Source: The College Investor

Digital banking solutions that actually work can be difficult to find for business owners. That’s why Grasshopper Bank is an option worth considering for business owners.

Grasshopper Bank offers a free digital checking account, flexible financing solutions, and an application programming interface (API) available for your own fintech brand.

Let’s take a closer look at Grasshopper Bank so you can decide if it is the right option for your banking needs.

Grasshopper Details | |

|---|---|

Product Name | Innovator Business Checking |

Min Opening Deposit | None |

Min Balance Requirement | None |

Monthly Fees | None |

APY | Up to 1.80% |

ATM Access | 46,000+ in-network ATMs with no fees |

Account Type | Business checking |

Promotions | None |

What Is Grasshopper Bank?

Grasshopper Bank was founded in 2019. The digital bank serves small businesses, startups, and investors.

As of May 2022, the bank currently holds approximately $300 million in assets. With a focus on the innovation economy, Grasshopper Bank offers forward-thinking options for small businesses looking to manage their funds efficiently.

Additionally, the bank offers API solutions to fintechs. But we will focus on the digital banking and lending solutions in this review.

What Does It Offer?

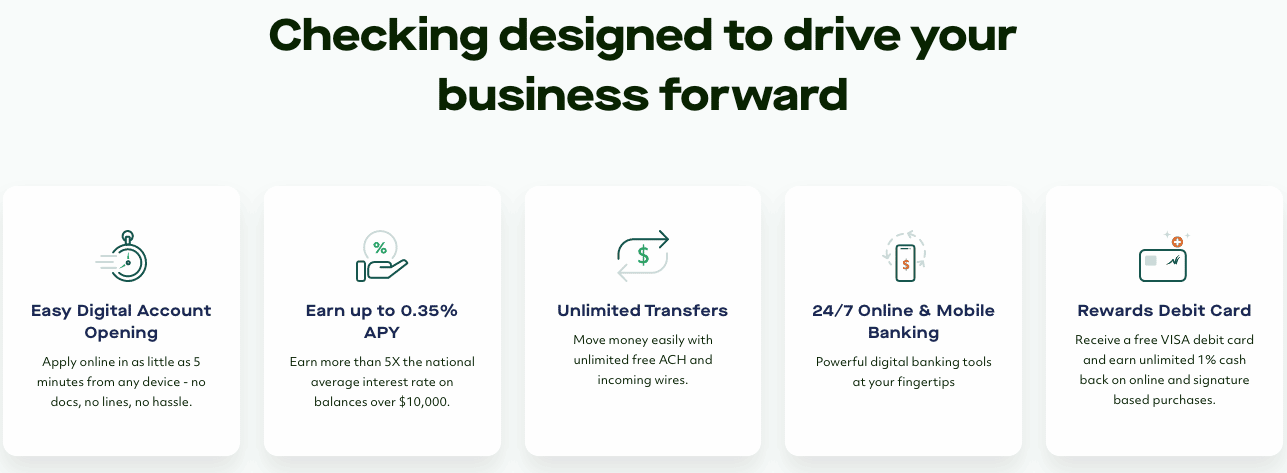

Grasshopper Bank has simplified the way small businesses can digitally manage their banking needs. From a frictionless way to apply for a checking account (according to their website you can apply in as little as five minutes!) to free ACH and incoming wires, here’s a closer look at what Grasshopper has to offer.

Digital Checking Account For Business

Grasshopper Banks’ digital checking account for businesses is built to make managing your business’ finances easier. Once you open this free account, you’ll have the ability to make unlimited free ACH transfers and accept income wires for free.

Additionally, you’ll find plentiful rewards for using this account. First, you’ll earn up to 1.80% APY on your balance.

They offer the following rate tiers:

- $0.01 - $24,999.99: 1.00% APY

- $25,000 - $250,000: 1.80% APY

- $250,000 or greater: 1.00% APY

You’ll also earn unlimited 1% cash back when using your free VISA debit card on online and signature-based purchases.

Innovator Money Market Account

If you have funds you want to keep in savings, you can add on the Innovator MMA Savings and earn 3.30% APY on balances of $25,000 or more.

Marketplace

To help you run your business more efficiently, Grasshopper has a marketplace of special offers from companies that provide services for small businesses.

For example, right now, you can get a free monthly subscription to the accounting software Autobooks. You can also get 25% off a subscription to Slack.

Built-in Digital Tools To Manage Money 24/7

Grasshopper Bank's digital checking account allows you to send digital invoices, automate bookkeeping, manage cash flow, and even pay bills seamlessly via check or ACH.

As a business owner, you will appreciate the opportunity to manage your business’ cash flow directly from a streamlined app.

Flexible Funding Solutions

As a small business or a startup, you have unique funding needs. Grasshopper will work with you to identify the appropriate lending solutions for your small business needs.

One option is access to Small Business Administration loans. You can use these funds for acquisitions, expansions, real estate, construction, partner buyouts, succession planning, and debt refinancing.

Other funding opportunities made available through Grasshopper Bank include:

- General Partner loans

- Fund Capital Call lines of credit

- Management Company working capital lines of credit and end-of-life facility

Strategic And Unique Support

Every business has specific needs. If you are pushing to get your startup off the ground, the strategic support offered by Grasshopper Bank provides the extra touches to enhance your banking experience and your business.

As a startup, you’ll have access to dedicated support staff who can help you navigate the fundraising challenges. Depending on your needs, you can practice pitches, ask for help determining sales targets, and access deck reviews.

Regular office hours hosted by industry experts can help you take your business to the next level.

Are There Any Fees?

The digital checking account for businesses offered through Grasshopper doesn’t come with any monthly fees. You also won’t be charged any fees by Grasshopper for using the accompanying debit card. However, you may encounter third-party ATM fees if you withdraw cash from an out-of-network ATM.

The digital checking account doesn’t have incoming wire fees or outgoing ACH. Plus, no overdraft fees looming over your account.

How Does Grasshopper Bank Compare?

Grasshopper Bank isn’t the only business checking account out there.

If you are looking for an option that allows for easy cash deposits, then Grasshopper Bank likely isn’t the right fit.

A traditional brick-and-mortar bank will likely be more up your alley if you want to deposit cash regularly. Chase Business Complete Banking is a good option if you want access to a more traditional branch experience.

If you like the digital banking atmosphere but aren’t sold on Grasshopper, then consider AXOS Basic Business Checking. It offers a free digital bank account for businesses. But you’ll miss out on any APY opportunities.

Header |  | ||

|---|---|---|---|

Rating | |||

Top APY | 1.80% | 0.05% | 1.01% |

Monthly Fees | $0 | $0 to $35 | $0 |

Min Deposit | $0 | $0 | $0 |

ATM Access | 46,000+ Free ATMs | 16,000+ Free ATMs | Unlimited |

Branches | N/A | 4,800+ | N/A |

Accounts For Kids/Teens | |||

FDIC Insured | |||

Cell |

How Do I Open An Account?

Decided that you want to work with Grasshopper Bank? Here’s what you’ll need to get started.

First, gather your personal information. This includes:

- Your name

- Contact details (i.e., email address, mobile number, address)

- Legal entity documents such as EIN and business address

Is It Safe And Secure?

When you store your funds in Grasshopper’s digital checking account, you’ll find peace of mind through enhanced FDIC insurance, that protects your funds up to $125 million.

Grasshopper Bank also requires two-factor authentication. And offers fraud monitoring, bank-level encryption and security.

Contact

Grasshopper is headquartered at 915 Broadway, New York, New York. If you need to get in contact, you can email support@grasshopper.bank. Or you can call 888-895-9685. You can also visit their contact page at Grasshopper.bank/contact.

Other ways to reach out include Twitter @grasshopperbank and LinkedIn @grasshopper-bank.

Customer Service

Grasshopper recently revamped their customer service department and states that 85% of calls are now answered within 30 seconds.

They've earned a 3.6 out of 5 on Trustpilot with over 80 reviews. Positive reviews state that the customer service is helpful and friendly and that it's easy to set up and use their account. On the other hand, some reviewers stated lack of notification and clarification regarding account closures, including fund freezes.

Is It Worth It?

Grasshopper Bank is offering a free digital business checking account. And it’s one of the best options out there right now. Without a monthly fee, small business owners and side hustlers can get excited about a banking experience that won’t be a drain on their finances.

With unlimited free transactions and the ability to earn cash back on your spending, that’s a bank account worth considering for any business. Plus, up to 1.80% APY on your balance is the icing on the cake.

With just a five-minute application process, you can set up a worthwhile checking account for your business. And then get back to work!

If you don’t think that Grasshopper Bank is the right fit, explore our other business checking account favorites.

Features

Account Types |

|

Minimum Deposit | $0 |

APY | Up to 1.80% APY |

Maintenance Fees | None |

Overdraft Fee | None |

Branches | None |

Mobile Check Deposits | Yes |

Cash Deposits | Not Available |

Checkbook Support | Yes |

ATM Availability | 46,000+ in-network ATMs |

General Customer Service Number | 1-888-895-9685 |

Online Support |

|

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | |

Promotions | None |

Grasshopper Bank Innovator Business Checking Review

-

Commissions & Fees

-

Customer Service

-

Ease Of Use

-

Products & Services

-

Specialty Services

Overall

Summary

Innovator Business Checking is a fee-free checking account for small businesses.

Pros

- Earn cash back on spending

- 46,000+ in-network ATMs without fees

- Earn 3.30% APY on the Innovator MMA

Cons

- No welcome bonus

- Poor customer service and question resolution

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak