If you’re an investor who loves to get into the details, your online brokerage account may be the only tool you use to help you understand your portfolio. But in reality, most of those sites make money when you trade at high frequency or purchase stocks on margin.

Some platforms “gamify” trading and give the appearance of providing insights when they actually just offer fast-moving screens. When you get too far into these apps, you may take on risky investment approaches that don’t make sense for investors who want to grow wealth over time.

But that doesn’t mean that the thirst for details is a bad thing. If you invest for yourself (rather than using a financial advisor or a robo-advisor), then you may want to test different investing methods to find one that best suits your goals. Portfolio Visualizer can help you do just that. It allows you to “test” different investment strategies without constantly trading in your portfolio. Here’s what you need to know about Portfolio Visualizer.

Quick Summary

- Online software designed to help you analyze potential portfolios, and test different investment strategies.

- The free tier allows you to analyze portfolios with up to 25 ticker symbols. Paid plans allow for up to 150 symbols.

- A wide array of analysis tools suited to help you understand an array of investment strategies.

Portfolio Visualizer Details | |

|---|---|

Product | Portfolio and investment analytics |

Price | $0 - $660/year |

Free Plan Details | Analyze up to 25 stocks, no saving or exporting |

Paid Features | Link to brokerages, |

Promotions | None |

What Is Portfolio Visualizer?

Portfolio Visualizer is a portfolio analysis tool designed to help investors plan test and compare different investment strategies. It offers six different categories of analysis including portfolio backtesting, factor analysis, Monte Carlo simulations, asset analytics, portfolio optimization, and tactical asset allocation.

Unlike many popular portfolio analysis tools, Portfolio Visualizer doesn’t link to your portfolio. Instead, it allows you to create “test portfolios” and analyze the portfolios using myriad different analysis tools. It offers a free version which allows you to review up to 25 assets at a time, or paid tiers that allow you to analyze portfolios with up to 150 assets.

What Does It Offer?

Porfolio Visualizer's portfolio analysis tools can help you feel more confident about investing. While you can't connect your real-life portfolio for analysis, it offers plenty of free tools so you can test various scenarios. I've provided a brief explanation of a few of the analytical tools below, but you can also view a gallery of examples here.

Analyze Up To 25 Assets For Free

Portfolio Visualizer's free to allows you to analyze a portfolio with up to 25 assets using various analyses, including backtesting, Monte Carlo simulations, and more. While you can’t save or export models, the free option serves as an excellent educational tool for people learning about different ways to view investment portfolios.

Backtest Portfolios To Understand Historical Performance

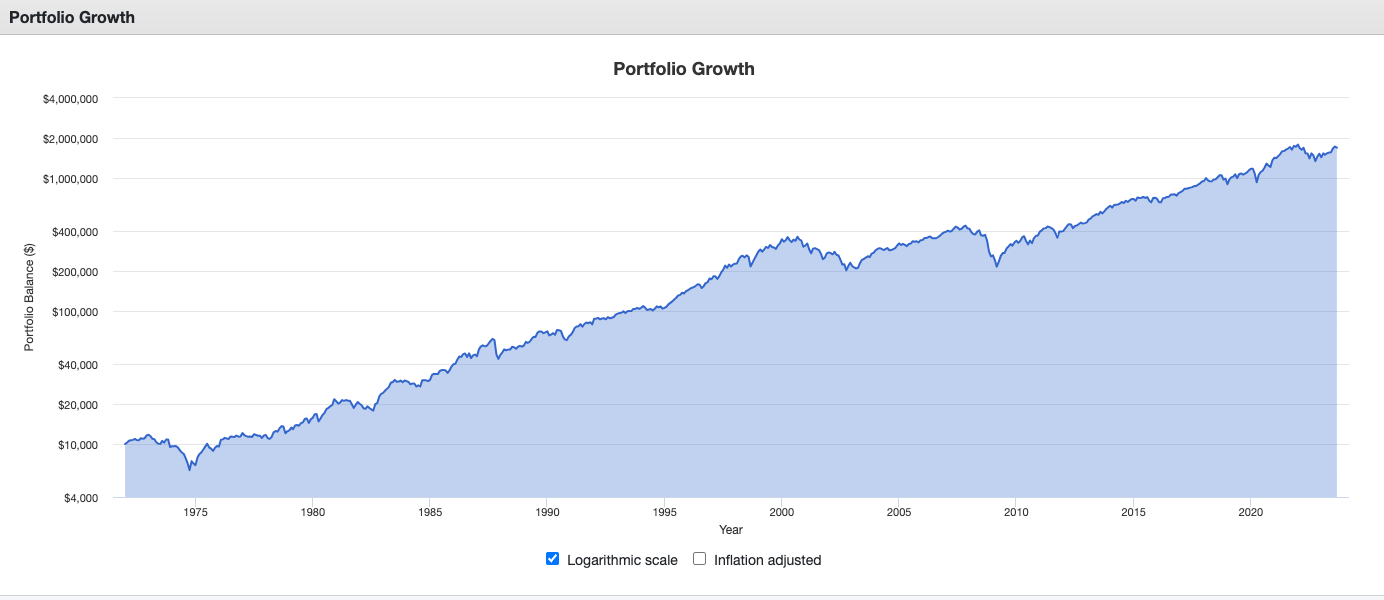

Portfolio backtesting involves looking at historical prices to see how a portfolio would have done in past scenarios. Backtesting is one of the best ways to determine if your investment portfolio would have longevity through difficult financial downturns such as the 2008-2009 mortgage securities crisis or earlier bear markets. Portfolio Visualizer allows you to backtest allocations, specific portfolios, or dynamic portfolio management to see whether your strategy would work during past situations.

Here's an example of what you can model, which is the US Stock Market from 1972 through today:

Monte Carlo Simulations To Understand Progress Towards Financial Goals

Monte Carlo simulations are designed to show the probability of a given outcome. Financial advisors regularly use Monte Carlo to determine if a portfolio would survive 30 or 40 years while an investor takes withdrawals. It’s an ideal tool to understand how a series of bad (and good) events would affect your portfolio size during retirement.

Dig Into Asset Allocation Strategies

Asset allocation is one of the most important facets of successful investing, and there are hundreds of methods you can use to manage asset allocation. While simply dividing your portfolio into a few diversified funds is good enough for most investors, more detail-oriented investors may want to understand the correlation between asset classes, and how different assets track together or separately.

Pay To Save and Export Models

While Portfolio Visualizer offers most of its tools for free, you must pay to save portfolios and export models. If you’re a heavy user of the tool, this will likely be a worthwhile upgrade since it makes comparing different strategies much easier.

Are There Any Fees?

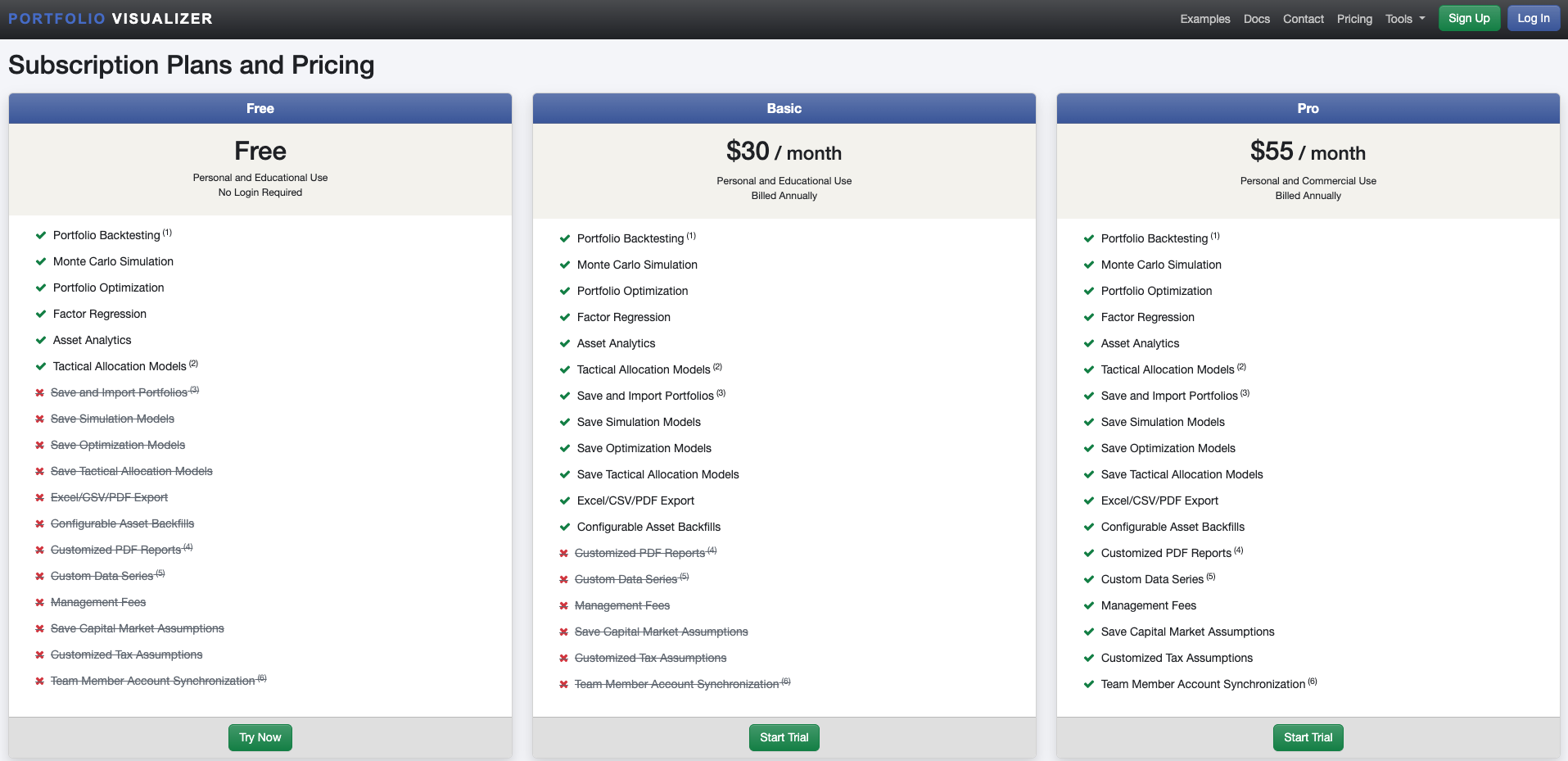

The Portfolio Visualizer tool has a shockingly robust free tier that unlocks most features and allows users to analyze up to 25 assets for free.

However, if you wish to save or export your models to Excel or PDF to allow for easy comparisons, you can choose one of the following paid plans:

The Basic Plan which costs $360 for a one-year subscription allows you to save and export up to 50 models. The Pro plan costs $660 per year. It allows you to save up to 150 models, and it opens up features such as custom tax analysis.

I recommend testing out the free plan before you commit to one of the more expensive plans.

How Does Portfolio Visualizer Compare?

Portfolio Visualizer has powerful educational features and allows you to understand portfolio analysis from many angles.

However, the software is more useful as an educational tool. If you want to look into the details of your portfolio, an app like Empower or Morningstar’s Xray tool will be more useful in helping you understand what’s happening inside your portfolio.

You can also look at tools like ProjectionLab if you're looking to model specific scenarios.

Portfolio Visualizer makes sense to use when you are considering changes to your investment strategy (especially if you want to withdraw money from your portfolio). It’s not particularly helpful for regular investment monitoring.

How Do I Open A Portfolio Visualizer Account?

To open a Portfolio Visualizer Account, navigate to the signup page on the website. You only need to provide your name, email address, company type, and password to get started. If you choose to upgrade, you’ll also need to enter your credit card information.

Is It Safe And Secure?

Portfolio Visualizer collects minimal information about you unless you opt for a paid tier. When you pay, you will need to provide credit card information along with personal information such as your name, billing address, and email. Portfolio Visualizer uses encryption and other forms of security to keep your information safe.

Portfolio Visualizer doesn’t sell customer information, and it allows users to opt out of any communications. Between these promises, the encryption, and the fact that it doesn’t connect to any of your accounts, Portfolio Visualizer is extremely safe and secure. Making online payments is risky, but paying for Portfolio Visualizer is about as risky as ordering a book from Amazon.

How Do I Contact Portfolio Visualizer?

You can fill out a request through Portfolio Visualizer’s website or email admin@portfoliovisualizer.com.

Is It Worth It?

If you want to learn about investment strategies and don't mind doing some in-depth research, you'll find Portfolio Visualizer to be an amazing tool. The free tier gives you a lot of information, and you don’t have to pay a dime for it. The paid tiers are quite expensive for educational tools, but they are very detailed and can help you become a more knowledgeable investor.

Overall, we recommend using the first tier extensively before paying for one of the more expensive subscriptions.

Portfolio Visualizer Features

Product | Portfolio and investment analytics software |

Free Plan | Yes |

Paid Plans | Basic: $360/year; Pro: $660/year |

Available Tools |

|

Number of stocks tracked | 25 with free plan, up to 150 with Basic and Pro plans |

Export formats | Excel, CSV, PDF |

Customer Service | Email: admin@portfoliovisualizer.com |

Save and Export caps | Free plan: 0 / Basic: 50 / Pro: 150 |

Promotions | None |

Portfolio Visualizer Review

-

Pricing and Fees

-

Ease of Use

-

Tools and Features

-

Products and Services

-

Customer Service

Overall

Summary

Portfolio Visualizer is an online portfolio analysis platform that allows you to test different investment strategies so you can become a more confident investor.

Pros

- Analyze a portfolio dozens of ways to get the insights you need.

- Compare different investment strategies with different types of analysis.

- Free tier offers most major features.

Cons

- Paid tiers are pricey

- You must pay to save export portfolios

- Cannot link your actual portfolio to model your current state

- Unlike some competitors, doesn’t offer wealth management services

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Colin Graves Reviewed by: Robert Farrington