Titan is an investment app that allows you to "invest like a hedge fund."

Hedge fund investing is normally reserved for those who have at least a few hundred thousand dollars to invest. You often have to be an accredited investor as well ($1 million net worth or $200 thousand income for the last two years).

Many hedge funds charge high fees. Two percent of assets plus 20% of profits are common for hedge funds. For the average Joe or Jane, who has only a few thousand dollars at best to invest, hedge funds are out of the question.

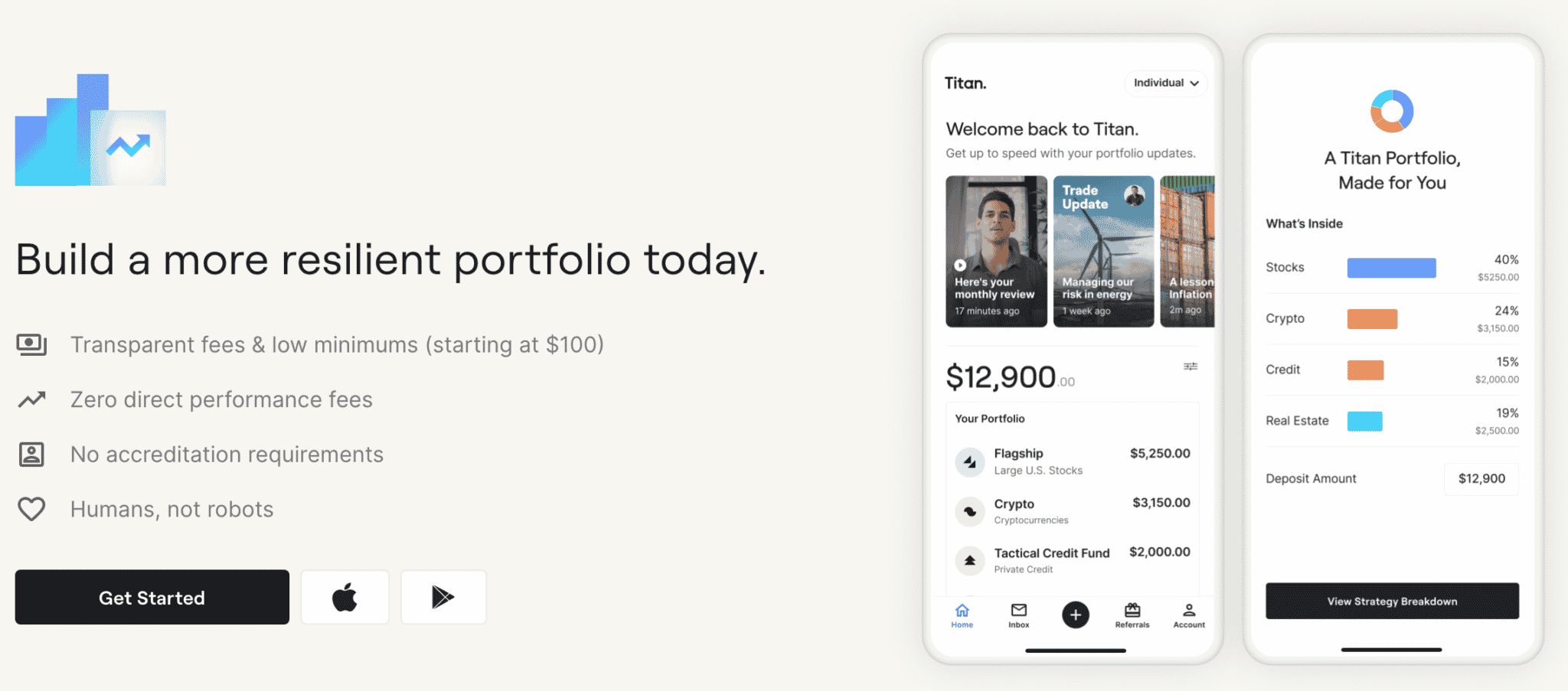

Not so fast. Titan is looking to change how people invest, and you only need $100 to get started. Investing in an automated portfolio of stocks and bonds on a robo-advisor like Wealthfront or Betterment will run you at least 0.25%. On Titan, it’s free.

In this article, we’ll tell you who they are and how to invest with them.

Titan Details | |

|---|---|

Product Name | Titan Invest |

Min Invesment | $500 |

Annual Fee | Free for automated investment strategies |

Advisory Fee For Using Portfolio Recommendations | 0.24% to 0.52% Annual Fee |

Account Type | Taxable, IRA |

Promotions |

|

What Is Titan?

Titan is a private fund that, according to them is a, "rigorous investment process that blends old school and new to identify high-quality businesses that can compound your capital at a high rate of return for the long run". There are five people behind the company, three of whom are co-founders. All have finance experience, and some have worked at hedge funds.

Calling Titan a hedge fund directly is a little misleading. Technically, they are not a fund. They are an SEC-registered investment advisor. You can also say they are a robo-advisor. There are real people doing the actual trades.

“To be very explicit, we are not a hedge fund,” said Clayton Gardner, co-founder of Titan, in an interview with FinancialPlanning. “We’re trying to open the idea of investing in managed portfolios. Some of those portfolios may be managed by software and some may be managed by humans. The idea of having another party managing a portfolio for you is something that is not readily accessible to most folks. And so that’s a really core focus. At the end of the day, we began building Titan for ourselves to solve a problem that we personally faced. I’m 28 years old. And my co-founders are 28 and 30. We’re mid-career professional millennials. And that’s certainly been our biggest source of early clients.”

How Does It Work?

Titan uses software to analyze filings by large hedge funds. By tracking hedge funds with long-term holdings, Titan tries to follow these same holdings. With that information, their team makes all trading decisions.

They have specific criteria for stocks, which include:

- Wide moat

- Strong cash generation

- High returns on capital

- Excellent management

- Attractive growth prospects

Your portfolio with Titan will hold roughly 20 stocks. The portfolio is re-adjusted each quarter where some stocks are removed while others are added.

The hedging part comes in by shorting 0% to 20% of the market based on your risk tolerance. The hedge is meant to minimize drawdowns in the case of a market drop. If the market goes down, the short position should go up in value, offsetting the portfolio’s decline.

Titan is an active manager and now offers Automated Stocks and Automated Bonds at no management fee. Competing platforms like Wealthfront or Betterment charge a minimum of 0.25% for this. Also, users can now meet with licensed advisors and Titan's Investor Relations team which can be helpful if you have questions or aren't sure about a certain investment.

You can track how well your investments are doing through their mobile app. In addition to tracking your investments, you also get insightful details about each position and educational videos about what’s going on in the market.

Currently, they have several funds with a minimum investment of $500.

- Flagship - This fund follows a large cap growth strategy.

- Opportunities - This fund follows a U.S. small/mid-cap growth strategy.

- Offshore - This fund focuses on non-US based companies.

- Crypto - This fund focuses on large-cap crypto assets.

- Carlyle Tactical Private Credit Fund - This fund focuses on investing in privately held credit.

- ARK Venture Fund - This fund looks at disruptive technologies in public and private markets.

- Apollo Diversified Real Estate Fund - This fund invests in a combination of large, established private real estate funds and public real estate securities.

Titan's Suite Of Products

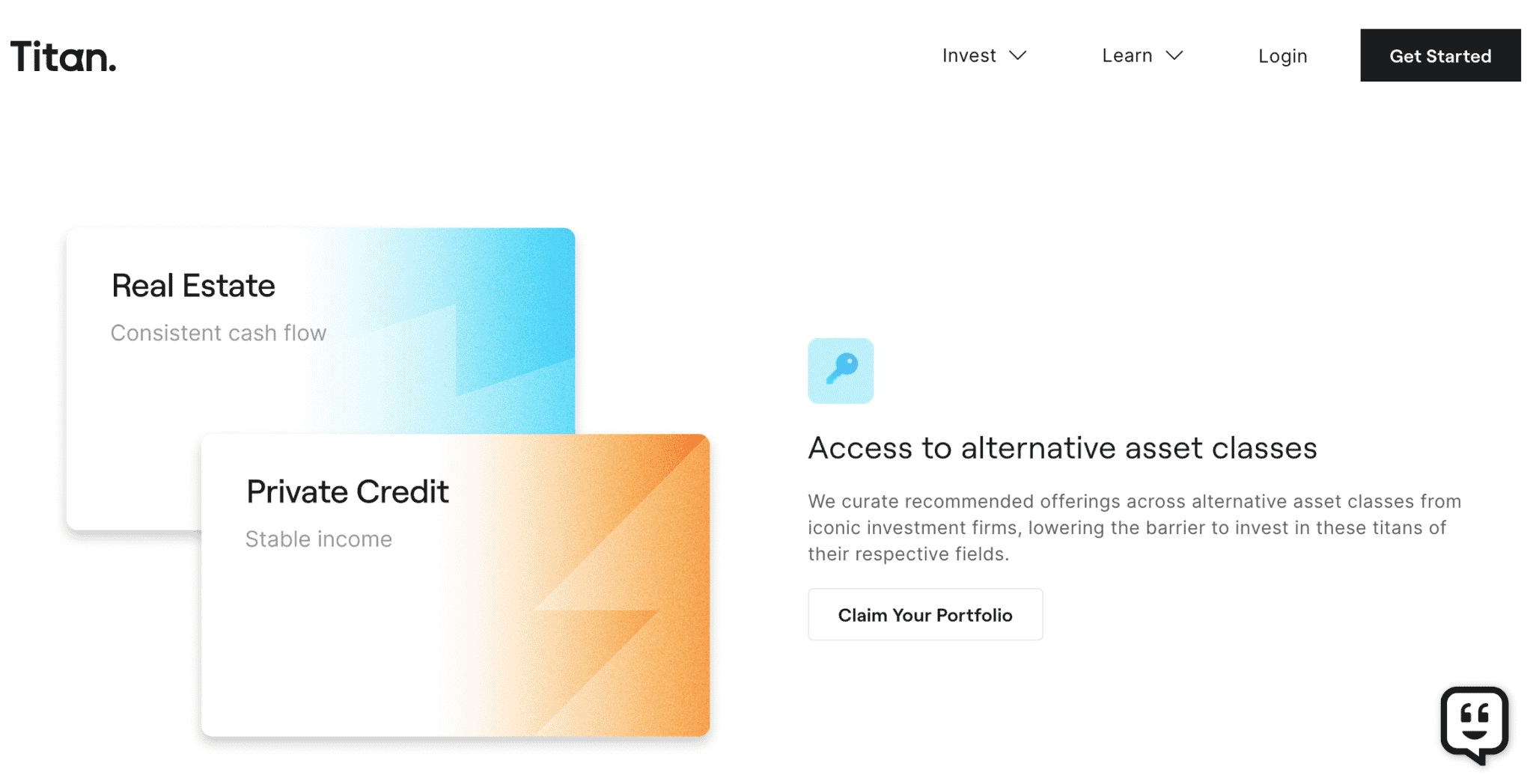

Titan launched a few new products including Private Credit and Real Estate. These products were created with the goal of bringing accessibility to funds, enhance diversification, and provide opportunities that would otherwise only be available at larger investment thresholds for accredited investors.

You don't need to be accredited to take advantage of these investment strategies.

Private Credit: Titan can recommend diversified private credit investments with lower minimums and quarterly liquidity. They "believe private credit is a great opportunity to earn stable income while diversifying portfolios further in an effort to build a more resilient portfolio." The fund minimum is $2,000 for individual accounts and $1,000 for IRAs.

Real Estate: Through Titan, you also have access to recommended real estate investments with lower minimums and quarterly liquidity. According to Titan's website, "The core focus of Real Estate is to provide investors with consistent, stable income throughout market cycles." The fund minimum is $2,500 for individual accounts and $1,000 for IRAs.

Titan Smart Cash: This is a cash management account that automatically moves your money between Cash Reserve and Treasury Money Market Funds on Titan when a better rate is found for you. Right now (April 2024), you can earn up to 5.24% APY - which is better than most savings accounts.

Fees and Terms

The Titan Automated Stock and Bond strategy are ETF baskets of index funds that track the broad market and fixed income securities.

Investing in an automated portfolio of stocks and bonds on a robo-advisor like Weathfront or Betterment will cost you at least 0.25%, but on Titan, it's free. Titan previously charged a $5 monthly fee for this but now offers Automated Investment Strategies for free.

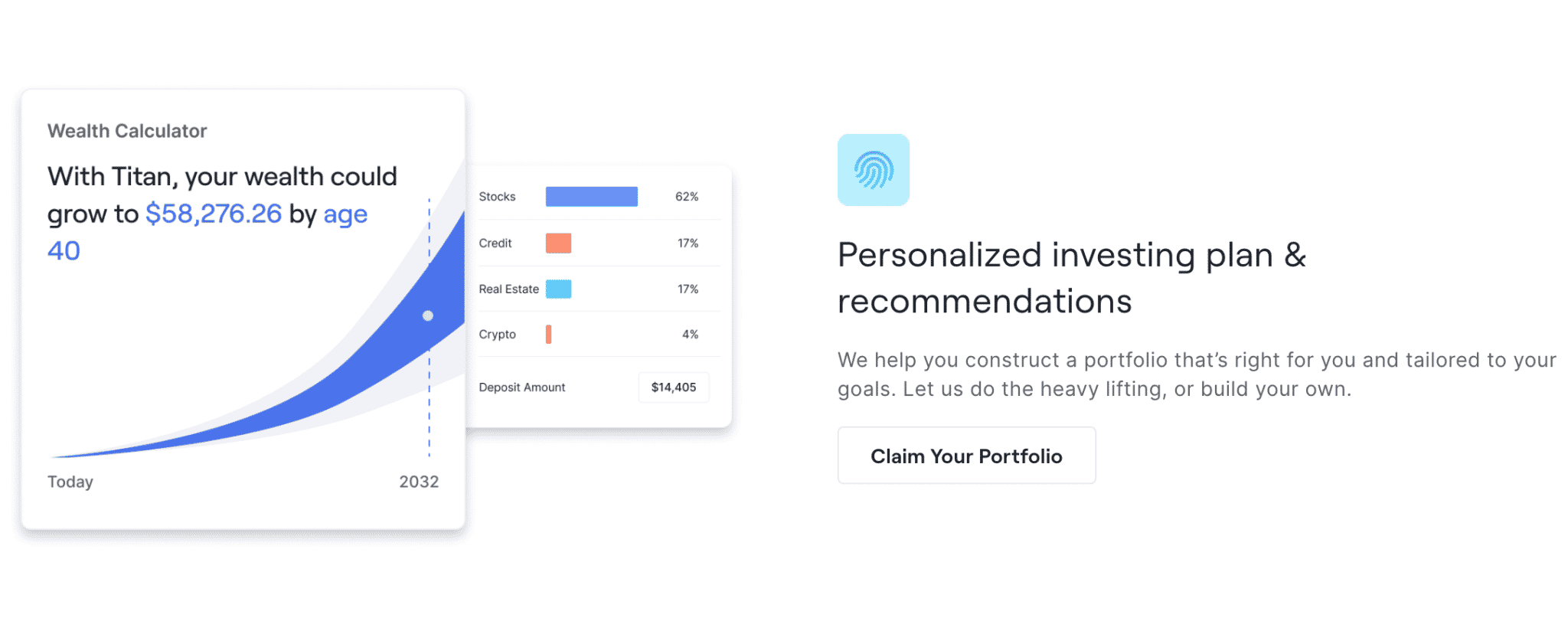

For customers who use Titan's portfolio recommendations, the annual Blended Titan Advisory Fee is 0.24% to 0.52%.

Titan’s and Partner’s actively managed, proprietary strategies such as Real Estate, Credit, Venture, Titan Flagship, and more, incur a Titan Advisory Fee of 0.7% to 0.9% , depending on your total net deposits. The more you invest, the more you save.

Here is how Titan structured these pricing tiers:

- $500–24,999 = 0.90%

- $25,000–99,999 = 0.80%

- $100,000+ = 0.70%

Unlike a hedge fund, which can lock up your money for months, you can withdraw your money any time. It takes about two to four days to receive it.

Titan currently supports both taxable accounts and the ability to have IRA accounts.

They also are able to be integrated into Personal Capital to track your holdings, but not Mint.

Is It Safe?

As safe as any other investment service. Titan uses 256-bit encryption security, and your account is also SIPC-insured for up to $500,000. They are an SEC-registered investment advisor with Pillsbury LLP as counsel. Clearing and custody are handled by Third Party Trade and Apex Clearing.

For non-accredited investors who want to see what it’s like to invest in a similar fashion to a hedge fund, Titan might be the closest thing there is to a hedge fund for you.

The idea of following 13F filings from hedge funds is viable. Since Titan is only looking to follow hedge funds with long-term horizons, the 45-day delay on 13F filings should have minimal impact, since these funds are not likely to have rotated out of their positions.

The 1% management cost is higher than a lot of robo-advisors, but if Titan is able to deliver on performance, the fee may be worth it.

Refer Your Friends

When you refer Titan to your friends and they sign up and fund their account, you'll get 25% off of your fees. This offer expires after your first 3 months of being invested with Titan (as of March 2023).

After your first 3 months, any completed referral will earn you a cash reward of $50.

Is It Worth It?

Titan's website lists their various performance metrics.

Since inception, Titan Flagship has delivered a 36.7% annualized return as of September 2022. Titan Opportunities (which just launched in August 2020), has delivered a 16.8% return as of September 2022.

However, Titan Offshore has returned a -37.2% annualized returned as of September 2022, and Titan Crypto has returned a -55.8% annualized return as of September 2022. As you can see, even with Titan, what you invest in matters.

See Titan's website for full performance disclosures.

Portfolios held by Titan are meant to be long-term. Meaning, years rather than months. If you like watching the market every day or need some of the invested funds within a few months after investing them, Titan Invest may not be for you. If you have a few years for a time horizon and don’t plan to touch any of the invested capital, Titan Invest might be a good place to invest your money.

It's also important to compare them to other similar companies. For example, you have the traditional robo-advisors like Betterment or Wealthfront.

Titan Review

-

Commission and Fees

-

Ease of Use

-

Customer Service

-

Tools and Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Titan is an investing platform that seeks to mimic the performance of hedge funds.

Pros

- Investors gain access to types of strategies usually only available to hedge fund investors

- Use their Automated Investment Strategies for free (other robo-advisors charge at least 0.25% for this)

- Titan funds are fully managed by their in-house team

Cons

- Higher fees than a traditional mutual fund

- Minimum investment of $500 for funds, which can be pricey for some investors

- Funds can be considered riskier than other robo-advisors

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak