Relay is an all-in-one business banking and accounting platform.

As a small business owner, banking and keeping track of your business finances can be more complicated than it needs to be. The constant back and forth with a bank can be a real drain on your time.

Relay Financial seeks to change this struggle for small business owners. It's created an integrated banking and accounting experience that's designed to remove so many of the headaches associated with traditional banking.

Interested in a solution that can help you streamline the financial management of your business? Here’s what you need to know about Relay Financial to help you decide if it could meet your needs.

Relay Financial Details | |

|---|---|

Product Name | Relay Financial |

Min Deposit | $0 |

Monthly Fee | Relay Standard: $0 Relay Pro: $30/mo |

APY/Rewards | None |

Promotions | None |

What Is Relay Financial?

Relay Financial is a digital banking platform designed with small businesses in mind. In mid-2021, the platform raised $19.4 million in funding to accelerate the platform’s growth.

Much of the recent funding came from Bain Capital Ventures. Keri Gohman said in a press release, “Relay is building a business banking platform that should exist — one that not only helps employer-based business owners to run their business more smoothly, but also enables game-changing collaboration between business owners and their most important financial advisors."

As a small business owner or bookkeeper, you may stand to gain a lot from this innovative platform. Below, we take a closer look at its features and fees.

It's important to remember that Relay is a financial technology company, not a bank. Banking services and FDIC insurance are provided through Thread Bank; Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Relay is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

Relay is built on the belief that business banking should enable growth for small businesses. In contrast to many large banking operations, it seeks to provide a streamlined experience to help move businesses forward and save time. Here are the features that stand out.

User Permissions For Team Members

Instead of sharing your banking information with others, Relay allows you to provide individual users with specific permissions. This makes it easy for your selected team members can jump in to help with money management.

A team member with the right permissions could pay the bills or handle the bookkeeping without needing your login information.

Depending on the size of your business, this option can be a big deal. If you don’t have the time to manage every single transaction yourself, user permissions provide a safe pathway to keep things monitored and organized.

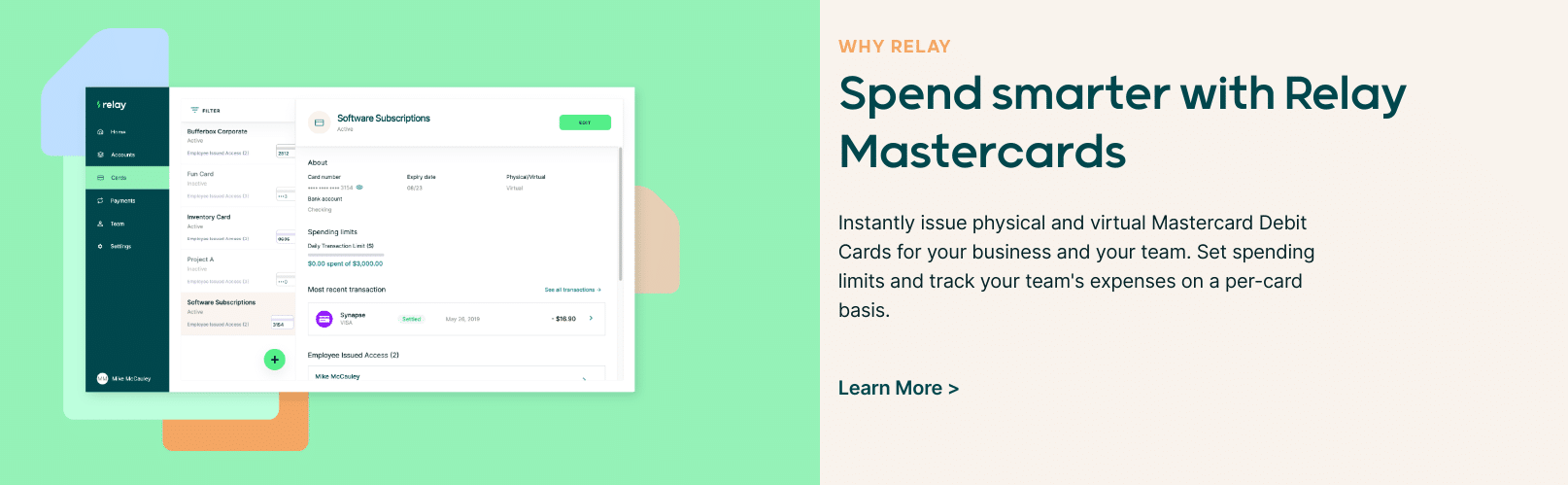

Instantly Issue Debit Cards

Within your Relay checking account, you can immediately issue up to 50 Mastercard debit cards to your team. The cards can be either virtual or physical based on your needs.

You’ll be able to easy track the spending of each individual team member and you'll have the option to set up daily transaction limits or ATM withdrawal limits on each debit card.

You can use your Relay Financial debit card to withdraw cash fee-free at over 32,000 AllPoint ATMs. Plus, these debit cards come with no foreign transaction fees.

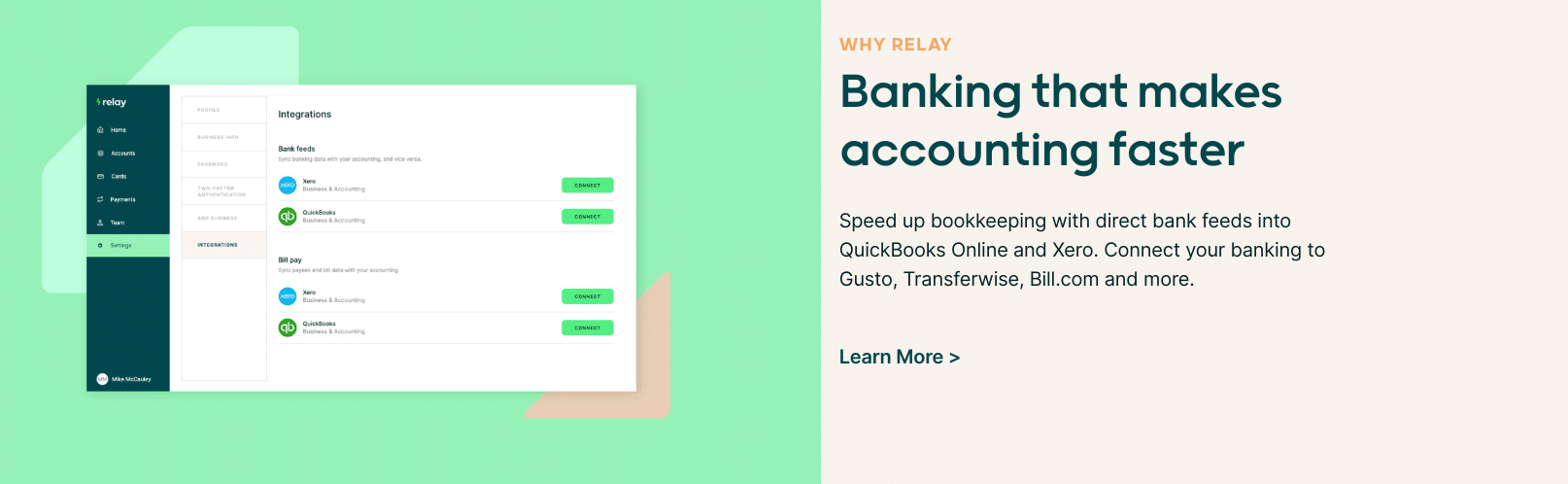

Convenient Integrations

Banking and accounting should go hand in hand. But it's not always as simple as you would think. Luckily, Relay Financial allows you to connect your bank feeds into different accounting software.

Xero or QuickBooks Online can be directly integrated into Relay. Additionally, Relay connects with Gusto, Transferwise, and Expensify to track transactions.

By working seamlessly with these popular accounting software providers, Relay could make it possible for you to manage all of your company's financial accounts in one place.

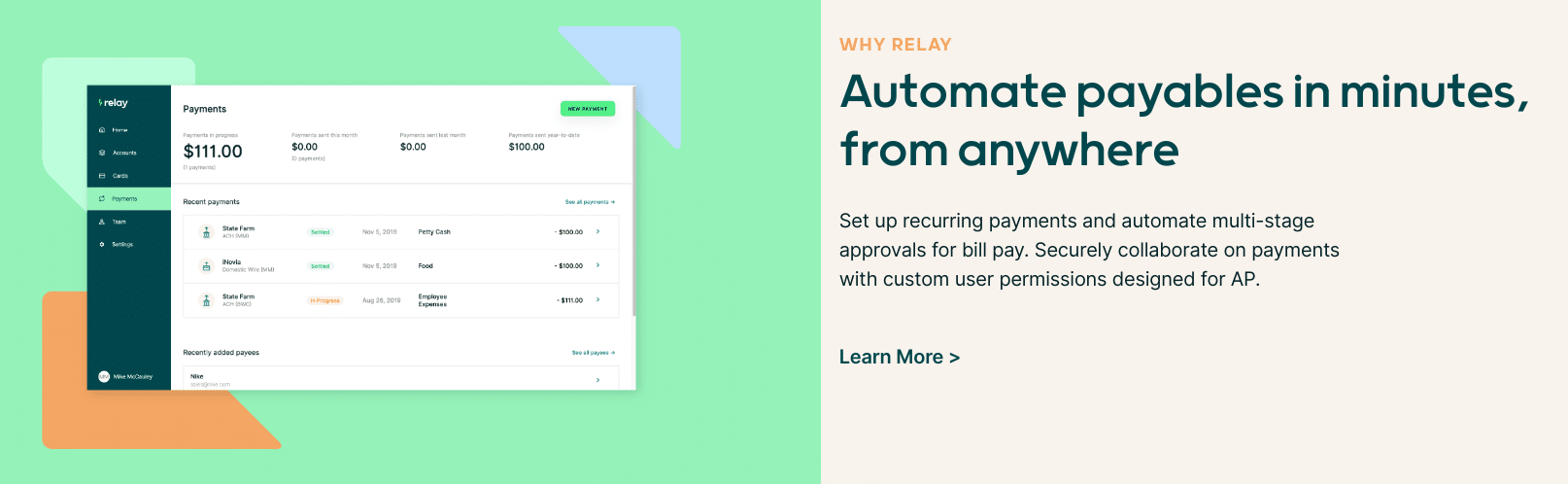

Bill Pay Automation

Customers who upgrade to Relay Pro get access to additional tools that can help to automate the process of paying vendors. These include the ability to import bills automatically from QuickBooks Online and Xero, pay bills in batches, and create multi-stage bill approval workflows.

Are There Any Fees?

Relay offers a free Standard option. Here’s what the free version of Relay Financial will get you:

- Free standard ACH transfers (money arrives in 1-2 business days)

- Create up to 20 no-fee checking accounts

- Add up to 50 virtual or physical debit Mastercards

- Pay by ACH, wire, or check

- Invite team members to join

- Direct bank feeds into Quickbooks Online and Xero

- Set spending limits for each team member

At this level, you'll pay $5 for sending domestic wires and $10 for outgoing international wire transfers. There are no fees for incoming wires.

Relay also offers a paid option, called Relay Pro, that costs $30 per month. In addition to the features above, Relay Pro will allow you to:

- Free same-day ACH transfers

- Pay bills in batches

- Enjoy free domestic and international wires

- Set up a multi-stage approval workflow for bills to automate

- Approve and pay bills in one place

- Import your bills from QuickBooks Online and Xero

Relay is able to support itself through these fees and a portion of the merchant fee that Mastercard shares with the platform.

How Does Relay Compare?

Relay Financial does a solid job of integrating your accounting procedures with your business bank account. But Novo (and other business banks) offers similar solutions while also providing unlimited reimbursements of out-of-network ATM fees.

It should also be noted that some business bank accounts, like Square, offer savings products that pay interest. But Relay doesn't currently have any interest-bearing accounts.

Relay separates from the pack, though, by allowing each business owner to open up to 20 no-fee checking accounts get up to 50 free debit cards. If you want multiple business bank account to help you with budgeting or if you have a lot of employees who will need card access, Relay Financial could be one of your best options.

Header |  |  | |

|---|---|---|---|

Rating | |||

APY | N/A | N/A | 0.50% |

Monthly Fees | $0 to $30/mo | $0 | $0 |

Min Deposit | $0 | $0 | $0 |

Fee-Free ATMs | 32,000+ | Unlimited | None |

Max Number Of Sub-Accounts | Up to 20 fee-free checking accounts | Up to 5 "Reserves" | N/A |

Max Number Of Debit Cards | 50 Business owner can set daily transaction and ATM withdrawal limits for each card. | 1 per user Each added user will have full account owner privileges. | Unclear |

FDIC Insured* | |||

Cell |

How Do I Open An Account?

Ready to move forward with Relay? You can sign up in minutes on their site. Start at the ‘Sign Up’ button.

First, you’ll need to provide your legal name, gender, and phone number. Additionally, you’ll need to provide an email and create a password. Keep the details about your business handy for a smooth process.

Relay Financial is able to work with most small businesses. But there are some industries which are left out. These industries include businesses that provide cryptocurrency, exchange cryptocurrency, privately-owned ATMs, money services, unlawful internet gambling, or cannabis sales.

Is It Safe And Secure?

Yes, Relay works with Thread Bank, Member FDIC to provide FDIC insurance on your deposits of up to $2,500,000. Additionally, two-factor authentication will keep your funds safe.

The Mastercard-issued debit card comes with a Zero Liability policy. That means that you won't be held responsible for unauthorized charges. Plus, you'll have the ability to freeze your card at any time.

How Do I Contact Relay?

You can reach out to Relay through support@relayfi.com. Additionally, you can get in contact through LinkedIn or Twitter @RelayFinancial. It also offers phone support at 1-888-205-9304 from 9 AM to 5 PM (ET), Monday through Friday.

Although it's a relatively new company, customers have great things to say so far. Relay has earned 4.1 out of 5 stars on Trustpilot, with 75 reviewers sharing their feedback.

Is It Worth It?

If you're looking for a business bank account that has a fee-free option and provides a collection of accounting and employee management tools, Relay Financial may be a good fit.

But you'll need to look elsewhere if you want unlimited ATM free reimbursements or would like to earn interest on your deposits. Also, it should be noted that if you don't have any employees, you may be better off choosing a freelancer-centric business banking platform like Lili.

Relay Financial Features

Account Types | Checking |

Minimum Deposit | $0 |

APY | N/A |

Maintenance Fees |

|

Branches | None (online-only bank) |

ACH Transfer Speed |

|

ATM Availability | 32,000+ fee-free ATMs that are part of the Allpoint network |

Out-of-Network ATM Fee Reimbursements | None |

Overdraft Fees | None |

Wire Transfer Fees | Relay Standard:

Relay Pro:

|

Sub-Accounts | Yes, up to 20 |

Number Of Debit Cards | Up to 50 |

Mobile Check Deposits | Yes |

Cash Deposits | Unclear |

Customer Service Number | 888-205-9304 |

Customer Service Hours | Mon-Fri, 9 AM to 5 PM (ET) |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Bill Pay | Yes |

FDIC Certificate | 9499, through Thread Bank |

Promotions | None |

Disclaimer

Relay is a financial technology company, not a bank. Banking services and FDIC insurance are provided through Thread Bank; Member FDIC. The Relay Visa® Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa® debit cards are accepted.

Relay Financial Review

-

Fees and Charges

-

Products and Services

-

Ease of Use

-

Tools and Resources

-

Customer Service

Overall

Summary

Relay Financial is a business banking platform that makes it easier to manage and automate your company’s finances.

Pros

- Up to 20 checking accounts within a single business account

- Up to 50 physical or virtual debit cards

- No monthly fees with Relay Standard

- User permissions for team members

Cons

- High monthly cost for Pro version

- Doesn’t pay interest or rewards

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak