Physical gold has long been a popular investing asset for protecting against inflation. However, the high costs of refining, inspecting, storing, and insuring gold have prevented most small investors from owning physical gold. Glint is a 21st-century technology company looking to change that problem.

With deep connections in the professional gold investment community and a robust digital platform, Glint is making it easier for everyday investors to buy and own physical gold bullion. Investors can buy gold from an app while paying low transaction fees. And Glint is injecting extreme liquidity into the gold market. Not only can investors buy and sell gold at current spot prices, but they can also instantly convert gold in their account to spendable US Dollars by swiping their Glint debit card.

If you want to become a gold investor, Glint’s investment platform may be the quickest and easiest way to get started. We explain how it works and what to look out for.

Quick Summary

- Gold investing with no minimums

- Buy and sell gold through an app

- Option to spend gold through a linked debit card

Glint Details | |

|---|---|

Product Name | Glint |

Min Invesment | $0 |

Transaction Fee | 0.50% |

Annual Storage And Insurance Fee | 0.125% |

Promotions | Storage and insurance fee is currently waived |

What Is Glint?

Glint is an app that allows small investors to buy and own physical gold. Investors can own any amount of gold (from $.01 to millions) through Glint. Glint keeps transaction fees low and is currently offering free storage and insurance fees for investors.

The low fees make it easy for investors to own physical gold, even if they can't afford their own gold bars. In the UK, Glint also offers peer-to-peer transfers between Glint users. This functionality isn’t currently available for people outside of Europe.

Glint is currently raising money from investors on Republic at a pre-money valuation of $32.5 million. Technically, anyone can become an investor in Glint by participating in this crowdfunding campaign. However, the offering is set to close on August 6, 2021.

What Does It Offer?

Glint helps everyday investors buy physical gold bullion that is insured and stored in a secure Swiss bank. Investors can buy as much or as little gold as they want, and they can feel secure knowing that they will be able to buy or sell at the best possible spot prices for gold.

Glint has also introduced a “Gold as currency” concept. Using a linked debit card, gold owners can spend using currency backed by their gold. Glint subtracts the gold from a user’s account based on the spot price of gold at the time of the transaction.

This sort of “instant conversion” from assets to cash is something I expected to see from cryptocurrencies years ago but is still only partially a reality. Seeing this forward-looking technology from a gold company is a fascinating development, However, it may not offer much value for gold investors looking for long-term gains.

Buy Gold At Competitive Spot Prices

Glint has a foothold in the professional gold investing community. That allows Glint to find the most attractive spot prices for its investors.

Private gold investors may have experienced trying to buy gold only to see inflated spot prices or super-high transaction fees. Glint clearly discloses the spot price and its 0.5% transaction fee to investors looking to hold gold assets.

Own Physical Gold With Low Fees

Physical investments in bullion have often been difficult to break into, even for investors with large amounts of cash. Transaction fees for private investors have often been high. And owning gold bars requires a lot of capital. Working through a company like Glint lowers the barrier to entry into the gold market, and lowers transaction fees for investors who want to buy or sell.

Glint users who buy gold will own physical gold which is stored securely for them. It charges a 0.5% purchase fee. And it typically charges a 0.125% annual storage and insurance fee. Currently, Glint is waiving the 0.125% annual storage fee. But investors should expect this fee to return in the future.

Instantly Convert Gold To Us Dollars For Spending

Glint Pay allows users to link a Mastercard debit card to their Glint gold account. Users can then spend USD backed by their gold.

When users spend their gold, they receive the spot price of gold for the day, and they pay no transaction fees if the gold is spent in the currency of residence. However, a 0.5% foreign transaction fee applies when you spend in a foreign currency.

$5,000 Daily Spend Limit

Glint limits the free-spending to $5,000 per day ATM withdrawals are limited to $300 daily. Anyone who wants to spend more than $5,000 per day (for example, if you want to make a down payment on a rental property) will have to pay the 0.5% selling fee and then transfer currency to their primary account.

Are There Any Fees?

The primary fees that Glint users should know about are the buy, sell, and storage fees. Whenever a user buys gold, they will pay a 0.5% purchase fee. And, whenever they sell, they'll pay a 0.5% selling fee. Additionally, users will pay a 0.125% annual storage and insurance fee for their gold once the waiver for this fee is lifted.

Users who choose to spend in a foreign currency (not USD) will pay a 0.5% fee for their spending. This is typically lower than a comparable fee for using a US debit card in a foreign country. That said, it's fairly easy to find travel credit cards that don't charge any foreign transaction fees.

There's also a $1.50 ATM fee that is applied each time a user withdraws cash. This can be avoided simply by swiping the card at a register since spending with Glint is free.

The last “fee” that investors need to understand is the tax implication of using gold to spend money. Investors may be subject to short-term capital gains implications if they constantly buy gold and spend it when the spot price of gold is higher. Certainly, Glint will do everything to help investors lower their tax burden. But this could surprise investors who try to treat their Glint account like a super high-yield checking account.

How Do I Contact Glint?

Investors who want to contact Glint in the United States can call (877) 258-0181 or email their customer support team at support@glintpay.com. Prospective and current investors can also contact the team through an online contact form.

Glint has offices in California, Nebraska, and London, and its headquarters address is:

1000 W. Maude Ave.

Sunnyvale, CA 94085

How Does Glint Compare?

Glint’s focus on spending gold is unique in the bullion investment space. While game players have long spent gold in Fortnite or League of Legends, people haven’t carried gold in their pockets for centuries (if ever). Allowing account holders to spend up to $5,000 worth of gold each day is a unique angle for a bullion investment company.

Aside from the spending angle, Glint compares favorably to other online gold investment platforms. BullionVault, a leading physical bullion marketplace, charges nearly identical fees for buying, selling, and storing all forms of bullion. Vaulted, an online gold buying app, charges higher fees than Glint but offers a similar buying experience. Check out this quick comparison chart:

Header | |||

|---|---|---|---|

Rating | Cell | ||

Transaction Fees | 0.5% | 1.8% | 0.05 to 0.5% |

Annual Fee | 0.125% (currently waived) | 0.40% | 0.12% |

Debit Card | |||

Cell | Cell | Cell |

Is It Safe And Secure?

Glint’s primary marketing point is the safety and security of physical gold investing, and in many ways, it lives up to the hype. Any gold purchased through Glint is physically secured, and it's insured against loss.

Investors can have the physical bullion shipped to them at any point (though this includes several additional charges). Glint also conducts all financial transactions through Sutton Bank, member FDIC. Its debit cards can be frozen or canceled if you ever lose physical control of the card.

Users will need to provide Glint with personal information to open an account. Whenever you provide a company with your personal information, that information becomes open to theft via a data breach. However, Glint, like all companies, does its best to store that information securely.

Glint does a good job of helping investors understand that gold has historically performed as a long-term hedge against inflation. However, as an asset, it may go up or down in value in the short-term. In an era of relatively modest inflation (yes, even now the measured rate of inflation is modest) the safety of gold may be overvalued.

How Do I Open An Account?

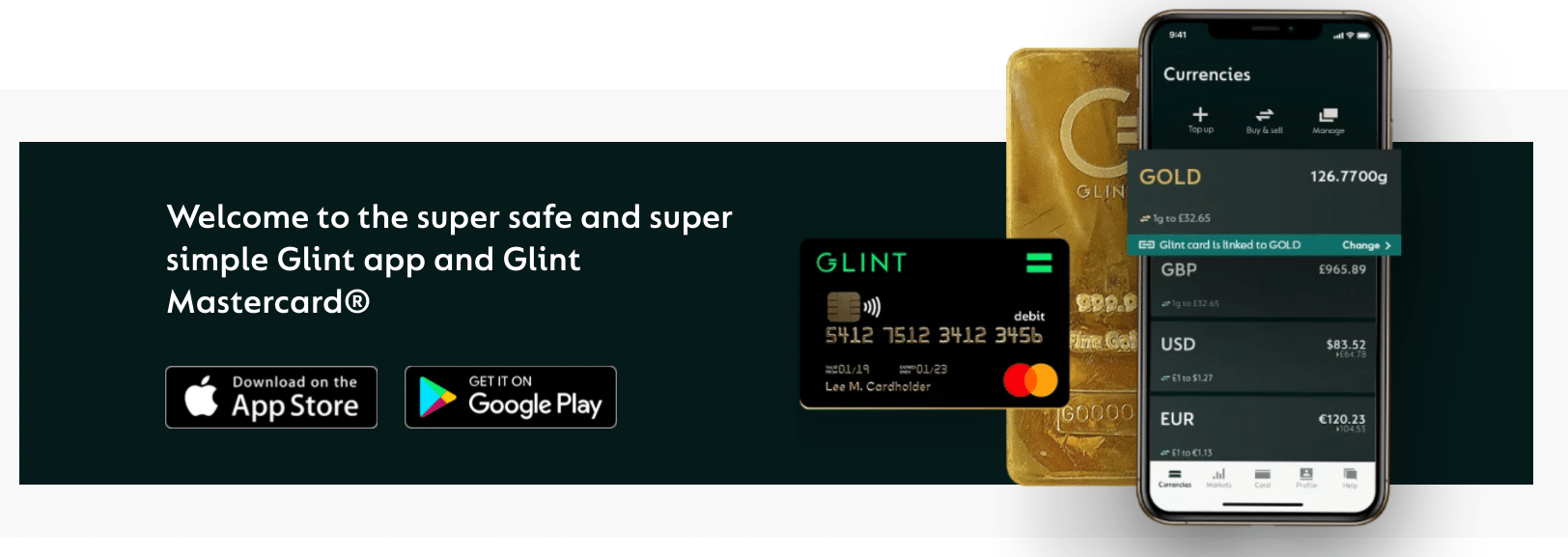

Investors who want to use Glint can download the app through Google Play or the App Store and start an investor profile. An investor profile includes some personal contact information and details about who you are.

Once Glint can verify your identity, you can fund your account by transferring money from a linked bank account. After the funds are cleared, investors can start buying gold. If you want a linked Mastercard it will be sent to you in the mail.

Is It Worth It?

Glint’s approach to gold ownership makes a lot of sense for investors seeking exposure to bullion. The fees are quite low, even compared to other digital-forward bullion exchanges. In fact, its costs are only slightly higher than owning a gold ETF which does not give users the advantage of physical bullion ownership.

However, Glint’s spending account seems gimmicky in the United States. We’re not suffering from hyperinflation at this time. If you need money in the short run, you should probably just keep it in your checking account. Even if you want to use Glint to save for a down payment or a large purchase, you'll be subject to fees. Glint spend is limited to $5,000 per day. If you spend more than that, you'll be subject to the 0.5% sell fee.

That’s not to say that Glint has a bad product. If we were facing hyper-inflation, I might be attracted to Glint spending. And, even without the inflation considerations, Glint’s fees are very reasonable for long-term gold investors.

Glint Features

Min Investment | $0 |

Transaction Fees |

|

Annual Storage And Insurance Fee | 0.125% |

Debit Card | Yes |

Debit Card Spending Limit | $5,000 per day |

ATM Cash Withdrawal Limits | $300 per day |

ATM Cash Withdrawal Fee | $1.50 for cash withdrawals |

Foreign Transaction Fee | 0.50% |

FDIC Insurance For Cash Deposits | Yes, through Sutton Bank FDIC Cert #: 5962 |

Availability | U.S. and Europe |

Customer Service Phone Number | 877-258-0181 |

Customer Service Email | support@glintpay.com |

Web/Desktop Access | No |

Mobile App Availability | iOS and Android |

Promotions | Storage and insurance fee is currently waived |

Glint Review

-

Commissions and Fees

-

Ease of Use

-

Customer Service

-

Tools and Resources

-

Investment Options

-

Specialty Services

Overall

Summary

Glint is a mobile app that makes it easy to buy, sell, and store gold and use it as everyday money with a linked debit card.

Pros

- No investment minimum

- Currently free storage fees

- Spend gold anywhere with a debit card

Cons

- Gold volatility can complicate spending

- Spending may trigger capital gains taxes

- No web/desktop account access

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller