What is an asset? It’s a resource with economic value that someone controls with the expectation that it will provide future value.

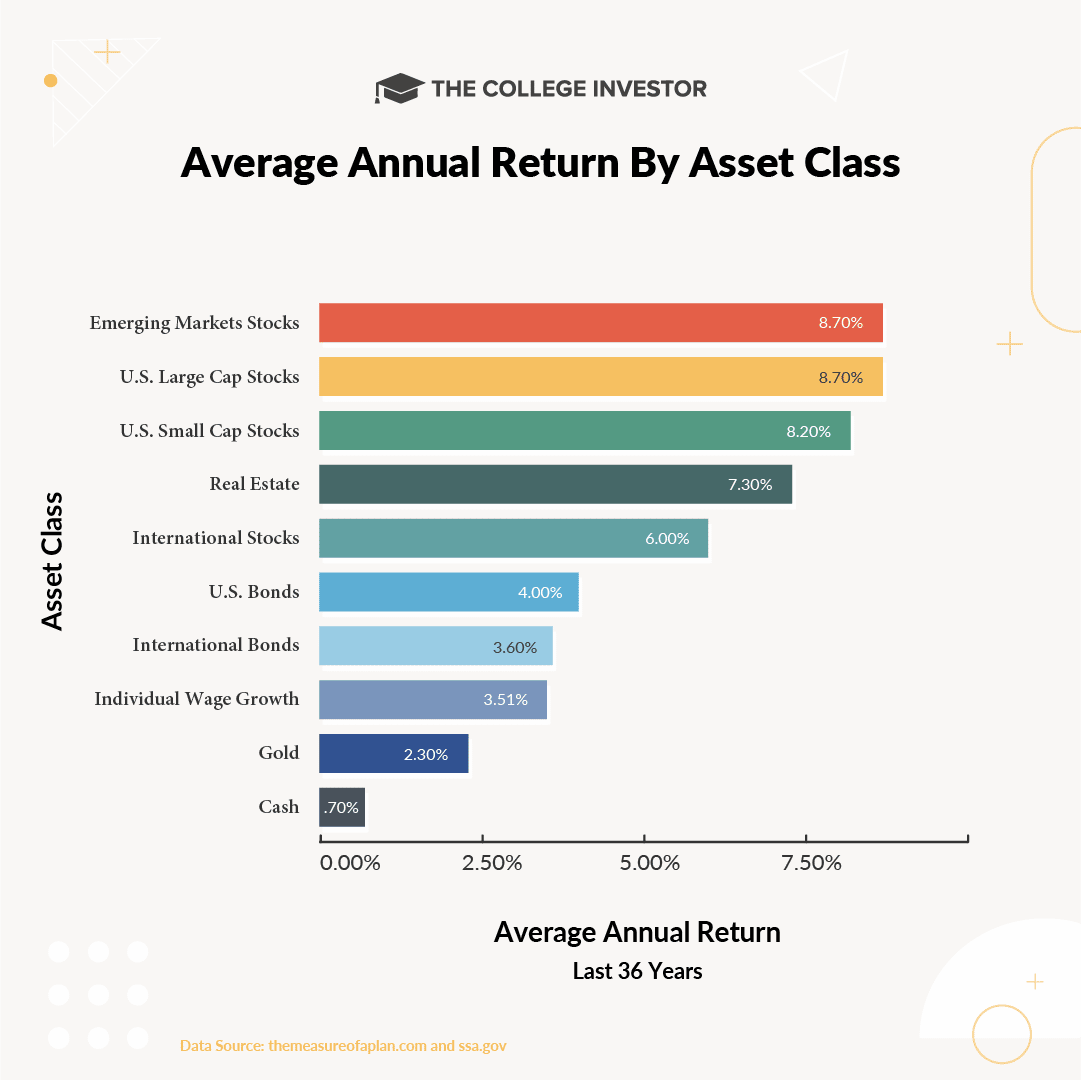

When most people think about assets, they think about stocks - large cap, small cap, international. Or maybe they think about the mix of stocks and bonds (have you heard of the 60/40 portfolio).

But the problem with this approach is that stocks and bonds are just paper assets - that’s one type (or bucket) of assets. But it’s not the only bucket of assets.

And if you want to really understand your money, you need to look at all the buckets of assets you might have - and you need to create a balanced approach across them all. Let’s dive in and understand what the main buckets of assets are, and how you can use this to think about your money.

4 Main Buckets Of Assets

There are 4 main buckets of assets:

- You

- Paper Assets

- Real Assets

- Business Assets

You: You are typically your biggest asset, at least for the first 25% to 50% of your life. You earn money, typically by working, which can provide for you and your family.

Paper Assets: These are stocks, bonds, options, cryptocurrencies, or anything else that you don’t physically own, but represent a value of some type. This is a big bucket for a lot of people - your 401k typically holds your paper assets.

Real Assets: These are physical assets, such as real estate. There are a variety of real estate assets, but these can both provide physical ownership and cash flow.

Business Assets: This is a business that you own. It can be combined with you, but typically this asset bucket focuses on both the value and cash flow that a business provides (outside of a salary).

Let’s dive into each a little more to understand how they impact your money.

You (Typically Your First Asset)

You are typically your first asset (I say typically because there are a few people that might have inherited money or have a trust fund, but for most of us, that’s not the case).

When I say “You”, I’m referring to your personal ability to earn money. This means going to a job and earning a paycheck. Or side hustling and earning some income. This income stream involves you doing something with your time, and in exchange, you earn money.

You can grow the amount of money you earn by increasing your skills or value. For example, this could mean specializing in a trade or going to college to get a degree. By improving yourself, you have the potential to earn more value for your time.

For example, the minimum wage in California is currently $15 per hour. However, if you build a specialized skill, like being an electrician, you can earn $36 per hour on average. And if you go to college to become an attorney, you can earn $100 per hour on the low end, or upwards of $500 or more if you specialize and gain experience.

The bottom line is your ability to earn money is an asset - treat it as such. And leverage your early ability to earn to diversify.

However, compared to other assets, your income typically does NOT grow as much as other assets. So you need to be mindful of that as you build wealth.

Paper Assets

Paper assets are a big bucket of assets - including stocks, bonds, options, cryptocurrencies, and more. The key distinguishing factor here is that paper assets can be transacted with fairly quickly and easily (whether converting to cash or trading or selling). They get their name because they used to be pieces of paper that define ownership of an asset - such as stock share certificates. Today, most of the ownership here is digital.

Paper assets are usually the first stepping stone most people take beyond themselves. For example, investing in a 401k at work. This is ownership in stocks - a paper asset.

Real Assets

Real assets are a contrast to paper assets in that they are ownership of tangible or physical things - typically real estate. As a result of being something real, transactions are typically harder or slower to process.

Real assets can provide value both intrinsically - by just existing - or by generating cash flow. Or both, in the case of most real estate assets.

The challenge with real assets, especially real estate, is that the bar to entry can be high.

Business Assets

Finally, you have business assets. This is direct ownership of a business that can generate cash flow or hold value outside of your personal salary or wage. This is ownership beyond a side hustle - to hold a business asset means that you can sell it and another company would pay you for your business without you in it.

Business ownership has been a clear path to wealth creation over the years, but it does typically take a combination of both your time and potentially your money, to make it happen.

How To Think About Your Money Across These Asset Buckets

So, with this understanding of money, what does it mean for your personal finances? Well, in the most simple terms:

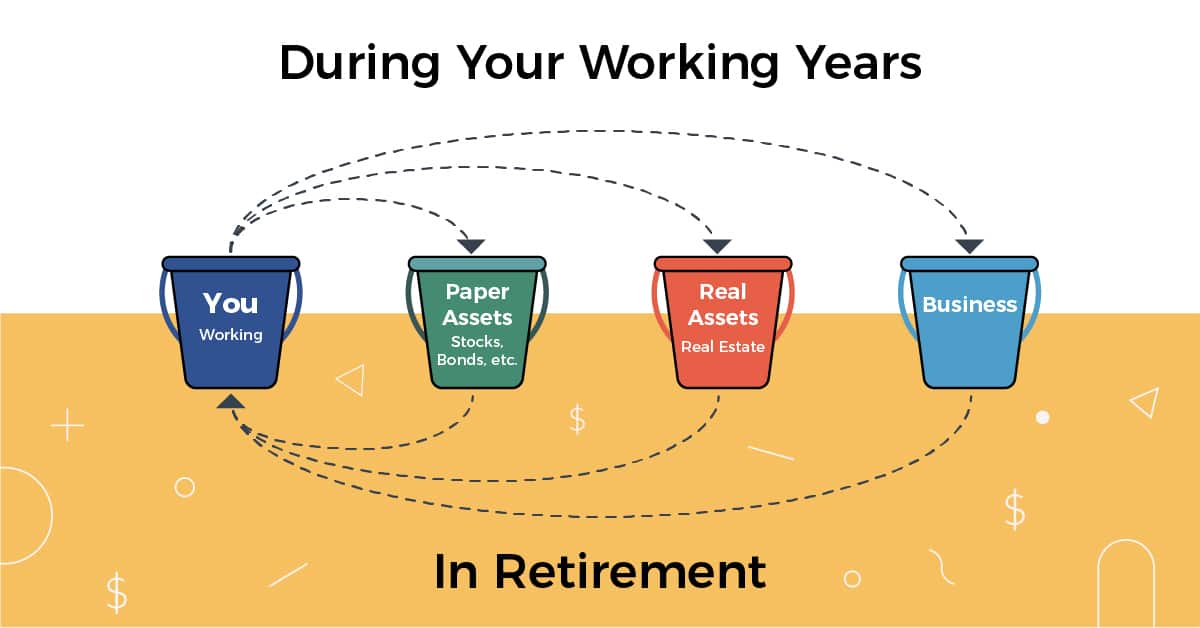

During your working years, you should be taking excess money from the “You” bucket (i.e. your earnings), and putting them to work in other buckets - paper assets, real assets, or your business.

At some point in the future, you want the other buckets to have grown large enough that you can use the income produced by them to replace the income generated by “You”.

But there are also practical considerations you might want to think about on your journey. For example, if the “You” bucket, or maybe the “Business” bucket grows to large, you might want to make sure you’re diversifying into paper assets or real assets to protect yourself.

Of, if you have a heavy cash-flowing business, it might dictate what types of paper assets you hold. For example, you might want to keep a more conservative paper portfolio to offset a highly risky or volatile business.

Final Thoughts

This concept might seem pretty common sense - but it’s important to visualize it and strategize around it. While your “plan” might be to work until retirement by simply using the “You” bucket - your plan could be derailed by something outside of your control.

Also, when you think about diversification, it doesn’t just mean within a bucket (i.e. within paper assets). It also means diversifying across buckets.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak