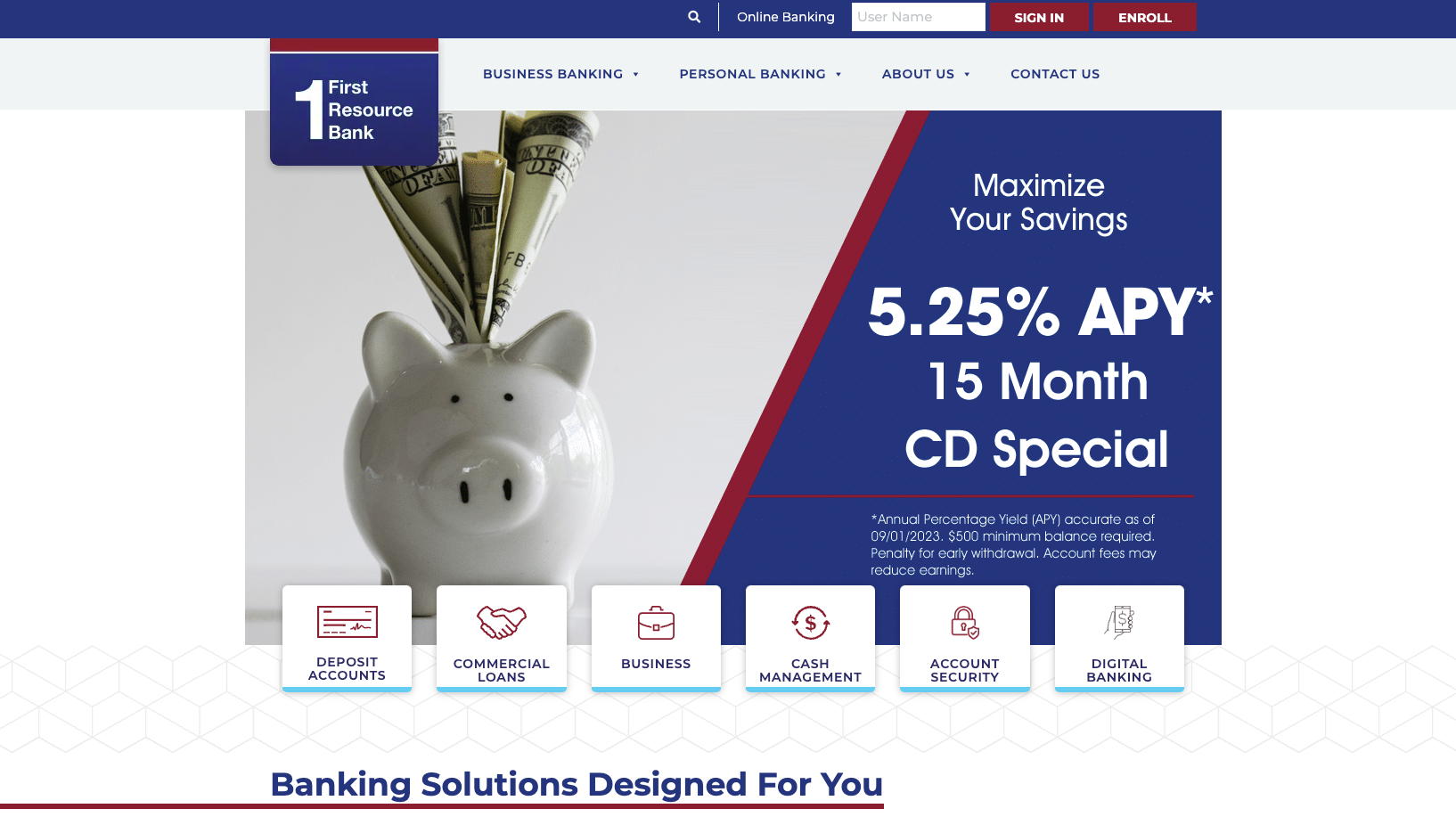

First Resource Bank is offering some of the best interest rates on savings right now.

Managing your money can be significantly easier when you have the right banking tools at your fingertips.

While it can be difficult to pick out a solid banking platform that suits all of your needs, First Resource Bank may be one worth considering.

First Resource Bank offers some attractive CD rates that could entice savers to invest with this financial institution. Additionally, anyone looking for an interest-bearing checking account option might like what they find. In this First Resource Bank review, we take a closer look at what the financial institution has to offer.

First Resource Bank Details | |

|---|---|

Product Name | First Resource Bank Money Market |

Min Deposit | $0 |

APY | 5.29% |

Account Types | Money Market |

Promotions | None |

What Is First Resource Bank?

First Resource Bank was founded in 2005. The Pennsylvania-based bank serves the Delaware Valley and beyond. It offers three brick-and-mortar locations to its customers, but customers from other areas of the country can access the bank’s online services.

What Does It Offer?

First Resource Bank offers a range of financial products, spanning personal and business products. The business banking services include checking accounts, lending products, and more. On the personal side, you’ll find home equity lines of credit, home equity loans, land loans, vehicle loans, personal loans, credit cards, and deposit products.

For the purposes of this review, I will focus on the personal deposit accounts available.

Interest-Bearing Checking Accounts

Not many banks offer interest-bearing checking account options. But First Resource Bank offers more than one interest-bearing checking account.

First up is the Free Checking account, with interest. The account comes with no minimum balance requirements, no monthly maintenance fees, and a free order of your first set of checks. As of October 2023, this account offers 0.05% APY on all balances.

Second is the Diamond Club Checking account, which offers a 0.10% APY. This checking account is an option for customers who are at least 60 years old. Like the Free Checking account, you won’t run into any balance requirements or maintenance fees.

Certificates Of Deposit

Certificates of deposit (CDs) offer a safe place to watch your funds grow at a predetermined pace. The only downside is that CDs require you to give up access to your funds for the term length. If you must access the funds early, you’ll face an early withdrawal penalty.

First Resource Bank offers a range of CD terms and rates.

In order to open a CD with this bank, you must start with at least $500.

Money Market Account

First Resource Bank offers a money market account that's near the top of the pack when it comes to interest rates. This account is in partnership with Raisin, and is only available online through their platform. This account has a $1 minimum to open, and currently yields a solid 5.29% APY.

Are There Any Fees?

First Resource Bank's fees vary based on the accounts you open and the services you use. Some of the fees you might encounter include a $40 non-sufficient funds fee, a $10 cashier’s check fee, a $20 stop payment fee, and a $45 outgoing foreign wire transfer fee.

How Does First Resource Bank Compare?

First Resource Bank offers more than one interest-bearing checking account option. But the interest rate offered through these accounts could be higher.

For example, if you open an account with GO2bank, a mobile bank with no branch locations, you can tap into a high-yield savings account with an APY of 4.50% on up to $5,000 in savings. Unlike First Resource, however, GO2bank does not offer CDs.

If you are looking for a CD with a great rate, First Resource Bank offers some options. But you can find slightly higher APYs elsewhere. For example, Western Alliance Bank offers a 12-month CD with a 4.05% APY through Raisin.

Header |  | ||

|---|---|---|---|

Rating | |||

Free Checking? | Yes | Yes | Yes, with Direct Deposit set up |

APY On Savings | 5.29% | 4.50% | 4.46% |

FDIC-Insured | |||

Cell |

How Do I Open An Account?

If you want to open an account with First Resource Bank, you must get in touch with the financial institution. You can call 610-363-9400 or email customerservice@firstresourcebank.com to move forward. Of course, you also have the option to open your account at a physical branch location. In any case, be prepared to provide your Social Security number, government-issued ID, and funding account information.

Is It Safe And Secure?

First Resource Bank protects the deposits you make through the Federal Deposit Insurance Corporation (FDIC). With this insurance, your funds are protected for up to $250,000.

How Do I Contact First Resource Bank?

You can call 610-363-9400 to get in touch with the bank. You also have an option to fill out an online form. If you live in the Delaware Valley area, you can visit one of the three physical branch locations.

Is It Worth It?

First Resource Bank offers an interesting opportunity for savers who want to open a high-yield CD. if you find a CD that suits your needs through the bank, it might be worth snagging the rate. But the other deposit products are less than ideal because you can find higher rates attached to both checking and savings accounts elsewhere.

Before you decide to sign up, make sure to explore all of your options. A close look can help you find the best option for your situation.

First Resource Bank Features

Account Types | Checking, Savings, Money Market, CDs |

Monthly Fees | $0 |

Minimum Balance Requirement | No |

CD Terms Available | 3 - 60 months |

Branches | Yes |

ATM Availability | Free access to 55,000 Allpoint ATMs nationwide |

Customer Service Number | 610-363-9400 |

Mobile App Availability | iOS and Android |

Mobile Check Deposit | Yes |

Direct Deposit | Yes |

Electronic Bill Pay | Yes |

FDIC Member | Yes |

Promotions | None |

First Resource Bank Review

-

Pricing & Fees

-

Products and Services

-

Ease of Use

-

Customer Service

Overall

Summary

Pennsylvania-based First Resource Bank offers free checking accounts, money market accounts, and competitive APYs on CDs.

Pros

- Competitive APYs on select CD terms

- No monthly fees attached

- Interest-bearing checking account options

Cons

- Must contact customer support to sign up for an account

- Rates for some accounts are less than ideal

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Colin Graves Reviewed by: Robert Farrington