Cryptocurrencies are volatile creatures. To make a profit, you have to be good at trading them or just hold and hope your crypto gains in value. Neither approach is particularly easy to do because of volatility.

What if you could just deposit your crypto somewhere and earn interest on it. This way, if the price increases by a small amount or not at all, you can still make a profit. That’s what YouHodler does. It pays high interest on savings. If you’re in the market for a crypto-backed loan, Youhodler can handle that also since it loans out its crypto on deposits. Let’s see how it works.

YouHodler Details | |

|---|---|

Product Name | YouHodler |

Features | Crypto savings accounts, loans, and exchange |

Savings APY | Up to 12% |

Minimum Balance To Earn Interest | $100 |

Promotions | None |

Who Is YouHodler?

YouHodler is a cryptocurrency exchange that specializes in crypto lending and high-interest savings for Hodlers. YouHodler is based in Limassol, Limassol, Cyprus.

The company's CEO is Ilya Volkov. YouHodler is an official Blockchain Association member of the Financial Commission. YouHodler is not available in the United States as well as in about a dozen other countries.

However, they are available as an exchange in the UK and other countries.

What Do They Offer?

YouHodler is for both those looking to earn a high-interest rate on their cryptocurrencies and those wanting a crypto loan.

Depositors fund the crypto loans, which is where the high-interest rate comes from. Over 30 of the top cryptocurrencies are available on the platform, including ADA, BTC, BCH, BNB, DASH, ETH, LTC, XLM, XRP, HT, and REP.

The YouHodler digital wallet is used to store any coins that a customer wants to earn interest on. In addition, the wallet supports crypto and fiat currencies. You can also use the wallet on YouHodler’s mobile app.

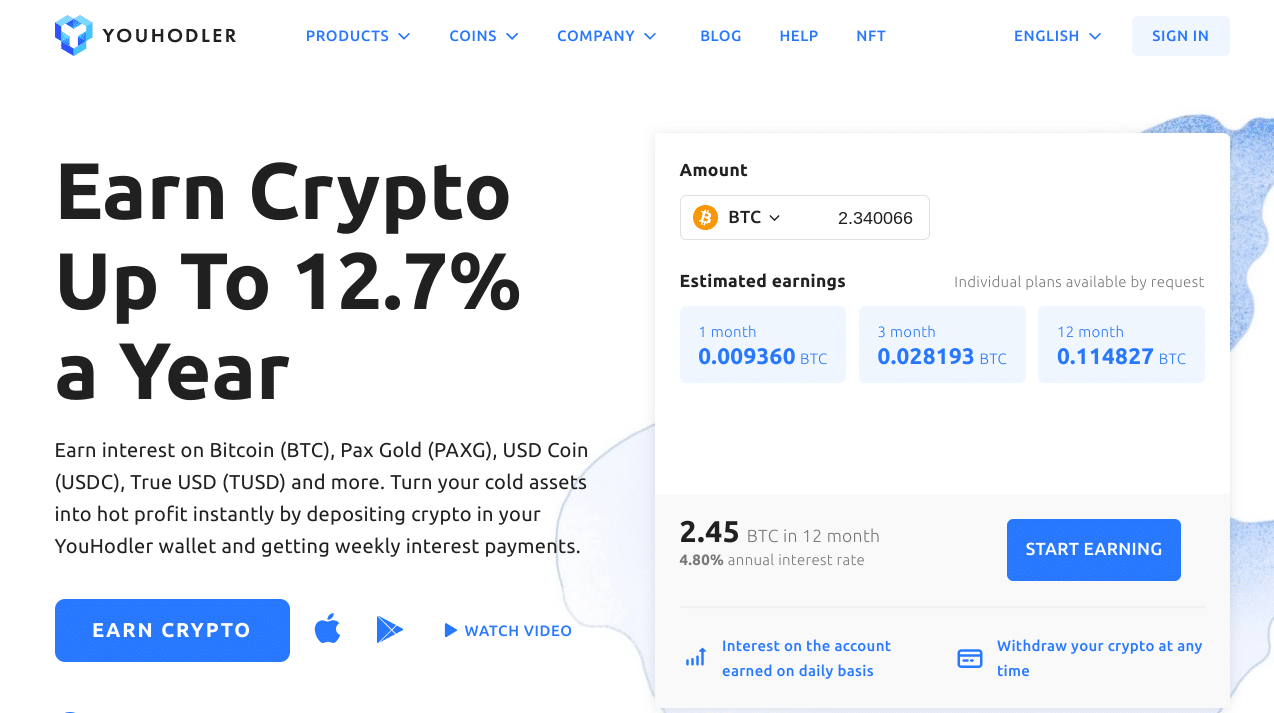

Earning Interest On Crypto

For cryptocurrency investors, the only way to make a gain is if the coin you’re holding goes up. But, of course, to capture that gain, you have to sell your crypto.

In other words, there isn’t a buy-and-hold option for stand-alone crypto. If you want something like that, you have to seek an exchange that will pay you interest.

You can do that with YouHodler by allowing them to lend out your crypto. You can earn from 3% to over 12% just by letting your crypto sit at YouHodler. Interest is compounded weekly and the minimum balance required to earn interest is $100.

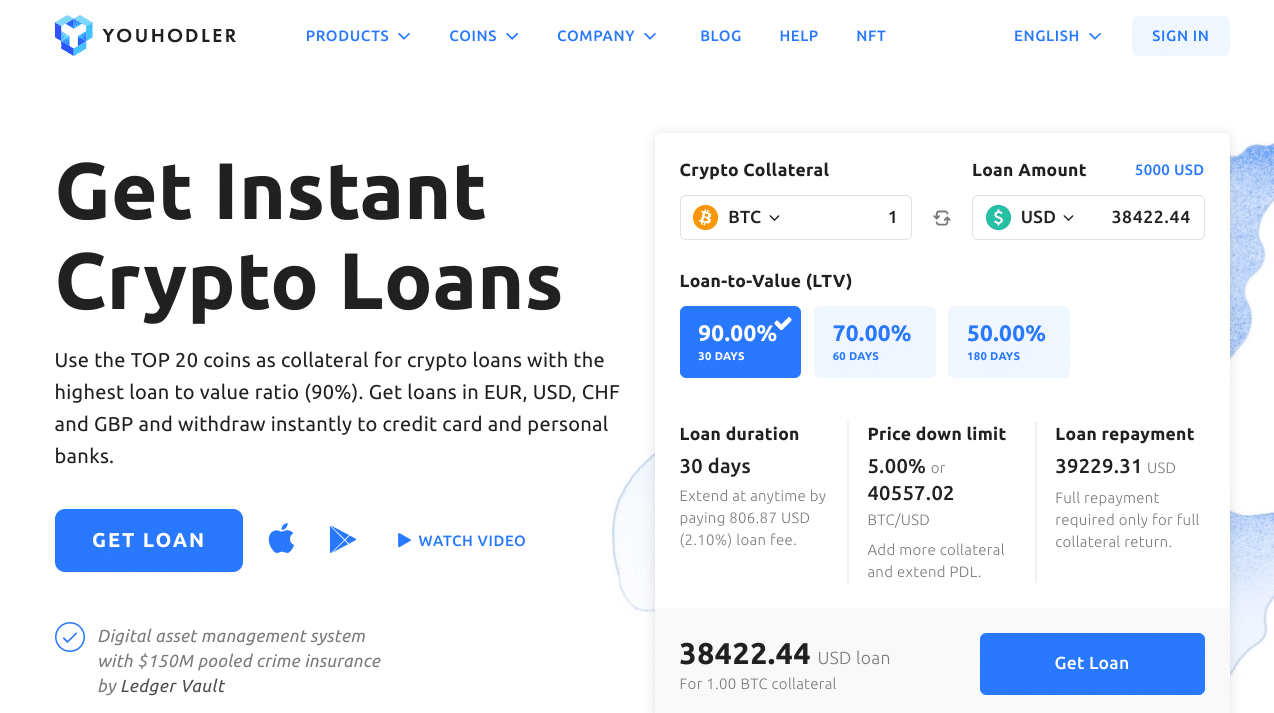

Crypto Loans

YouHodler also provides loans in crypto and fiat. Loans are backed (i.e., collateral) in crypto. There is a 90% max loan-value-ratio which is far higher than many crypto lenders. You can borrow in crypto or fiat (EUR, USD, CHF and GBP) and can instantly withdraw your funds to a credit card or bank.

Once the loan is paid back, your collateral is returned. Besides simply paying back your loan, there are three other ways to close it:

Note that both the Close Now and Reopen options are subject to fees. Three different loan terms are available depending on how long you want to borrow:

- 30 days: LTV of 90%

- 60 days: LTV of 70%

- 180 days: LTV of 50%

YouHodler has a term called “Price Down Limit” or PDL. This is the price that your collateral must remain above. If your collateral falls below the PDL, YouHodler can sell your collateral and close out the loan.

You have the option to set the PDL which will also change the loan terms. If the value of your collateral is approaching the PDL due to a decrease in the value of your coin, you can always deposit more crypto to keep the loan open.

Multi HODL

Multi HODL is the name of YouHodler's margin trading product. With Multi HODL, you can amplify your trading power by up to 30x. You can also keep earning interest on your leveraged crypto.

Of course, using margin can be dangerous. And, in extreme cases, traders can even lose more than they initially invested. Thankfully, that can't happen with YouHodler. The most you can lose on a Multi HODL position is 100% of the crypto asset that you used as leverage (which is the most you could lose on a non-margin trade as well).

While 100% is technically the maximum loss you can sustain, YouHODLER allows traders to set much more conservative "stop loss" levels. It also encourages Multi HODL users to set a "take profit" level for every trade.

Are There Any Fees?

Yes, there is a 5% fee for bank wire withdrawals and a 3.5% fee for credit card withdrawals. There are also a variety of fees related to crypto loans:

- Close now fee - 1% of the overdraft amount

- Reopen - Interest fee + 1% service fee (from the borrowed amount)

- Extend PDL - 1.5% of the additional collateral

- Increase LTV - 1.5% of the increased amount

If you make a profit on a Multi HODL deal, you'll be charged a profit share fee. In one example that YouHodler provided, this fee was 0.45%. However, we couldn't confirm that this is always what traders are charged on profitable deals. If your Multi HODL trade is subject to a margin call, a service fee will apply. Unfortunately, we again couldn't find a clear breakdown of how this fee is calculated.

It's also unclear what YouHodler users are charged to buy/convert currencies. In a recent announcement, the company said that it was introducing "market pricing rates" which are "executed using the most accurate market rate possible."

YouHodler promised that this change would lead to lower fees for its users. The company also provides a calculator which shows the conversion fees and total amount you'd receive for any particular crypto or fiat. Still, we would prefer to see a more clear and transparent fee structure.

Header |  |  | |

|---|---|---|---|

Rating | |||

Supported Currencies | 20+ | 15+ | 30+ |

Interest Rates | Up to 12% | Up to 10% | Up to 7.4% |

Max LTV | 90% | 50% | N/A |

U.S. Availability | |||

Mobile App | |||

Cell |

How Do I Open An Account?

You can visit the YouHodler website to get started with opening an account. You can visit this page to learn about YouHodler's AML/KYC policy.

Note that you'll be required to select your country of residency during the registration process. And it bears mentioning again that YouHodler does not currently accept customers from the United States.

Is My Money Safe?

YouHodler is not a US-based company and does not adhere to US laws. There is no FDIC protection. YouHodler does, however, use Ledger which provides $150 million in pooled crime insurance.

Is It Worth It?

Earning interest on crypto and taking out crypto-back loans are both risky compared to other loans or investments. However, if you already trade crypto, you're likely used to this level of risk and may benefit from using YouHodler.

With a simple and clean user interface, YouHodler could be a great choice for beginners who live outside the United States and don't plan to trade frequently.

But if you're a U.S resident, you'll need to look at other crypto savings accounts. And regardless of where you live, you'll need to join a different crypto exchange if you want access to advanced trading tools. Compare cryptocurrency investing websites and exchanges here >>>

YouHodler Features

Product Type | Crypto savings accounts, loans, and exchange |

Deposit Types |

|

Deposit Fees | None |

Minimum Deposit |

|

Minimum Balance to Earn Interest | $100 |

Minimum Loan Amount | $100 |

Supported Currencies | 20+ |

Interest Rates |

|

Payout Frequency | Weekly |

Withdrawal Limits | Varies by withdrawal method and currency |

Withdrawal Fees |

|

Conversion Fees | Varies by currency |

Transfer Speed | Instant transfers available |

Account Type | Taxable |

Availability | Available worldwide except for the following areas:

|

FDIC Insurance | No |

Security | Adheres to the PCI Security Standards and Cryptocurrency Security Standard (CCSS) $150 million of pooled crime insurance through Ledger |

Digital Wallet | Yes |

Desktop Availability | Yes |

Mobile App Availability | iOS and Android |

Customer Service Options | Live chat and email |

Customer Service Email Address | support@youhodler.com |

Promotions | None |

YouHodler Review

-

Commissions and Fees

-

Interest Rates

-

Ease of Use

-

Customer Service

-

Safety and Security

-

Availability

Overall

Summary

YouHodler allows users to store, earn interest, and borrow against their crypto. But the platform doesn’t currently serve U.S. citizens, but allows for citizens of most other nations.

Pros

- Competitive interest rates

- Weekly interest payouts

- Easy-to-use interface

- 20+ crypto collateral options on loans

Cons

- Not available to U.S. residents

- Conversion fees are unclear

- $100 minimum balance to earn interest

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Richelle Hawley