take you less than three minutes to run through the questions. Once you submit the application and are approved, you will be able to fund your account.

And if you sign up with our link, you’ll enjoy one month free. Get started here >>>

Is It Safe And Secure?

NorthOne provides FDIC insurance on its deposit accounts via The Bancorp Bank, N.A. With that, your funds will be provided for at least $250,000. Additionally, NorthOne uses TouchID and Face ID to help you keep your account secure.

Why Should You Trust Us?

I have been writing and researching banking and personal finance products since 2009. At The College Investor, we've been comparing and reviewing banks since 2018, and track the best banks for savings and money market accounts daily from a list of over 50 major banks and credit unions.

We are also small business owners, and finding bank accounts that match our needs has been a challenge. That's what led us to review the best business banks and share those with you.

Furthermore, our compliance team reviews our rates every weekday to ensure that we are accurately showing the correct rates and terms so you can make an informed decision about where to open a bank account.

Who Is This For And Is It Worth It?

As a small business owner myself, I think that the banking experience offered by NorthOne is valuable. You’ll be able to manage your business funds on the go without dealing with a mountain of fees that can add up quickly. Instead, you can set up a monthly budget for your business and be able to stick to that plan.

Additionally, most will appreciate the digital tools built into the NorthOne banking experience. You’ll find these useful while running your small business with limited time available. However, there are other business bank accounts out there. If you don’t think that NorthOne is a good fit for your situation, then don’t force it. Check out other great business banking solutions here >>>

NorthOne Features

Account Types | Business checking |

Minimum Deposit | $50 |

APY | N/A |

Monthly Fee | $0-$20 |

Transaction Fees | None |

Domestic Wire Transfer Fee | $15-$20 |

Branches | None (online-only bank) |

ATM Availability | 2 Million+ fee-free ATMs at Cirrus ATMs worldwide |

Budgeting | Yes |

Invoicing | Yes |

Mobile Check Deposit | Yes |

Customer Service Number | 332-205-9253 |

Customer Service Hours | 8 AM to 10 PM (ET), Monday - Sunday |

Customer Service Email | support@northone.com |

Desktop Account Access | Yes |

Mobile Apps | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | 14625 through The Bancorp Bank, N.A. #35444 |

Promotions | None |

NorthOne Review

-

Fees and Charges

-

Tools and Resources

-

Customer Service

-

Ease of Use

Overall

Summary

NorthOne’s business bank accounts provide a suite of digital tools, fee-free ATM access, mobile check deposits, and more.

Pros

- Digital banking tools

- 300,000+ fee-free ATMs

- Integrates with a wide range of apps

- No monthly maintenance fee for North One Standard plan

Cons

- Hefty $20 monthly fee for North One Plus account

- No physical branches

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak