Source: The College Investor

Tracking your net worth is one way to ensure that you’re making financial progress. A growing net worth indicates healthy saving and investment behaviors.

But if you’re a modern investor who dabbles in asset classes beyond stocks and bonds (especially crypto), you know that it becomes more difficult to find accurate net worth trackers.

Kubera works to solve that problem for investors. But it carries a steep monthly price tag which means investors will need to be convinced of the value before signing up.

Here’s what you need to know about the tool.

Kubera Details | |

|---|---|

Product Name | Kubera |

Price | $199/year |

Platform | Web |

Features | Track crypto, stocks, currencies, precious metals, cars, houses, domains, private equity, and more |

Promotions | 14-day free trial |

What Is Kubera?

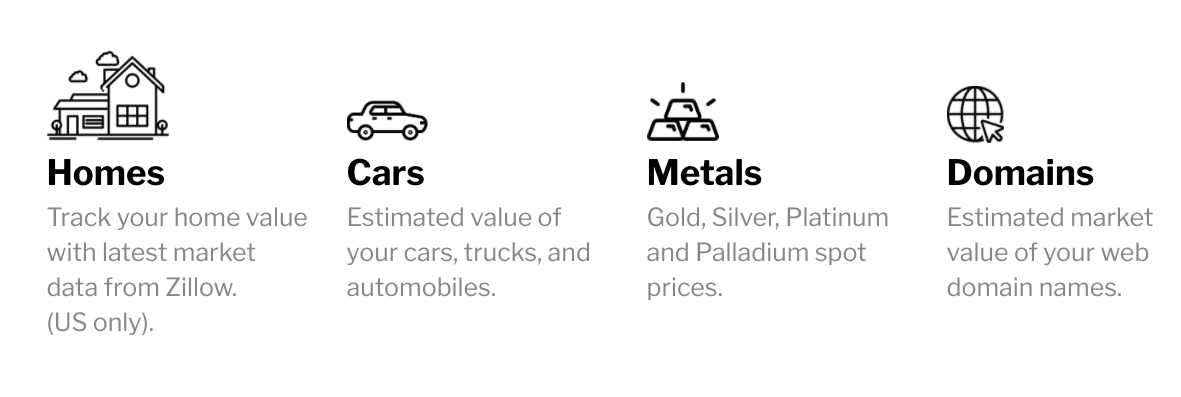

Kubera is a “modern” wealth tracking app that allows users to track net worth and investment returns for ALL major investment classes. It allows users to track crypto, global currencies, stocks, precious metals, and even assets like cars, houses, URL value, and private equity.

What assets Kubera supports [Screenshot by The College Investor]. Source: Kubera

By giving users access to their total financial picture in one place, Kubera ensures that users understand their investments.

The app also serves as a storage vault for passwords and other critical information. If you don’t log into your account for a set time, and you don’t respond to email inquiries, your assets will be passed on to your “trusted angel” (typically a spouse or a trusted friend). This will ensure that all your assets get passed down to a loved one instead of being locked in a crypto wallet forever.

At launch, Kubera was only available on desktop, but it's now available on mobile as well as a Progressive Web App (PWA). Just go to app.kubera.com on your phone (iOS or Android) and log in. The PWA doesn't require you to download anything to your device yet delivers a native app-like experience.

In 2024, we named Kubera an Editor's Pick for Best Money Apps because of its ability to track assets across multiple categories and customize the dashboard.

What Makes It Special?

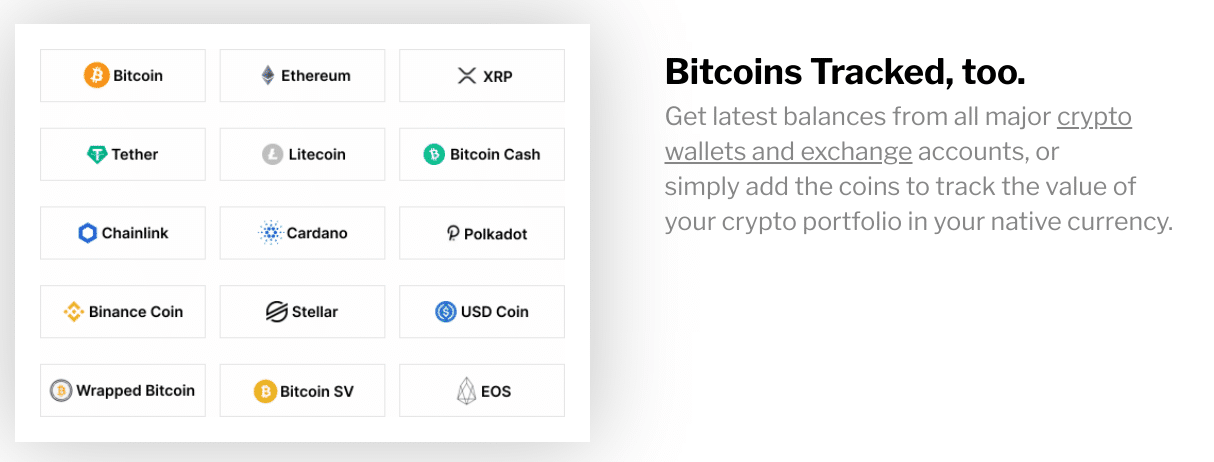

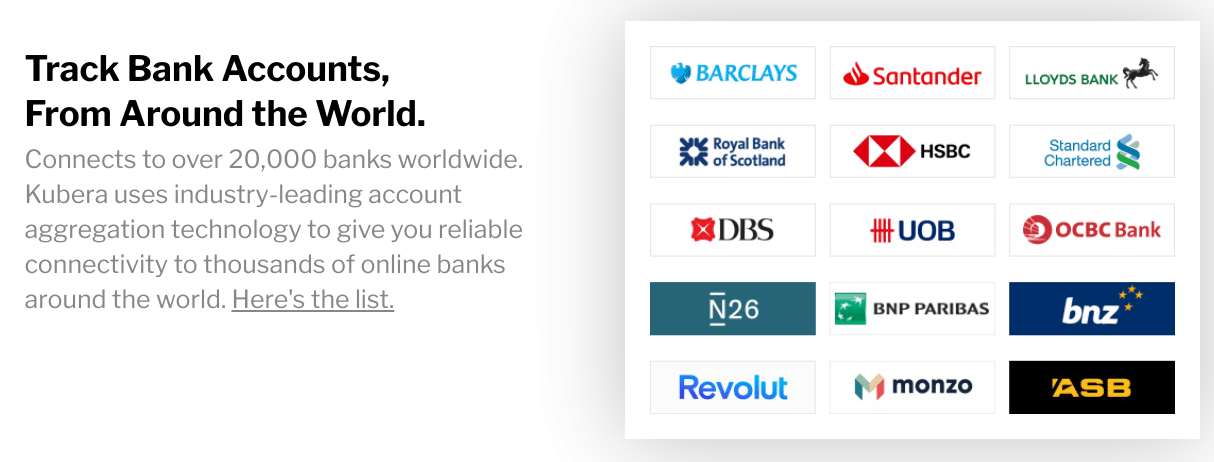

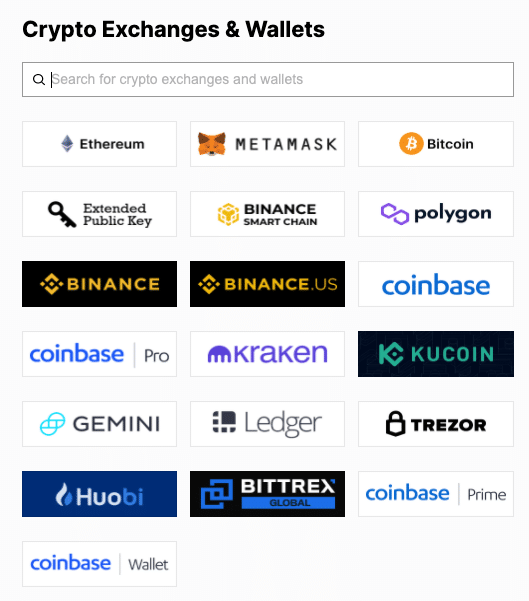

Kubera’s distinguishing feature is its connections to all major crypto exchanges and wallets and over 20,000 banks and brokers.

Kubera crypto asset tracking [Screenshot by The College Investor]. Source: Kubera

Kubera account link options [Screenshot by The College Investor]. Source: Kubera

It converts all your assets to the currency of your choice. This kind of tracking is extremely difficult, especially if you invest in a wide array of asset classes.

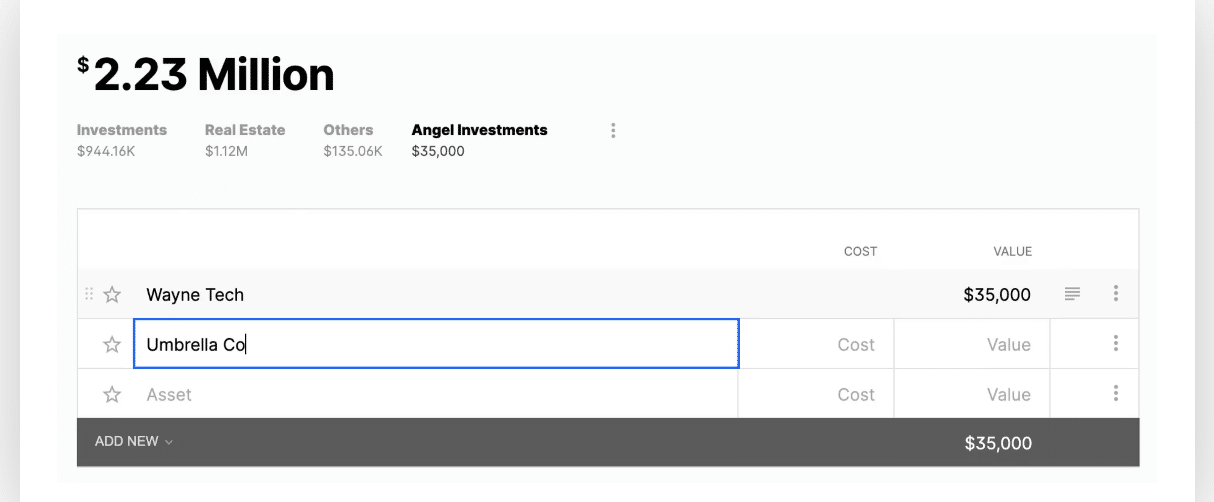

Kubera also allows for manual asset entry. This is useful if you own difficult-to-classify assets such as a stake in a family business, land, or cryptocurrency.

Another unique feature is Kubera’s legacy planning tools. It requires users to respond to “life beat” prompts by logging into the app or responding to emails. If too much time passes without a response, Kubera passes your information to a “trusted angel” or the person who will handle your estate on your death.

The app allows users to put estate documents, life insurance policy numbers, passwords, and other legal documents in the secured vault, so your beneficiary can have access to them upon your passing. This is a unique and often overlooked angle in personal finance apps.

Where Kubera Shines

Kubera’s “spreadsheet-like” interface is intuitive for most users who need to manually-enter data. But it also drives cool graphs and trackers for user dashboards.

Kubera net worth spreadsheet [Screenshot by The College Investor]. Source: Kubera

The automated options to value cryptocurrency, cars, houses, precious metals, and even URLs also show promise for people who invest in diverse assets. Kubera doesn’t currently value art or NFTs, but you can add the value in manually.

What's great is that Kubera uses multiple back-end connection tools so that you can connect to pretty much any digital account - from your bank and brokerage, to API connects on your crypto wallet. Kubera connects to these popular crypto wallets and exchanges:

Kubera crypto wallet support [Screenshot by The College Investor]. Source: Kubera

Kubera is also the only tool we know about at this point that can easily track DeFi assets as well. You can track DeFi assets on multiple chains like Ethereum (ETH and ERC20), BSC and Polygon.

Finally, you can also track NFTs on the Ethereum blockchain!

It’s also great to see Kubera’s focus on estate planning. While most people don’t want to think about their death, it is important to plan for it. Kubera simplifies the process of handing over your assets once you’re gone.

Where Kubera Doesn’t Shine

Most financial apps try to do it all. Kubera doesn’t - it exclusively focuses on being a net worth and portfolio tracker. You won’t find budgeting tools, or detailed portfolio analysis, or credit score monitoring.

It’s a one-stop-shop for tracking your assets and your net worth. But it doesn’t offer insights into how you could spend smarter or save more. Such a strict focus isn’t necessarily a shortcoming, but it's important to understand.

How Much Does Kubera Cost?

Kubera is a subscription service that costs $199 per year. It offers a 14-day $1 trial.

Why the fee? Unlike other services (Empower, etc.), Kubera focuses on privacy. They don't sell your information or use your information for advertising or upsells. As such, your fee helps cover the cost of all the development and banking connections.

If you value privacy, this is a small fee to pay.

Kubera Pricing [Screenshot by The College Investor]. Source: Kubera

As can be seen in the screenshot above, Kubera also advertises that financial advisors can pay for subscriptions on behalf of their clients. However, you'll have to work with your financial advisor on an individual basis to see if that's something that your advisor recommends for you.

How Kubera Compares

Kubera is one of the few portfolio trackers apps that's able to integrate with cryptocurrency wallets and exchanges. But it also offers less goal tracking and retirement planning tools than other popular net worth trackers like YNAB and Empower (formerly Personal Capital). Here's a closer look at how Kubera compares to these two alternative personal finance apps.

Header |  |  | |

|---|---|---|---|

Rating | |||

Pricing | $199/yr | $11.99/mo or $84/yr | Free |

Cryptocurrency Tracking | |||

Budgeting | |||

Portfolio Analysis | |||

Cell |

Who Is This For And Is It Worth It?

While Kubera impresses with its ability to track investments from a huge array of asset classes, the price tag can be tough to swallow. Still, it solves a problem that modern investors face. And that makes it one of our favorite portfolio and net worth trackers right now.

It's difficult and time-consuming to track your net worth when you have crypto, real estate, and stocks. It will be even harder to pass those assets to your beneficiaries when your private keys are locked on a hard drive somewhere.

For investors who see value in Kubera’s offerings, the $15/month (or $150/yr) price tag may be worthwhile. But everyone else may want to track their net worth instead through an app that also offers budgeting tools, or portfolio analysis.

Kubera Features

Price |

|

Supported Assets |

|

Budgeting | No |

Income Tracking | No |

Expense Tracking | No |

Bank and Broker Integration | Yes, 20,000+ financial institutions |

Portfolio Analysis | No |

Credit Score Monitoring | No |

Digital Vault | Yes |

Automated Transfer To Beneficiary | Yes, after extended periods of inactivity |

Tax Preparation | No |

Customer Support Options | Email and Help Center |

Customer Service Email Address | hello@kubera.com |

Mobile App Availability | None |

Promotions | 14-day $1 trial |

Kubera Review

-

Pricing and Fees

-

Ease of Use

-

Supported Assets

-

Tools and Features

-

Customer Service

Overall

Summary

Kubera is a wealth tracking app that allows users to track their assets from all major investment classes (including cryptocurrency).

Pros

- Spreadsheet-based portfolio tracking

- Connects with all major crypto wallets and exchanges

- Easy to store estate planning documents

- No advertisements, very privacy focused

Cons

- No mobile version (yet)

- Fee is higher than other portfolio trackers or digital vaults

- Doesn’t offer portfolio analysis

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak