Investing in alternative assets is a great way to begin to diversify your portfolio. And precious metals are a popular first step for many investors.

Gold, silver, or other metals don't generate revenue like a company that's listed on a stock exchange does. But as a store of value, they're often considered to be a hedge against inflation. And since their value isn't as directly related to the stock market as other investments, they can also provide some stability during economic downturns.

If you're looking to invest in precious metals, APMEX is a marketplace that could help you get started. It's one of the largest dealers in the United States and offers a wide variety of investment options. Keep reading our APMEX review to learn more about how the platform works and what it offers.

APMEX Details | |

|---|---|

Product Name | APMEX |

Min Purchase | $0 |

Transaction Fee | Check or Bank Wire: $0 All Other Payments: 4% (Via Discount Removal) |

Annual Fee On Storage | 0.45% to 0.55% |

Promotions | None |

What Is APMEX?

APMEX is a precious metals dealer that has been in business for over 15 years and during that time has sold over 130 million ounces of gold and silver. The company is based in the United States, but it's available in 60+ countries around the globe.

In addition to gold and silver, APMEX sells platinum and palladium. It also sells a variety of numismatic and semi-numismatic coins and currency. Today, APMEX is a billion dollar company that employees over 200 people.

What Does It Offer?

One reason that we recommend APMEX to beginners is that it's a well organized website. It’s categorized by metal-type (gold, silver, platinum & palladium, and collectibles), and then further organized by product type (bars and rounds or coins).

We also love that APMEX offers so many features to simplify the process of investing in assets that can be complicated for the average investor. When you invest in tangible assets, you have to think about things like shipping and storage and it's typically a lot harder to invest on a recurring basis or track your portfolio.

Thankfully, APMEX has solutions for all of these common problems and more. Here's a closer look at what the company offers.

QuickShip

If you're planning to take physical possession of the assets that you buy on APMEX, you shouldn't have to wait long for them to be heading your way.

Through its QuickShip program, APMEX promises to send out all eligible orders by the next business day after a payment has been processed. And APMEX Club members get same-day shipping on QuickShip-eligible orders when payment is processed before 4 PM (Monday - Friday).

To access free domestic shipping with APMEX, your order size will need to be at least $200 ($500 for Citadel orders). The shipping fee for smaller orders is $9.95.

Citadel Storage

Don't have a safe space to store the goal or silver that you buy from APMEX? No problem. The company can help this for you through its Citadel Global Depository Services.

Citadel storage facilities are managed by Brink's and are insured against theft, loss, and damage. Storage fees are reasonable and you can request on-demand delivery of your precious metals any time you want.

AutoInvest

Investing in stock market assets is convenient since it's easy to set up a schedule of automatic recurring purchases. This not only saves you time, but also makes it easy to implement a dollar-cost averaging strategy.

Historically, it hasn't been as easy to invest automatically in precious metals. But APMEX has been working to change that. It will allow you to set up recurring buys for a wide selection of precious metal products.

Currently, customers can set up the following AutoInvest schedules: daily, weekly, biweekly, monthly or quarterly. Recurring purchase schedules can be set up for any products that have a "Start AutoInvest" option right above the "Add to Cart" button.

IRA-Eligible Products

For a precious metals product to be IRA-eligible it needs to meet certain requirements. For example, gold must be at least .995 fine (with the exception of the American Gold Eagle) and silver must be at least .999 fine.

APMEX has a large number of IRA-eligible products on its platform and it makes it easy to limit your shopping results to only these assets that are IRA-approved.

You can't actually open an IRA with APMEX. But it does list several preferred Precious Metal IRA custodians, including: The Entrust Group, Goldstar Trust, Kingdom Trust Company, STRATA Trust Company, and Equity Institutional.

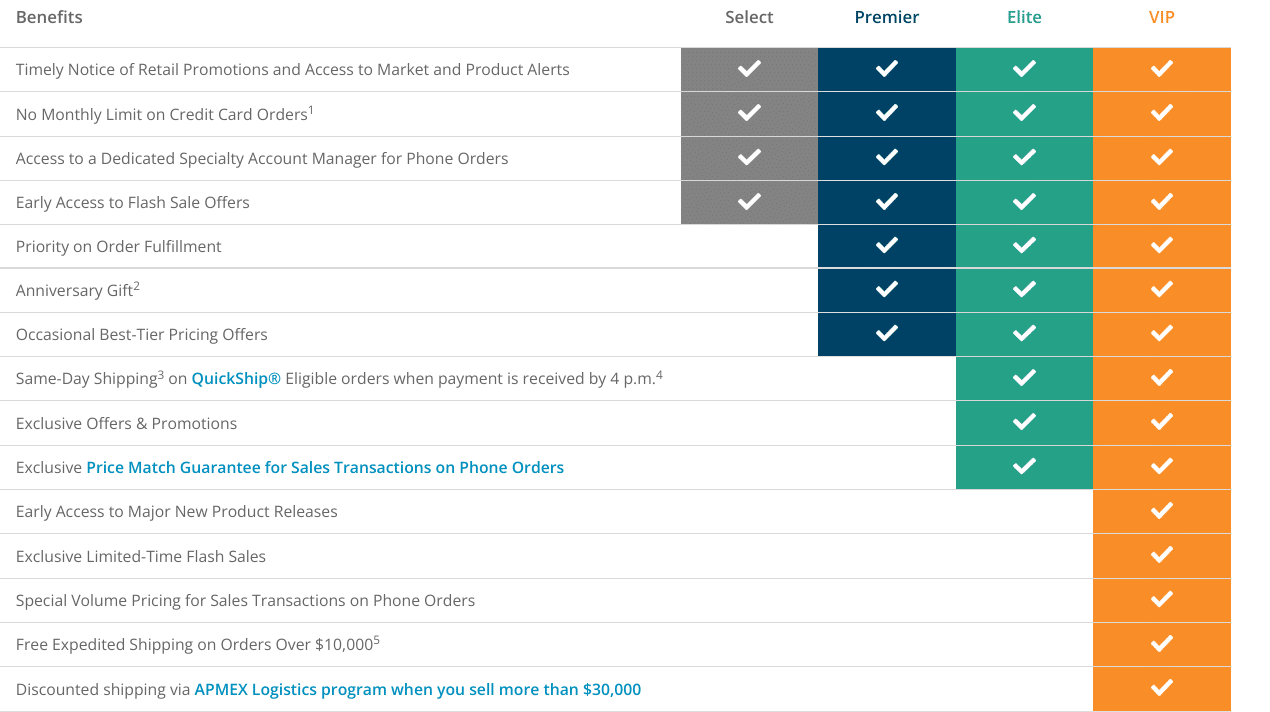

APMEX Club

Buyers become APMEX Club members after they complete their second purchase on the platform or have purchased or sold at least $5,000. There are four different APMEX Club Tiers. Here's what they are and how you qualify for them.

- Select: Complete 2-5 orders or spend or sell at least $5,000

- Premier: Complete 6-9 orders or spend or sell at least $10,000

- Elite: Complete 10+ orders or spend or sell at least $10,000

- VIP: Invitation only

Member can qualify for a variety of perks including faster shipping, exclusive offers, access to flash sales, anniversary gifts, and more. There's no cost to an APMEX Club membership and once you reach a certain tier, you'll remain there for life.

Tools & Resources

APMEX has two alert tools that can help customers who are wanting to make sure that they never miss out on a great opportunity. These are:

- Custom Spot Price Alerts: Get notified when a product reaches your ideal purchase price.

- AlertMe: Get notified when an out-of-stock product becomes available for purchase.

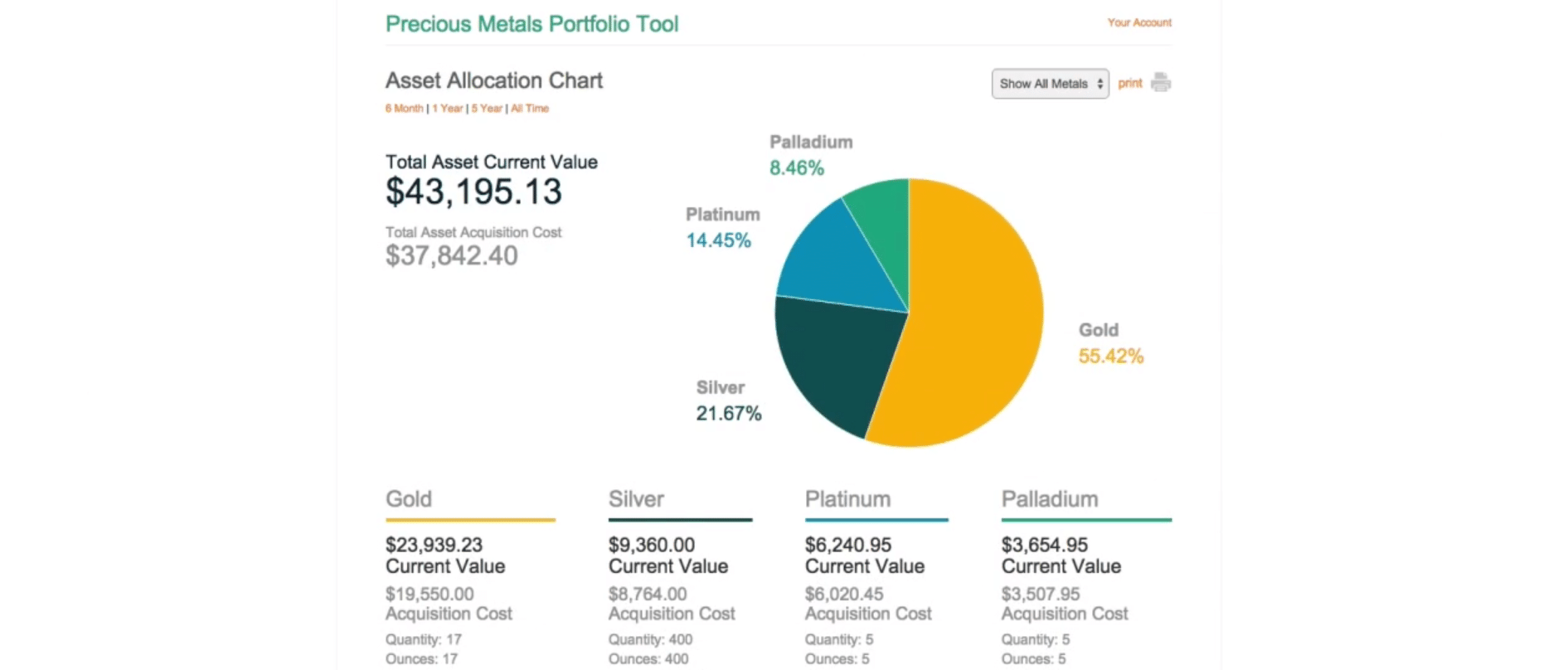

There's also a nifty precious metals portfolio tool. It allows you to see all of your precious metal holdings in one place and monitor their cumulative value.

You can add any precious metal investments to APMEX's portfolio tracker – even those that were purchased from another dealer. And you can enter the prices you originally paid to get up-to-the-second views of your gains or losses.

Return Policy

Unlike some bullion sites, APMEX does allow you to return items after you buy them. You’ll have 7 days after receiving an item to return it and receive a refund.

If the item you’re returning loses value, you may be a required to pay a “market loss” fee to restock the item. You also won't be able to recoup any shipping or handling charges.

In general, most investors won’t take advantage of the APMEX return policy. But it's still nice to have the option in your back pocket.

BitPay Integration

The APMEX platform offers BitPay as a payment option at checkout. This means that you may be able to use your crypto assets to purchase precious metals on the platform. Currently, APMEX customers can buy products with the following crypto tokens: Bitcoin, Bitcoin Cash, Ethereum and Dogecoin.

Sell To APMEX

Have gold or silver that you'd like to sell? APMEX can help with that too as it's one of the largest buyers of bullion and other precious metal products in the U.S.

With its 1-day guarantee, APMEX promises to pay you for the products you sell by the next business day after it receives them. Its logistics team also provides fast, easy, and affordable shipping.

Note that APMEX has a minimum transaction size for purchase orders of $1,000. You can request a quote online at any time. But if you want to lock in your price, you'll need to call 800-514-6318.

Are There Any Fees?

APMEX says that it doesn't add any fees to the spot prices that are displayed on its platform. But the reality is that these prices include a 4% discount for paying with a check or wire transfer. If you use any other form of payment (credit card, PayPal, or BitPay), this 4% discount is removed.

The "discount removal" wording is a crafty way of saying that APMEX charges a 4% transaction fee for buying products with any of those payment methods. In addition to this potential fee, you'll also pay a $9.95 shipping charge on standard orders under $200 or Citadel orders below $500.

If you decide to use Citadel Storage, you'll also pay an annual storage fee. The fee is 0.55% for portfolio values up to $1 million, $0.50% for portfolios up to $10 million, and 0.45% for portfolios over $10 million.

How Does APMEX Compare?

APMEX stands out from other precious metals dealers by offering so many different types of assets. Bullion Vault, for example, only offers gold and silver. And Glint and Vaulted are both gold-only marketplaces. So if you're looking to invest in platinum, palladium, or rare coins, APMEX may be your best choice.

But while most of its competitors charge transaction fees ranging from 0.5% to 1.8%, you'll essentially be paying a 4% transaction fee (via the discount removal) to APMEX if you pay with a card, PayPal, or BitPay. You can dodge this cost by using a check or bank wire, but APMEX doesn't support ACH purchases which would be much more convenient and cost-effective.

Finally, it should be noted that APMEX doesn't offer a way to spend the gold that you own on day-to-day purchases. If that's something that interests you, you may want to consider Glint instead. The Glint Mastercard® makes it easy to spend real gold as everyday money virtually anywhere.

Header | |||

|---|---|---|---|

Rating | |||

Transaction Fees | 0% on checks and bank wires 4% on cards, PayPal, & BitPay | 0.5% | 1.8% |

Annual Fee On Stored Assets | 0.45 to 0.55% | 0.02% | 0.40% |

Mobile App | |||

Cell |

How Do I Contact APMEX?

There are several ways to get in touch with APMEX support. For general inquiries, you can call 800-375-9006, live chat, or email their team at service@APMEX.com. Hours of operation are Monday - Thursday, 8 AM - 8 PM (EST) and Friday, 8 AM - 6 PM (EST).

For questions regarding IRAs, you can call the same number as above. But there's a separate email address (ira@apmex.com) and the hours of operation are slightly different: Monday - Friday, 8 AM - 6 PM (EST).

Finally, if you have questions about Citadel storage, you can call 888-518-7596 or email citadel@APMEX.com. Hours of operations are Monday - Friday, 9 AM - 6 PM (EST).

APMEX's Trustpilot rating is low at just 2.5/5 from over 7,500 reviews. But it does have an A- rating on the Better Business Bureau (BBB) and it's historically been very quick to respond to complaints there and seek to resolve them.

Is It Safe And Secure?

Yes, APMEX's website and apps are encrypted. Assets that are stored at Citadel sites are protected by insurance and the company submits to random audits by an independent accounting firm. Finally, all APMEX shipments (both to and from customers) are insured up to $60,000.

Is It Worth It?

APMEX is one of the most robust platforms for buying and selling precious metals. So if you're looking for a wide variety of features and supported assets, APMEX might be right for you.

However, having to pay an extra 4% for paying with a card, PayPal, or cryptocurrency is a bummer. And since ACH transactions aren't supported, the only way to avoid this penalty is to return to the Stone Age by mailing a physical check or make a wire payment (which is likely to cost you in bank fees).

Ultimately, APMEX is a precious metals platform that can do it all -- from giving you IRA and AutoInvest options to storing your products or buying them back. But it's unlikely to be your lowest-cost place to buy gold or silver...unless you're willing to pay with a check.

APMEX FAQs

Let's answer a few of the most common questions that people ask about APMEX:

What do the letters "APMEX" stand for?

American Precious Metals Exchange

Where is APMEX located?

APMEX is based in the United States and its headquarters is located in Oklahoma City, Oklahoma.

Does APMEX sell fakes?

No, it only sells authentic products that have been verified by its numismatic team.

Is APMEX the same as OneGold?

Not exactly, but OneGold was founded by APMEX and Sprott with the intention of helping investors buy and sell digital metals quickly and easily.

Does APMEX have any promotions or discounts?

APMEX often offers exclusive promotions and deals to APMEX Club members. To become a member, you'll need to complete at least two orders or buy or sell at least $5,000 on the platform.

APMEX Features

Account Types | Taxable only, but IRA-eligible products are available |

Minimum Purchase | None |

Minimum Sell | $1,000 |

Transaction Fee |

|

Shipping Fee | $9.95 (waived on standard orders of at least $200 Citadel orders of at least $500) |

Citadel Storage Fee |

|

Payment Methods |

|

Automatic Investing Options | Yes |

General Customer Service Number | 800-375-9006 |

General Customer Service Hours | Monday - Thursday, 8 AM - 8 PM (EST) and Friday, 8 AM - 6 PM (EST) |

Mobile App Availability | iOS and Android |

Web/Desktop Platform | Yes |

Promotions | None |

APMEX Review

-

Pricing & Fees

-

Customer Service

-

Ease of Use

-

Tools and Services

Overall

Summary

APMEX is one of the leading tools to use for buying gold, silver, platinum, palladium, and rare coins.

Pros

- Huge inventory

- Automatic investing options

- IRA-eligible products

- Secure storage is available

Cons

- Card, PayPal, or BitPay payments cost 4% more

- Other platforms have lower storage fees

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller