Want to help your teen or college student learn about money management? Prepaid debit cards for teens can make it easy to track spending, set limits, and transfer money to your kids.

Your best opportunity to teach your children the money lessons that can set them up for financial success is while they're still living under your roof. But you may feel uncomfortable giving your teenager access to a full bank account (and the potential to rack up overdraft fees) until they've developed some solid financial habits.

Prepaid debit cards for kids offer many of the same features of a bank account without the risk of your teen spending more money than they actually have. Here’s what you need to know about prepaid debit cards before you give one to your teen.

What Are Prepaid Debit Cards?

Prepaid debit cards are cards that only allow you to spend money that is loaded onto the card. Prepaid cards aren’t linked directly to a bank account. You can't overdraft with prepaid cards so they're are a great option for people learning about money.

Prepaid cards also offer an added convenience of having account numbers. This means that teens can use the cards to make online purchases if necessary.

One drawback to prepaid debit cards is the cost. These cards typically cost a few dollars each month, plus you may have to pay a “cash loading fee” to do a cash transfer to the card. Every card that we recommend has at least some unavoidable fees.

Are Prepaid Debit Cards For Teens A Good Way To Teach Them About Spending?

Prepaid debit cards can be a great way to teach teens (especially young teens) about money management. Parents can transfer a set amount of money and allow teens to budget for clothing and school supplies at the start of the academic year.

Parents may transfer a set amount of fun money to their teens, and teens can choose how to spend it. Because prepaid cards make it easy to review transactions, parents can help their teens review spending and plan for the future while avoiding the risk of overdraft fees.

Best Prepaid Cards For Teens

Any prepaid debit card with low fees and high functionality could be a good fit for a teenager. These are the top overall prepaid debit cards. But these are our top three recommendations for prepaid cards for teens specifically.

Greenlight

Greenlight is likely one of the most well-known prepaid debit cards for kids and teens. Beyond just a simple debit card and bank account, Greenlight has a great app that allows parents to enable spending controls and more. They also allow "parent paid interest", which is a nice feature like allowance for your kids.

Greenlight has also enabled a bunch of new features (that cost more, of course), including some investment management.

Depending on the Greenlight plan you pick, you'll pay anywhere from $4.99 to $9.98 per month.

Read our full Greenlight review here.

FamZoo

FamZoo is our top recommendation for prepaid cards for teens and children. Unlike the other cards, FamZoo offers a number of features that will help teens learn about money management beyond spending.

With FamZoo, parents have a “master account” and kids or teens have connected accounts. One of the accounts (a spending account) is linked to a prepaid debit card. The other accounts are earmarked for saving, giving or investing.

FamZoo is loaded with a ton of features like the ability for parents to lock cards for a temporary ban and even the option to pay interest on their kids' investment accounts. The cost for FamZoo is $5.99 per month or $30 per year, which includes up to four prepaid cards.

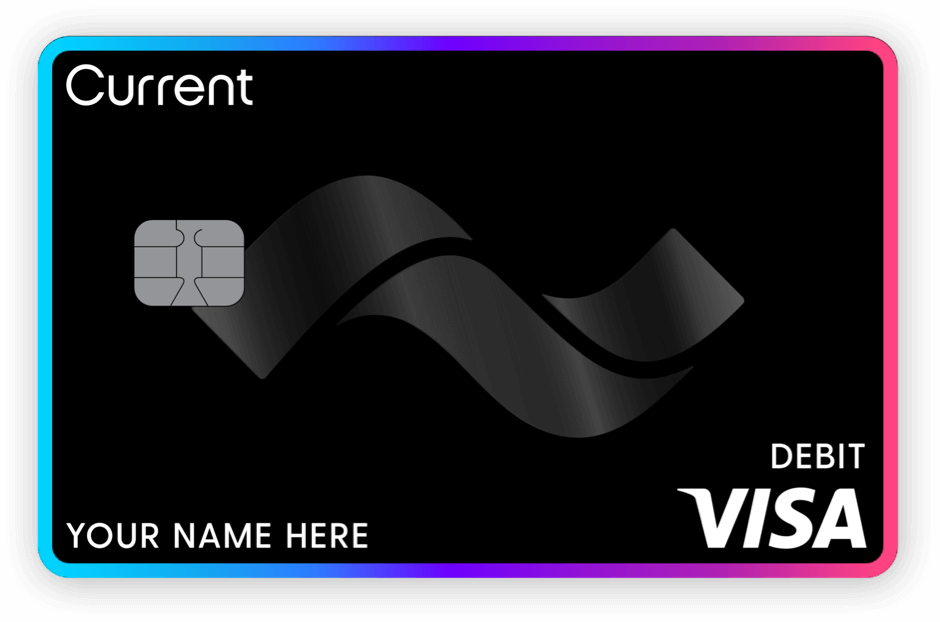

Current Visa Debit Card

The Current Visa Debit Card is essentially a bank account with training wheels. This could one of the best prepaid cards for teens that are working as cardholders can set up direct deposit and even receive their funds up to two days faster.

The app allows parents to block certain merchants and set spending limits for teens. The account also has a “savings pod” features, where teens can set aside money for giving or future spending.

Parents can receive notification for all purchases made with their child or teen's prepaid card and it's easy to set up automatic allowance payments. The Current Visa Debit Card charges $36 per year per teen which is a bit more expensive than FamZoo’s price.

Read our full Current Banking review here.

MOVO Digital Prepaid Visa

MOVO is one of the only prepaid cards for teens that offers “throw away” account numbers. These one time use account numbers allow you to make a transaction, but the account number becomes inactive once the purchase is made.

In an increasingly digitized world, security in online shopping is critical. Disposable account numbers add an extra element of security for parents or teens who are nervous about having account information stolen.

MOVO is also an incredibly low-cost option. It costs $5.95 to buy your debit card and $2 to withdraw cash from an ATM. But, notably, MOVO charges no monthly fees.

Alternatives To A Prepaid Debit Card For Kids

One of the shocking things about all of these services above is that they charge money! I know, but in this world of free banking, why should you be paying to simply have a debit card for your kids and teens.

One of our favorite options is to simply open a starter checking account at your bank that you can link to you main checking account. Most banks allow checking accounts (and savings accounts) for kids and students. You can then link this to yourself via online banking. And your child will get a debit card for it!

Unlike a prepaid debit card, this is a full-fledged bank account. However, because the account belongs to a minor, there may be some limitations. For example, you might not be able to use some money transfer services like Zelle. However, if you are linked to your main checking account, this might not matter much.

When Should Teens Upgrade To A Full-Service Bank Account?

Prepaid debit cards are good for putting controls on spending, and helping teens learn about spending. However, spending is just one slice of money management. Teens also need to learn about earning money, saving, and investing.

When your teen starts earning money regularly, you might want to consider opening a full-service bank account with them. While a bank account can introduce new risks, like allowing your teen to overdraft, it can also help them learn to be disciplined with their spending. And that's a critical skill to develop before credit cards enter the picture down the road.

We have a our full list of the best bank banks for teenagers here.

A bank account can also help your teen practice paying bills by setting up bill pay for their cell phone, car insurance, or other expenses. And they could even start earning some interest on their savings by opening a high-yield savings account.

Many banks and credit unions offer student accounts that automatically remove parents when the student turns 18. See our list of the best student checking accounts.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller