Socially responsible investing is growing in popularity as investors seek to positively impact the environment or community. Beyond investing, the socially conscious may look for other ways to make a difference—including where they bank. Opting for a socially responsible bank is one more way to consciously make your dollars work for something you believe in.

If you’re shopping around for your first bank account or want to switch, you won’t have to sacrifice a quality banking experience when choosing a socially responsible bank.

We’ve outlined eight socially responsible banks and a few runners-up as well. These banks have different missions, but they are recognized as leaders in their efforts to achieve environmental or social changes.

Best Banks for Addressing Climate Change

These banks take an active stance against climate change. They don’t issue loans to fossil fuel companies, and they invest in environmentally positive causes.

Atmos Bank

Atmos Financial is a bank that wants to transform the financial industry to bring a big focus to the power of green energy in banking. The company invests deposits into essential green initiatives like clean energy investments, and all fossil fuel investments.

Products Available:

- Online checking account

- High-yield savings account

Certifications:

- B-Corp certified bank

Aspiration

Aspiration is a FinTech company that works in conjunction with Beneficial State Bank (listed below). The company operates using a customer donation model. Users can opt to pay Aspiration for its services (and how much to pay).

Aspiration donates 10% of all revenue to charities that help build a better life for Americans. The company also eschews all loans to oil or coal companies and commits to maintain carbon neutrality on all products.

Best Banks Promoting Social Justice Causes

The banks listed here promote causes such as union workers' rights, affordable housing, and other social causes. Both banks specifically fund these causes by lending to various organizations promoting worthy causes.

Amalgamated Bank

Founded as a bank to serve union clothing workers in 1923, Amalgamated Bank has stayed close to its roots nearly a century later. The lender is now publicly traded and continues to focus on empowering people and organizations to enact positive change.

They support a wide variety of progressive causes including rights for immigrants, workers and unions, LGBTQ, climate change, and economic change, to name a few.

Products Available:

- Checking accounts

- Savings accounts

- Fossil Fuel Free Investment Portfolio

- Mortgages

- Home equity lines of credit

Certifications:

- Member of the Global Alliance for Banking on Values (GABV)

- B-Corp certified bank

- Green America Member

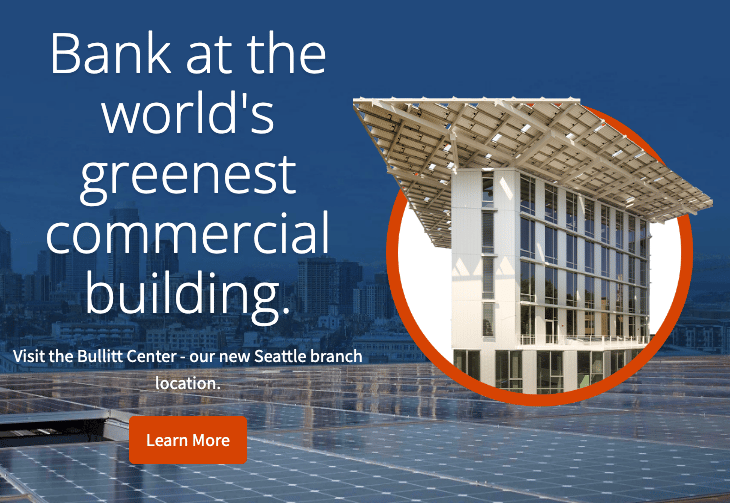

Beneficial State Bank

Since its inception in 2007, Beneficial State Bank has been owned by the Beneficial State Foundation, a non-profit that uses profits from the bank to fund projects for social change.

Beneficial State Bank has issued $250 million in loans for affordable housing, $130 million in loans for clean energy, and $44 million in loans for social justice. Fully 80% of the loan Beneficial issues directly support its mission.

Products Available:

- Personal checking, savings, and credit cards

- Auto Loans

- Business checking, savings, and credit cards

- Business loans

Certifications:

- Member of the Global Alliance for Banking on Values (GABV)

- B-Corp certified bank

- Green America Member

Best Community Reinvestment Banks

These banks have nationwide locations, but are focused on uplifting underserved communities through lending and financial innovation.

Runners-up in this category have a smaller geographic footprint, but they focus on uplifting their local community.

Southern Bancorp

As a Community Development Financial Institution, Southern Bancorp has community reinvestment at its heart. Founded in 1986, the bank serves primarily rural and underserved communities across the mid-south region.

It seeks to extend business and personal lending to communities that have historically been overlooked by larger lending institutions. The company is especially focused on reaching unbanked and underbanked individuals. These are the people who may have struggled to open bank accounts or cash their checks with traditional banks in the past.

Products Available:

- Personal checking and savings

- Business checking and savings

- Home Loans

- Auto Loans

- Personal Loans

- Small Business Loans

- Agricultural Loans

- Poultry Loans

Certifications:

- Member of the Global Alliance for Banking on Values (GABV)

- B-Corp certified bank

- Green America Member

Sunrise Banks

Based out of St. Paul, Minnesota, Sunrise Banks focuses on financial empowerment for all people including marginalized people. It partners with FinTech companies, including Self, to create products that will serve underbanked people.

The full-service bank, which was founded in 1986, offers the full range of its financial products to people across the nation.

Products Available:

- Personal checking and savings

- Business checking and savings

- Home Loans

- Credit Builder Loans

- Auto Loans

- Personal Loans

- Small Business Loans

- Small Business Credit Cards

Certifications:

- Member of the Global Alliance for Banking on Values (GABV)

- B-Corp certified bank

- Community Development Financial Institution

Best Black-Owned Banks

Black-owned banks are one of the most important institutions for building up economically underserved communities of Black people in the United States.

Today, there are only 18 Black-owned banks in the United States, and most of these institutions have a strong track record of socially responsible lending and building up the community.

City First Bank, A Subsidiary of Broadway Federal Bank

In April 2021, following the merger of City First and Broadway Federal, Broadway Federal became the largest Black-led minority depository institution.

While the company only operates in Washington D.C. and Los Angeles for now, customers can access the mobile banking app nationwide. City First operates as a public benefit corporation, which means it works with several nonprofit organizations to promote social justice. Causes include affordable housing, education, small business, wellness, and the arts.

Products Available:

- Personal checking and savings

- Business checking and savings

- Small Business Loans

Certifications:

- Member of the Global Alliance for Banking on Values (GABV)

- B-Corp certified bank

M&F Bank

At the turn of the century, the Black community had limited access to financial capital to grow businesses. Mechanics and Farmers Bank, now known as M&F Bank, was founded in 1907 in North Carolina to address that need.

Since that time, the bank has expanded to build the well-being of their communities. They do this through quality financial solutions and paying specific attention to underserved people and geographies.

Products Available:

- Personal checking and savings

- Health Savings Accounts

- Business checking and savings

- Home Loans

- Credit cards

- Auto Loans

- Personal Loans

- Small Business Loans

Certifications:

- Community Development Financial Institution

Runners Up

Methodology for Selecting Most Socially Responsible Banks

The College Investor considered all banks that were either part of Green America, B-Corp certified, or members of the Global Alliance for Banking on Values. Credit unions were excluded from the rankings.

To be listed as a “Best Bank” the bank must be part of a nationwide network of ATMs, and have a mobile app that makes it accessible to people that don’t live close to a nearby branch. The bank must also have at least one fee-free checking account.

The best Black-owned bank category was expanded to include some of the nationwide Black-owned banks listed on BankBlack USA. The listed banks have a strong history of social responsibility and reinvestment in the Black community, and they have a nationwide presence.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington