BrioDirect is the online banking arm of Webster Bank, N.A., which is an FDIC member organization. BrioDirect offers a very competitive APY on its high-yield savings account, as well as certificates of deposit (CDs).

But with no checking accounts, credit cards, loans, or long-term investment products, is BrioDirect worth it?

Also, how does it compare to other top online banks? We answer those questions and more in our full review.

BrioDirect Details | |

|---|---|

Name | BrioDirect |

Products | High-Yield Savings, CDs |

Monthly Fee | $0 |

Savings APY | 4.85% |

Promotions | None |

What Is BrioDirect?

BrioDirect is an online bank offering two types of deposit products: A high-yield savings account, and various CDs. The financial institution is a brand of Webster Bank, N.A., an FDIC-member and a leading provider of employee benefits solutions.

Webster Bank has over $70 billion in assets and has its headquarters in Stamford, Connecticut.

What Does It Offer?

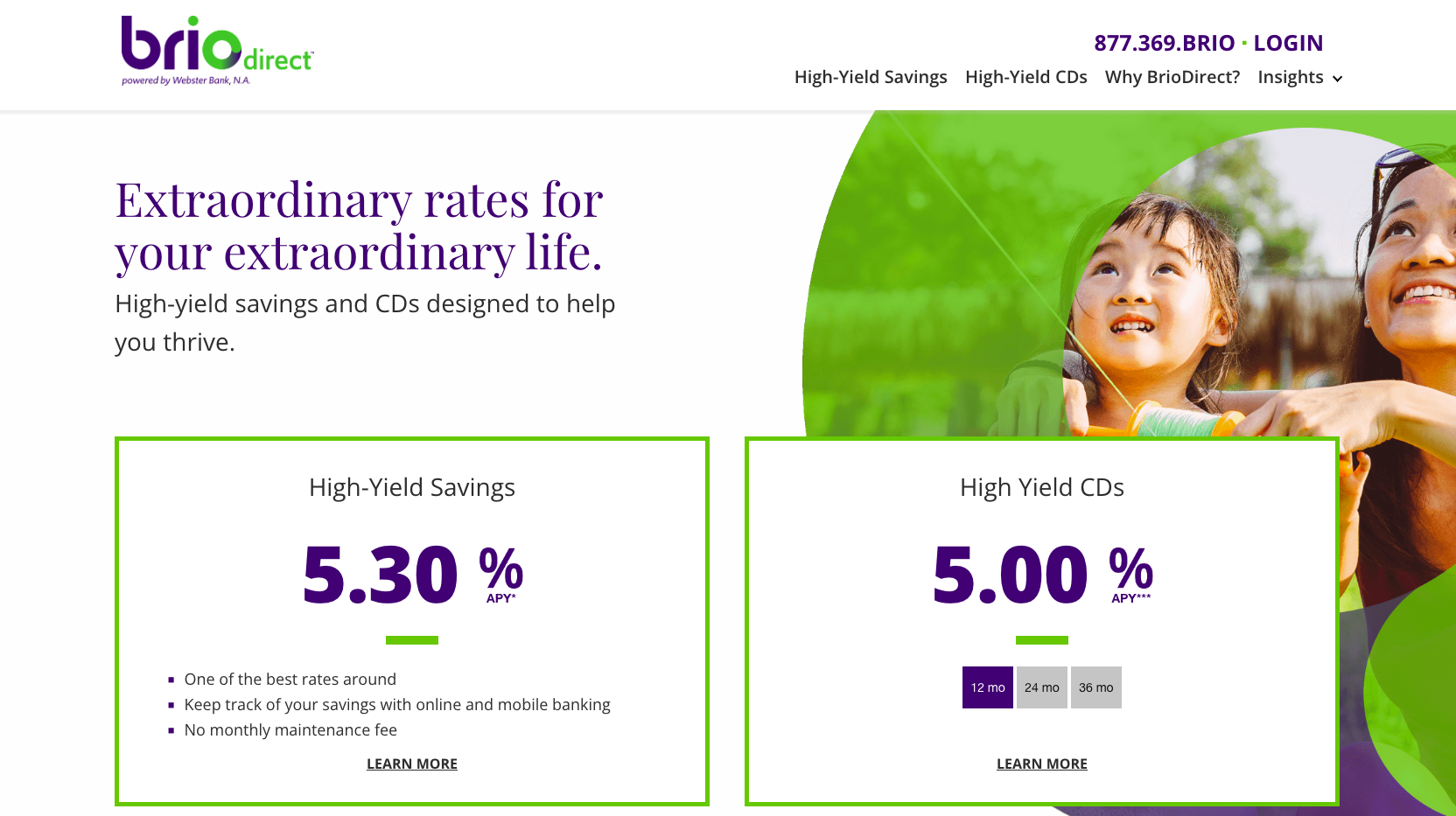

BrioDirect offers a high-yield savings account and three high-yield CDs, ranging between 12 and 36 months. Here's a closer look at both products:

High-Yield Savings

BrioDirect offers one of the highest savings annual percentage yields (APYs) on the market. You can get 4.85% with an initial deposit of $5,000. You also must maintain a balance of $25 to continue qualifying for the high rate. You can open an account online within minutes, and there are no monthly maintenance fees.

Brio offers several ways to fund your account, although the easiest is via an ACH deposit from your primary bank. You can also send funds via check or wire transfer. You can access funds in your Brio Direct account by using its External Transfer feature to send money to another bank.

Certificates of Deposit (CDs)

On its website, BrioDirect features three CD terms: Its Promo High-Yield 12-Month CD is currently offering an attractive yield of 5.00%. While lower than what Brio is offering on its savings account, it's a fixed-rate, so the APY won't change for the full 12 month term. Also, the minimum deposit is only $500, whereas the savings account minimum is $5,000.

Unfortunately, BrioDirect's other two CDs leave a lot to be desired. At the time of writing, the APYs are a lacklustre 2.30% on the 24-month, and 2.45% for the 36-month term. You can find higher returns elsewhere.

Are There Any Fees?

There are no monthly maintenance fees with a BrioDirect Savings account. There are also no fees to purchase a BrioDirect CD, however, if you withdraw funds before the CD term expires, you will incur an early withdrawal penalty, of up to 9 months interest, depending on the term length.

How Does BrioDirect Compare?

BrioDirect offers a very attractive savings APY, but its product lineup is very limited. If you're looking for a more comprehensive online banking solution, there are more suitable options.

Discover Bank is an online bank and FDIC-member. If offers a much broader range of products than BrioDirect, including checking and savings accounts, money market, CDs, credit cards, and personal, student, and home loans. While its savings APY is lower than BrioDirect (3.90% vs. 4.85%), there is no minimum opening deposit, and customers have access to more banking options.

Like Discover Bank, Ally Bank is a full-service online bank. Customers have access to checking and savings accounts, money market, CDs, investment accounts (including retirement), credit cards, mortgages, and auto loans. Ally Bank's high-yield savings also lags behind BrioDirect (3.85% vs. 4.85%); however, there are no monthly maintenance fees, and you can take advantage of Ally's RoundUp Savings feature to boost your balance. Also, it's CD rates are superior to BrioDirect.

How Do I Open An Account?

According to BrioDirect, it only takes a few minutes to open an account online. You will need the following: your smartphone, contact information, driver’s license, passport or state I.D., and Social Security number.

Is It Safe And Secure?

BrioDirect is a division of Webster Bank, N.A., which is a reputable bank. BrioDirect employs the same protections that most banks use, including password requirements, face ID, One Time Password, and security questions. It also uses multi-factor authentication. And your deposits are FDIC-insured up to $250,000.

How Do I Contact BrioDirect?

You can contact BrioDirect's Client Service Telephone Center by dialing 1(877) 369 - 2746 (BRIO) during business hours: Weekdays, 8 am to 8 pm ET, and Saturday, 8:30 am to 3 pm ET. The bank's mailing address is: Webster Bank, 1 Jericho Plaza, Jericho, NY 11753 (Attn: BrioDirect Deposit Operations). We could not locate an email address on the company website.

Is It Worth It?

If you have over $5,000 to deposit and are looking for a solid, low-risk return, then BrioDirect is worth considering. It's high-yield savings APY is up there with the best rates at other leading online banks. If you can't meet the high opening deposit requirements, or are looking for more from an online bank, including checking, credit cards, and other options, then you're better off looking elsewhere. Unfortunately, with the exception of its 12-month Promo CD, Brio's CD APYs are mediocre at best.

BrioDirect Features

Account Types | High-Yield Savings, CDs (12-, 24-, and 36-month) |

Savings APY | 4.85% |

Minimum Opening Deposit | $5,000 |

CD APYs: |

|

Minimum Deposit (CDs) | $500 |

Monthly Fees | $0 |

Mobile Deposit | Yes (1-3 days for checks to be deposited) |

Branches | No |

ATM Availability | No |

Customer Service Number | 877.369.BRIO |

Customer Service Hours | Weekdays, 8 am to 8 pm ET |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

FDIC Member | Yes (Webster Bank, N.A.) |

Promotions | None |

BrioDirect Review: High Savings APY

-

Interest Rates

-

Pricing and Fees

-

Customer Service

-

Products and Services

Overall

Summary

BrioDirect is the online banking arm of Webster Bank, N.A., an FDIC member organization. BrioDirect offers a very competitive APY on its high-yield savings account and certificates of deposit (CDs).

Pros

- High APY on savings

- No monthly maintenance fees

- FDIC-insured

Cons

- No checking account is available

- High $5,000 opening deposit on savings

- No long-term investments or lending products (credit cards, loans, etc.)

Colin Graves is a personal finance editor and writer. During 20+ years in the banking industry, he managed books of business in excess of $1 billion, winning awards for outstanding leadership and customer service. In 2022, after building his side hustles into a full-time business, Colin walked away from the 9-5. He teaches others how to do the same at ColinGraves.com

Editor: Robert Farrington