For decades, startup investing was limited to high-income millionaires called accredited investors. But in 2012, Congress passed Regulation Crowdfunding. This law allows “main street” investors to put money into the startups they believe in.

Since this time, crowdfunding platforms have come online making it easier for investors to find startup deals and invest. Republic is one such platform. This platform allows everyday people to invest in startups for a share of the equity. While the investment style is inherently risky, Republic offers hundreds of deals with small minimums. This makes it easier for regular people to invest in a diverse array of startups.

If you’re considering investing in vetted startups, Republic could be a great starting place for you. Here’s what you need to know about it.

Quick Summary

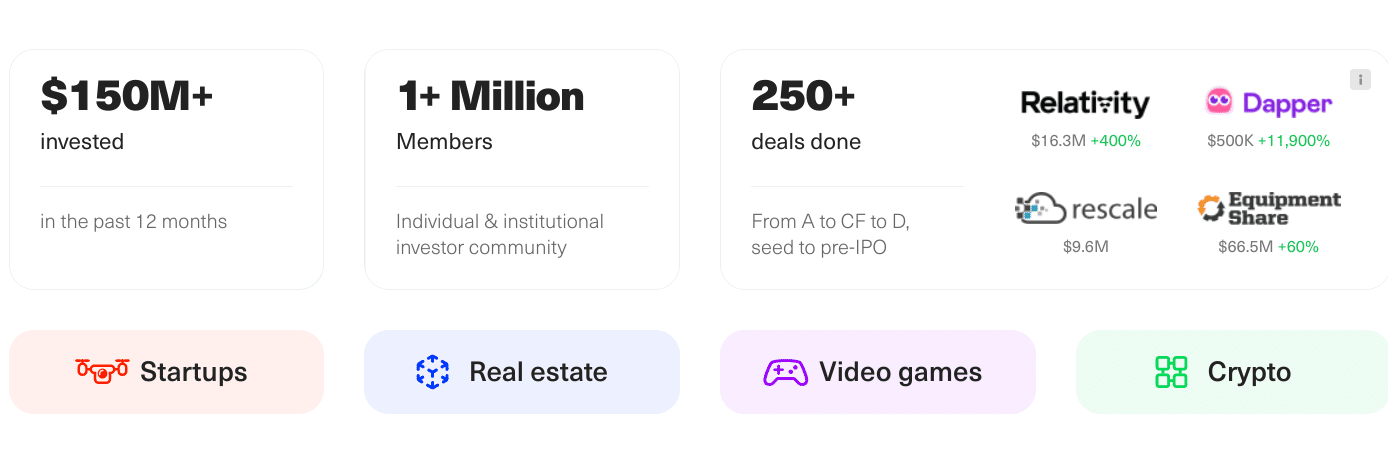

- Startups, real estate, video games, and crypto investments

- Investment minimums as low as $10

- Deals vetted by a large team of private investment experts

Republic Details | |

|---|---|

Product Name | Republic |

Min Investment | $10 |

Fee For Investors | $0 |

Open To Non-Accredited Investors | Yes |

Promotions | None |

What Is Republic?

Republic was founded in 2016 by alums of AngelList, the largest private investment platform in the world. Today, the company still sits under the AngelList umbrella of companies. The founders have deep expertise in venture capital investing and are dedicated to making private investing accessible to all investors.

At this point, the company has helped more than 250 companies raise over $200,000,000. Most of the companies on the platform are limited to raising $1 million per year from “main street investors” though they can raise more from accredited investors, venture capital firms, etc.

The company boasts that it raised millions of dollars for household names such as SpaceX, Robinhood, and the video game Pillars of Eternity II (among hundreds of other deals).

What Does It Offer?

Republic is a digital marketplace for startups, real estate, video games, and crypto. It offers one portal for regular investors seeking equity shares for their investments.

It offers another portal for accredited investors who follow different rules for investments. Investors can access deals through Republic’s webpage or its iOS app.

All the investment opportunities on Republic are vetted by Republic’s experienced team and the financials of the deal (including estimated market caps) are detailed on the site.

Invest As Little As $10

Investors can invest as little as $10 in certain deals, though the minimum investment amount varies by the deal. Through Autopilot, investors can also invest automatically in highly-successful Republic campaigns with as little as $20.

These low thresholds allows investors to maintain a diverse portfolio of equity holdings.However, for most investors, even a diverse portfolio of startup equity should only be a small segment of their overall investment portfolio. Startup investing is inherently risky, and the companies may go out of business.

Deals Vetted By Private Equity Experts

All the investment opportunities on Republic are vetted by private equity investing experts. Most have deep experience in venture capital investing. Less than 3% of all deals make it to the site.

This expertise is important. But it's important to note that even the companies on Republic can suffer a total loss. Investors need to be careful when investing in startups.

Highly-Rated App For Investing

Republic’s highly-rated (4.7 out of 5 stars) app is an important differentiating point for the company. Investors who are used to investing easily from an app can quickly get up to speed on Republic’s app. The app is full of information without being cluttered or difficult to use.

Funds Remain Locked For One Year

Investments remain locked up for one year before an investor has the option to sell their shares. The shares are sellable, but Republic emphasizes that you will need to find someone willing to buy the shares at that time.

Investors should probably view startup investments as very long-term investments. In other words, it's likely that you'll only have a chance to make money on an exit (i.e. the company being sold to another entity or going public).

Are There Any Fees?

Republic does not charge any fees to investors. Instead, it charges the companies that raise funds through the platform. The fees for companies are 6% of the total funds raised in cash and 2% as a Crowd Safe. These fees are only charged when the company successfully raises funds.

While investors don’t have to pay fees upfront, indirect fees may be passed onto investors through the form of slightly lower returns.

How Do I Contact Republic?

Republic has two brick-and-mortar locations, one in New York and the other in San Francisco. These are not “walk-in” centers. They are offices that allow the Republic team to vet investment opportunities.

Customer Service

Republic’s website does not have a chat feature and it does not advertise a customer service phone number.

The best way to contact Republic is through its contact webpage. The page directs users to email portals for all inquiries.

How Does Republic Compare?

Republic is working to make startup investing accessible to everyday investors. Its highly rated app is a testament to the team’s hard work and dedication to its cause. One of its standout features, the deal terms and disclosures can help investors understand what they are investing in.

However, Republic is one of many companies participating in equity crowdfunding. Other investing platforms such as SeedInvest and Mainvest offer similar startup investment opportunities for investors. But Republic's platform-wide investment minimum is lower than both of those competitors.

Republic has a few other points of differentiation compared to other crowdfunding sites. The team of advisors has deep experience in Venture Capital, so investors can feel confident that the barrier to entry is higher than most other sites. Additionally, Republic emphasizes clear disclosure and the risks of investing in startups. This clarity is important for investors to understand. Check out this comparison chart:

Header |  |  | |

|---|---|---|---|

Rating | |||

Min Investment | $10 | $100 | $100 |

Fees For Investors | $0 | 2% (up to $3,000) | $0 |

Fees For Companies | 6% of total cash raised + 2% as a Crowd Safe | 7.5% | 6% |

Open To Non-Accredited Investors? | |||

Cell | Cell |

Is It Safe And Secure?

Republic is a reputable company and hasn’t had any public hacks or breaches of confidentiality. It uses secure links and third-party verification services to limit the exposure of your personal information.

Startup investing is inherently risky. But Republic does its best to disclose the risks and ensure that investors understand that they could lose their investments.

How Do I Open An Account?

Opening an account is relatively straightforward. Users can download the app, or navigate to the webpage. The first requirement is to open an account. Republic is required to collect information on all investing entities.

If you’re a US Citizen, you are required to provide either a Driver’s License or Passport number. Non-US Citizens must provide a passport number. Investing entities (like LLCs) must provide formation documents. All this information is collected over a secure website and is required to create an investor profile.

Once Republic can confirm your identity, you’ll need to take an investor quiz. This quiz ensures that investors understand the inherent risks associated with startup investing.

Is It Worth It?

Republic is a solid platform for people seeking exposure to the highly volatile (but potentially rewarding) startup investing scene. But you should probably avoid Republic if you’re a brand new investor trying to focus on saving for retirement. Republic is best suited for investors who have a solid future-looking portfolio and want to metaphorically swing for home runs.

Startup investing could be part of the “alternatives” portion of a standard investment portfolio. An alternative segment of the portfolio typically holds more esoteric investments. It could include real estate, commodities, and cryptocurrency. Most investors limit their alternative investments to a small percentage of their overall portfolio.

If you're looking to add more diversification to your alternatives category, Republic could be a great option. But if you're just looking to lay the building blocks of your portfolio, you may want to consider investing in stock funds with one of our favorite discount brokers or robo-advisors instead.

Republic Features

Account Types |

|

Minimum Investment | $10 (Each company sets their own investment minimum) |

Investor Fees | None |

Fees For Companies | 6% of total cash raised and 2% as a Crowd Safe |

Target IRR | Varies by project |

Automatic Investing | Yes |

Investor Requirements | None |

Investment Offerings |

|

Fund Transparency | High -- fund financials are filed publicly with the SEC |

Investment Term | At least 12 months |

Share Redemption Program | None |

Secondary Market | Yes |

Customer Service Options | Contact form only |

Mobile App Availability | iOS |

Promotions | None |

Republic Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Diversification

-

Liquidity

Overall

Summary

Republic is a crowdfunding platform that allows anyone to invest as little as $10 in startups, real estate, gaming, and crypto.

Pros

- Low investment minimums

- Supports automatic investing

- Highly-rated iOS app

- Clear deal terms on the site

Cons

- Startup investing is inherently risky

- Limited secondary market

- No Android app

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller