“Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't ... pays it.”

- Attributed to Albert Einstein (origin of quote is disputed)

If you are currently investing or plan to invest, it is critical that you familiarize yourself with the amazing effects of compounding.

Here’s a quick example – imagine you are earnings 10% interest a year on an investment. How long will that investment take to double?

At first glance, you may think it would take 10 years (after all, 10% x 10 = 1), but that’s not right. An investment growing at 10% a year will double in about 7.3 years.

The reason your investment would double in ~7.3 years instead of 10 is because of the power of compound interest. You aren’t just earning a return on your initial investment, you are earning a return on your initial investment, plus growth from previous years.

Robert Farrington has covered this topic before on The College Investor. Specifically, he has covered a short-cut to calculating how quickly your money will double under the effects of compounding. Here’s his easy-to-understand explanation of ‘The Rule of 72’:

“The Rule of 72 is a method for estimating how long it will take for money to double at a specific interest rate. The best way to highlight this is with an example. Let’s say you have $1,000, and you want to know how long it will take to get to $2,000 at 2% interest.

Using the Rule of 72, you can estimate it will take 36 years. You simply take 72 and divide it by the interest rate. That is what makes this rule so amazing, and simple.”

There is a specific investment style that takes full advantage of the unique math behind compound returns.

It is called dividend growth investing.

Dividend Growth Investing Overview

What separates dividend growth investing from other types of investing is its unique focus on businesses that compound wealth over time.

Dividend growth investors look for businesses that pay rising dividends year-after-year. For a business to pay increasing dividends every year, it must have a durable competitive advantage.

By definition, dividend growth stocks have shareholder friendly managements (in general). A company must care about shareholders to pay them more money every year.

In addition, dividend growth investors look for above-average dividend yields. The higher the dividend yield, the better.

Combining these ideas, dividend growth investors look for:

- Stocks with above-average dividend yields

- Stocks with a history of increasing dividends

- Stocks with a durable competitive advantage

The Evidence For Dividend Growth Investing

Receiving rising dividend income every year sounds nice, but how does it work in practice? Dividend growth investing has historically produced enviable returns.

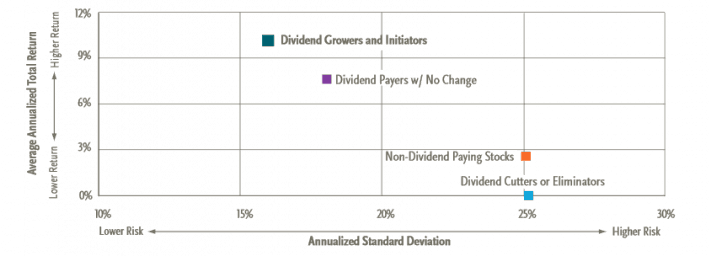

Dividend growth stocks have outperformed the market – with lower volatility – from 1972 through 2014, as the image below shows.

Source: An Economic Perspective on Dividends, page 9

That is impressive, but it’s far from the only piece of evidence that points toward the efficacy of dividend investing.

Consider a special group of stocks called the Dividend Aristocrats. The Dividend Aristocrats Index is comprised only of businesses in the S&P 500 that have paid increasing dividends every year for 25 or more consecutive years.

The Dividend Aristocrats Index is comprised of many well-known businesses with long histories. A few examples are below:

- Clorox (CLX)

- Target (TGT)

- PepsiCo (PEP)

- Chevron (CVX)

- Wal-Mart (WMT)

- ExxonMobile (XOM)

- McDonald's (MCD)

You may think stable ‘boring’ stocks like these don’t offer much in the way of returns. That is simply not the case.

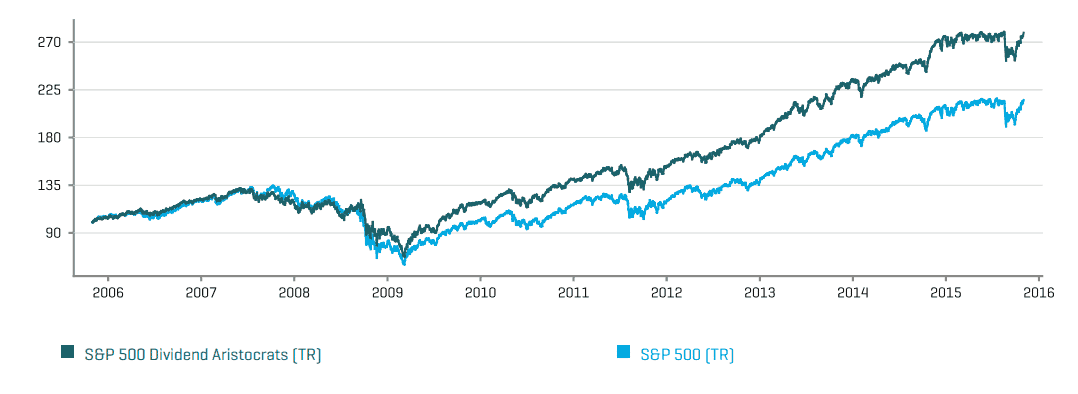

The Dividend Aristocrats Index has outperformed the S&P 500 by an average of 2.8 percentage points a year over the last decade. The rule of 72 tells us if that level of outperformance continued indefinitely, an investment in the Dividend Aristocrats Index would be worth double an investment in the S&P 500 in 27 years.

The image below shows the outperformance of the Dividend Aristocrats Index over the last decade:

Source: S&P Dividend Aristocrats Index Fact Sheet, page 2

When you really think about it, the fact that businesses with strong competitive advantages have provided above-average returns is not surprising.

Past performance is no guarantee of future success. With that said, I believe it is likely that high quality businesses continue to generate solid total returns for investors in the future so long as these high quality businesses are purchased at fair or better prices.

How To Build Your Compounding Dividend Portfolio: Identify Potential Stocks

To build a portfolio that will compound your dividends for you over time, you have to identify the right kinds of businesses.

Only businesses that have strong and durable competitive advantages are suitable for dividend growth investing. If you cannot rely on dividend increases in the future, they you are not building a dividend compounding portfolio.

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

- Warren Buffett

There are a few ‘hacks’ to quickly find high quality businesses that are likely to be around for decades in the future rather than years.

The first one is to peruse the Dividend Aristocrats Index for ideas. I’ve already discussed the Dividend Aristocrats Index earlier in this article.

Another excellent place to look for ideas is to look at the even more exclusive Dividend Kings. To be a Dividend King a business must have 50+ years of consecutive dividend increase. The Dividend Kings are the most exclusive dividend group. Man of the companies in the Dividend Kings are very well known. Several examples are below:

- Johnson & Johnson (JNJ)

- Procter & Gamble (PG)

- Colgate-Palmolive (CL)

- Coca-Cola (KO)

- 3M (MMM)

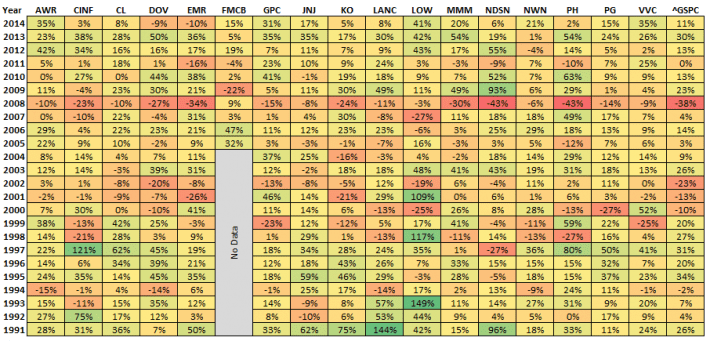

There are currently 17 Dividend Kings. The image below shows the return of each Dividend King by year from 1991 through 2014 (^GSPC is the ticker for the S&P 500 Index):

Source: Sure Dividend

Note: FMCB is thinly traded; price data was not available for the entire period.

How To Build Your Compounding Dividend Portfolio: Don't Overpay

Once you identify a high quality business, the next step is to determine if it is trading at a fair or better price.

Value matters. If you buy a stock that is wildly overvalued, you will likely lose money over time.

A quick way to tell if a stock is worthy of further research is to determine if it is trading for less than its historical average price-to-earnings ratio.

You can find historical price-to-earnings data through Value Line. Value Line subscriptions are free through most public libraries in the United States. Ask your library how to access Value Line for free.

If a business is trading for lower than its historical average price-to-earnings ratio, it is likely trading at fair value or better.

It is important to avoid stocks with high price-to-earnings ratios (anything over 25 is probably too high for an established business).

Another important metric in calculating value (and returns) is a stock’s dividend yield. The dividend yield is the total dividends paid per year divided by the stock price. It’s like the interest rate on your savings account. The higher, the better.

How To Build Your Compounding Dividend Portfolio: Diversification

An investment in any stock comes with two types of risk:

- Systematic Risk

- Unsystematic Risk

Systematic risk is the risk of investing in the stock market in general. It cannot be diversified away. Systematic risk is what you take on to benefit from the growth of the overall stock market. It is the risk ‘of the system’.

Unsystematic risk is also called business risk. It is risks inherent to one specific business. Unsystematic risk can be diversified away. The more stocks you own, the less risk (and reward) you have from any one specific stock.

On the other hand, one can over-diversify. If you own 1,000 stocks, there’s no way to track them all. You also probably own a lot of overvalued stocks, and low quality stocks with poor growth prospects with a portfolio that size.

With diversification, you want to take a goldilocks approach – not too much and not too little. Holding around 20 stocks gives you nearly all the benefits of owning a much larger portfolio, with the added advantage of being able to focus on just high dividend-paying businesses trading at fair or better prices. A 20 stock portfolio assumes you will invest an equal amount in each stock. If you invest 90% of your portfolio in 1 stock, and the remaining 20% in the next 20 stocks, you are (obviously) not well diversified.

Not any 20 equally weighted stocks will give you diversification. If you invest in 20 oil and gas companies, you won’t be well diversified. It is prudent to invest in high quality businesses in a wide variety of industries.

How To Build Your Compounding Dividend Portfolio: 20 Stock Model Portfolio

To summarize where we are so far, to build a compounding dividend portfolio, an investor should look for:

- High quality businesses (like Dividend Kings and Dividend Aristocrats)

- Stocks with above-average yields

- Stocks trading at reasonable valuation levels

- At least 20 stocks, equally weighted for diversification (see why equally weighted portfolios outperform)

A 20 stock model portfolio is shown below. This portfolio is only an example meant to show the type of stocks and diversification required to build a dividend compounding portfolio. It is in no way investment advice.

Name | Ticker | Industry | Weight | Dividend Yield | Forward P/E Ratio |

|---|---|---|---|---|---|

ExxonMobile | XOM | Integrated Oil & Gas | 5.0% | 3.4% | 21.4 |

Phillips 66 | PSX | Oil & Gas Refining | 5.0% | 2.4% | 13.4 |

Philip Morris | PM | Cigarettes | 5.0% | 4.6% | 18.8 |

General Mills | GIS | Processed & Packaged Goods | 5.0% | 3.1% | 18.2 |

Procter & Gamble | PG | Personal Products | 5.0% | 3.4% | 18.1 |

Wells Fargo | WFC | Money Center Banks | 5.0% | 2.7% | 12.4 |

Aflac | AFL | Accident & Health Insurance | 5.0% | 2.6% | 10.1 |

T. Rowe Price Group | TROW | Asset Management | 5.0% | 2.7% | 16.2 |

Johnson & Johnson | JNJ | Diversified Health Care | 5.0% | 2.9% | 15.9 |

Abbott Laboratories | ABT | Diversified Health Care | 5.0% | 2.1% | 19.0 |

Pfizer | PFE | Drug Manufacturer | 5.0% | 3.2% | 14.8 |

3M | MMM | Diversified Machinery | 5.0% | 2.6% | 18.8 |

United Technologies | UTX | Aerospace/Defense Products | 5.0% | 2.6% | 15.2 |

Wal-Mart | WMT | Discount Retail | 5.0% | 3.4% | 13.9 |

W.W. Grainger | GWW | Industrial Equipment Wholesale | 5.0% | 2.2% | 17.6 |

Union Pacific | UNP | Railroads | 5.0% | 2.5% | 14.4 |

Mircosoft | MSFT | Business Software & Services | 5.0% | 2.7% | 17.4 |

Verizon | VZ | Telecom Services | 5.0% | 4.9% | 11.6 |

Southern Company | SO | Electric Utilities | 5.0% | 4.8% | 15.5 |

Consolidated Edison | ED | Electric Utilities | 5.0% | 4.0% | 16.2 |

Total | 100% | 3.1% | 15.9 |

The model portfolio above is well diversified between sectors and industries. It has a higher dividend yield and lower forward price-to-earnings ratio than the S&P 500. Further, it invests only in high quality businesses with long dividend histories.

Final Thoughts: Dividend Reinvesting & Purpose

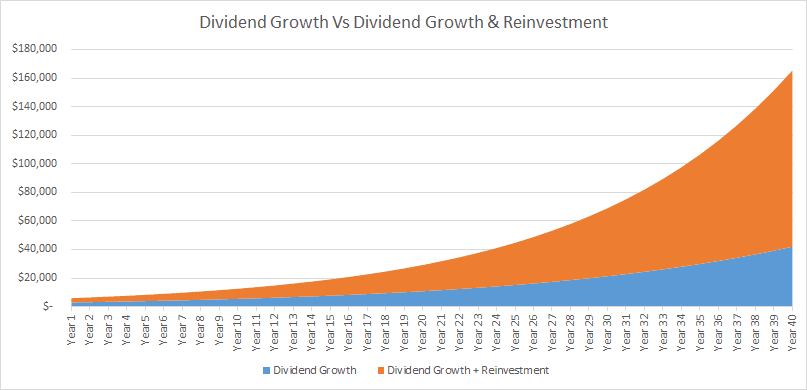

A dividend compounding portfolio will provide a growing stream of dividend income. What you do with that income is up to you. To take full advantage of the effects of compounding, reinvesting your dividend income back into your portfolio will provide even faster growth.

The image below shows the fantastic effects of compounding on a portfolio with a 3% dividend yield and a 7% dividend growth rate. Annual income per year starting with $100,000 portfolio is shown. You can see the drastic difference in income as time goes by that results from reinvesting dividends back into the portfolio versus not reinvesting dividends.

The purpose of building a dividend compounding portfolio is to provide a perpetual source of growing cash flows. If you reach a point where you can live off the growing dividend income your investments produce, you have reached financial freedom. What’s more, you will never have to touch your principle. Your money will be left compounding indefinitely. This can create intergenerational wealth.

Ben Reynolds founded Sure Dividend in 2014. Reynolds has long held a passion for business in general and investing in particular. He graduated Summa Cum Laude with a bachelor’s degree in Finance and a minor in Chinese studies from The University of Houston. In his spare time, Reynolds enjoys watching movies, reading, exercising, and relaxing with his wife.

Editor: Clint Proctor Reviewed by: Robert Farrington