Source: The College Investor

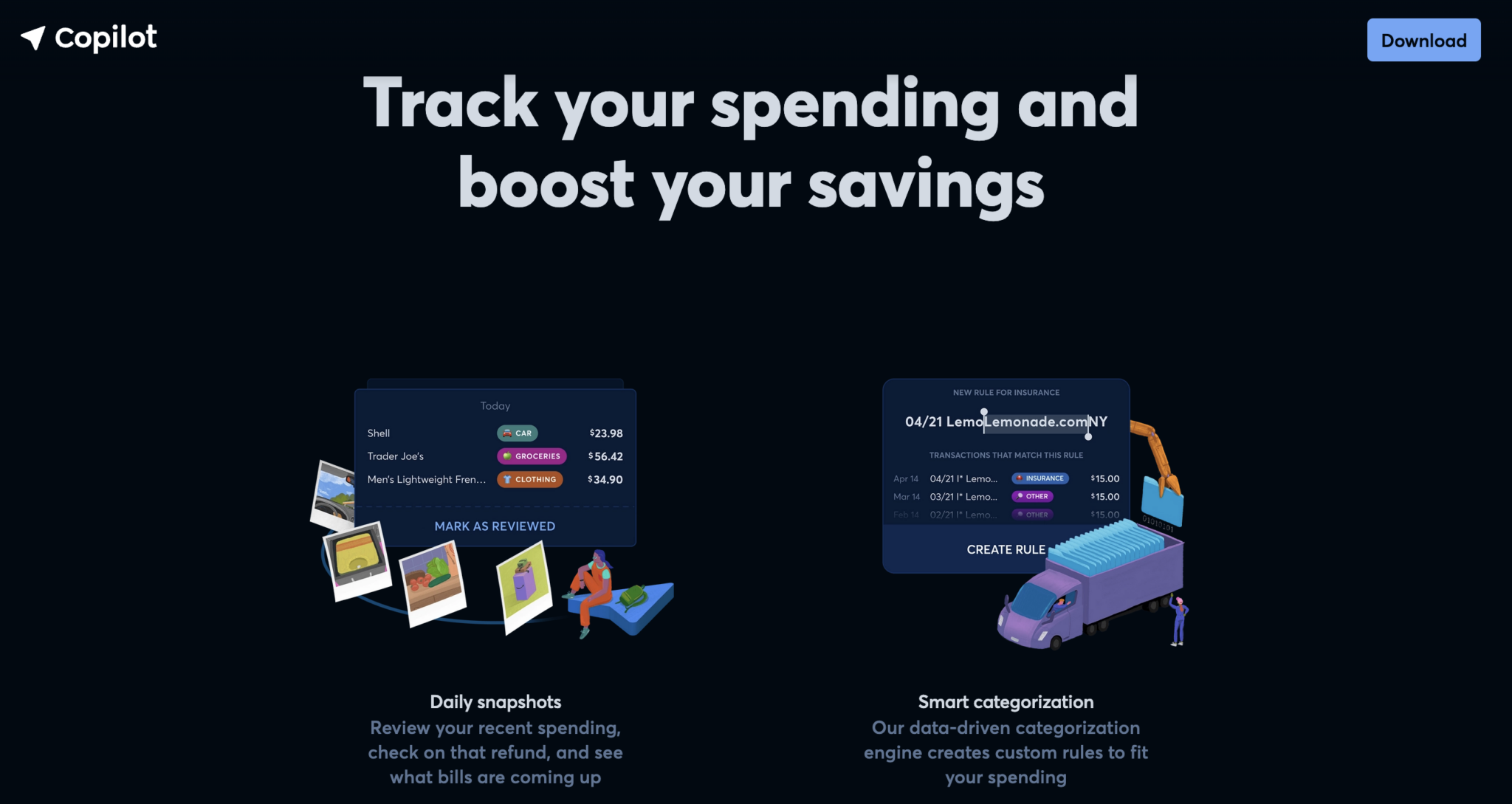

Copilot is an innovative budgeting tool that is making budgeting and tracking your finances easier.

If you've used Google or ChatGPT, you’ve experienced the benefit of finely honed natural language processing (NLP). Through simple rules based on real language, you can filter through tons of information to find what you need. Despite the growing usage of NLP in other parts of our digital life, FinTech companies have been slow to latch onto NLP as a way to serve people.

Copilot is changing that. This AI-powered app allows you to train it to serve up the best information for you. By combining the best elements of design and AI, Copilot is a true digital assistant.Here’s what you need to know about this new money app.

Copilot Details | |

|---|---|

Product Name | Copilot |

Price | Free for 1 month, after that, $13 per month Or yearly price of $95 ($7.91 per month) |

Platform | iOS and MacOS only |

Promotions | 2 month free trial with promo code TCI2024 |

What Is Copilot?

Copilot is an app designed to help you become a better manager of your money. The company’s focus on a user-centric experience ensures that you’ll understand the most important parts of your financial life, like whether you’re earning more than you’re spending. It allows you to really dig into the details of your finances.

Founded in 2019, the New York-based Fintech company flew under the radar for a long time. But with more than 6,000 reviews in the App Store, the company is starting to gain attention as a quality personal finance app.

Unlike many Fintechs, Copilot doesn’t partner with big banks and credit card companies. Instead, it charges a monthly or annual subscription fee to its devoted customers - which pays for the connection costs to these companies.

In 2024, we named Copilot a top budgeting app in our annual comparison.

What Does It Offer?

Copilot offers a user-centric approach to money management with helpful visualizations and useful notifications. It focuses on a streamlined user experience enhanced by AI.

Intuitive Visualizations

Copilot has several dashboards that allow users to understand the facets of their finances. The investments dashboard shows long-term trends as well as more recent tickers of returns. The budget dashboard shows at-risk categories where you may overspend, as well as a breakdown of spending by category. These forecasts show whether you’re likely to overspend your income.

The tools are easy to use, especially if you want to examine a specific transaction.

Spending Tracker and Budgets

The part of the Copilot app that will apply to almost everyone is the spending tracker and budgeting portion of the app.

Getting the budget set up correctly can take a little bit of work since you have to “train” the app on how to categorize transactions. For example, you may need to label transactions as transfers or income rather than expenses. It’s biggest downfall of the app—characterizing transactions isn’t intuitive. But once you have the budget set up, it’s fairly simple to track expenses against the budget you set in the app.

They recently launched their Transaction AI, which should make labeling and categorizing much faster and easier. We're excited for this.

Copilot enables you to adjust budgets by month or enable “rollovers.” An example of a rollover is underspending several months to account for larger spending months. This is perfect for tracking vacation spending, or even childcare spending if you tend to have larger expenses in the summer months.

Investment Tracking

Copilot helps you track the value of your whole portfolio and gives you details on some of the bigger movers in your portfolio.

You can customize the “widgets” on your investment page to focus only on the details that matter to you. If you’re a long-term index fund investor, you may not care to see the daily movements in your portfolio. In this case, you can remove those from your investment tab.

Those who are more active traders may want to enable a watchlist or some other functionality through the app. Copilot is highly customizable, which makes it great for a variety of investors.

Copilot tracking options [Screenshot by The College Investor]. Source: Copilot

Support for Crypto Tracking

If you have crypto, you can track the value of this investment, even if you hold your crypto in a hardware wallet. Copilot has guides that show how to connect to your wallets so that your crypto investments are properly tracked with the rest of your net worth.

Copilot doesn’t give you detailed crypto tracking information like CoinTracker, but it offers a reasonable way to look at your crypto alongside your other investments.

Notification Flexibility

If you’re interested in building credit or watching for low account balances, you can set up push notifications through Copilot. On the other hand, if you’re more concerned with staying on budget, you can prioritize those notifications instead.

When notifications are designed for everybody, they may not apply to your situation. But with Copilot, you can set the notifications that matter to you, and never see the ones that don’t pertain to you.

Transaction Categorization Using Natural Language Processing

When you first start using Copilot, the app may feel relatively generic, as a lot of your spending transactions will be characterized as “Other.”

But when you get into the app, you can start tagging transactions to the right “bucket” of your finances. As you start to do this, Copilot asks if you want to make a rule.

Rules allow Copilot to appropriately characterize similar transactions on your behalf. This is a huge time saver and makes budgeting and tracking much easier.

Copilot transaction categorization [Screenshot by The College Investor]. Source: Copilot

Are There Any Fees?

You can try Copilot free for two months with code TCI2024, but after that, you have to pay. Copilot costs $13 per month or $95 per year.

Unlike many budgeting apps, Copilot doesn’t partner with a brokerage or a credit card company, so users have to pay to use the app.

Contact

You can access Copilot’s help center online or through the app in-app chat support. If you want to contact the company, you can email Copilot at hello@copilot.money.

The company does not advertise a phone number or alternative contact method.

How Does Copilot Compare?

Copilot is one of the myriad budgeting apps we’ve reviewed over the years. Of these apps, it is one of the few that makes transaction characterization easy and automated. With limited data, Copilot “learns” your custom money rules that make the app easier for you to understand.

Tiller and You Need A Budget offer similar customizability as Copilot, but neither of these apps has built-in “learning” that makes it easy to track spending.

Other apps, like Mint or Empower (formerly Personal Capital), offer almost as much functionality as Copilot, and they are free.

Copilot is competing in a crowded marketplace of excellent budgeting apps, but it still stands out.

Most people won’t switch from their budgeting app of choice, but Copilot could soon become a widely recognized name in the Fintech space.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Pricing | $13/month or $95/year | $14.99/mo or $98.99/yr | Free |

Free Trial | 60 Days With Promo Code TCI2024 | 34 Days | N/A |

Platform | iOS, Mac | iOS, Android, Web, Alexa, and more | iOS, Android, Web |

Cell |

How Do I Open An Account?

To open a Copilot Account, download the Copilot app from the App Store either on a Mac or an iPhone. From an iPhone, you can choose to use your biomarkers for access, such as FaceID or you can create an account using an email address and password combination.

You don’t need to provide any information beyond your credentials. Instead, you’ll link accounts and crypto wallets

Is It Safe And Secure?

Copilot offers complete transparency regarding its security practices. It requires multi-factor authentication and offers the option of FaceID for access. The company connects to your accounts using a third-party system called Plaid. Plaid is recognized as having a safe and secure connection service. Copilot is also committed to continually assessing its app for threats and making updates to it.

Despite the high degree of safety and security, Copilot could be hacked. Users would not be at risk of losing money in a hack (all accounts are connected using read-only access), but private data could be leaked. It is always important to assess your risk tolerance before signing up for any online financial app.

Is It Worth It?

Using Copilot is a pleasure. If you have an hour to set up the app to your liking, it’s great to log in and get a meaningful status update on your money without wading through unnecessary garbage.

When you don’t consider cost, Copilot is one of the best general personal finance apps available.

The only hangup with Copilot is the cost. At $95 annually, Copilot is fairly expensive, and many people don’t need all of its bells and whistles.

If you’ve tried some of the free budgeting apps, and you don’t like them then give Copilot a try. The cost is high for a budgeting app, but a great money-tracking system is a game changer. Copilot could be that app for you.

Features

Price |

|

Budgeting | Yes |

Income Tracking | Yes |

Expense Tracking | Yes |

Bank Integration | Yes |

Investment Tracking | Yes |

Crypto Tracking | Yes |

Credit Score Monitoring | No |

Net Worth Tracking | Yes |

Bill Pay | No |

Tax Preparation | No |

Import Bank Data Files | Yes |

Customer Support Options | Email and in-app chat |

Customer Service Email | hello@copilot.money |

Web Account Access | Web app for Macs only |

Mobile App Availability | |

Promotions | 2 month free trial with promo code TCI2024 |

Copilot Review

-

User Friendliness

-

Customer Service

-

Mobile App Functions

-

Security

Overall

Summary

Copilot is a true digital financial assistant that can help you budget and track your spending. Here’s what you need to know about it.

Pros

- Deep knowledge of taxes and tech worker finances.

- Low-cost asset management and portfolio construction services.

- Help center staffed by real people during business hours.

Cons

- Changing transaction types wasn’t intuitive, even after doing it a few times.

- Only available for Mac and iPhone (iOS operating systems)

- Must pay a monthly or annual fee after the first free month.

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington