If you own a smartphone, there’s a good chance you probably use it to manage your finances. According to a survey by Insider Intelligence, a whopping 97% of millennials use mobile banking on their phones.

But with so many finance-related apps at your disposal, it can be challenging to remember which ones have access to your bank information – and how much access they have.

Plaid Portal is a tool that helps you manage the information you share between your bank and your favorite financial apps. Below, we’ll dive into what Plaid Portal is, how to use it, and why it’s important to protect your financial data.

What Is Plaid Portal?

Plaid Portal enables fintech apps and financial institutions to communicate with one another. The San Fransisco-based company powers more than 8,000 fintech apps and services, including Betterment, Stash, Wave, and Drop.

The average consumer uses so many different apps and financial institutions that it can be difficult to keep track of who they grant account access to. Plaid Portal is a tool to help users manage their financial privacy.

A Plaid Portal account allows you to see which apps, services, and institutions have access to your financial accounts. It’s also a central hub that allows you to grant control to the connections Plaid manages on your behalf.

For example, the Plaid Portal activity feed shows you the connections you’ve made, including the date the connection was established. If you decide to disconnect an app, Plaid Portal will show the date you disconnected or deleted it.

Why Connect Your Accounts Using Plaid?

There are more than 4,000 banks in the United States. This includes well-known national banks like Chase and Bank of America, as well as local community banks and small credit unions.

These banks connect with over 11,000 fintech startups offering budgeting or money management services. The problem is there isn’t a universal way to pull data from your bank account to these apps.

Plaid securely connects your financial accounts with a wide variety of apps, allowing you to manage your money regardless of where you bank.

Whether it's Venmoing a friend or using a budgeting tool, most financial apps will want to access your banking information. By connecting your data – like bank balances, transaction amounts, and vendor details – they can help you make sense of how much money you have and where it’s going.

Some popular apps Plaid connects with include:

- Mobile banking: MoneyLion, Chime, M1 Finance

- Savings and investing: Ellevest, Acorns, Qapital

- Financial wellness: YNAB, Rocket Money, Albert

- Business operations: Wave, Bench, Expensify

- Payment processing: Venmo, Wise, World Remit

- Lending services: SoFi, Figure, Petal

Plaid’s goal is to create a better financial system that makes managing money seamless – and secure.

How Do You Create a Plaid Portal Account?

If you already use digital financial products or services, creating a Plaid Portal account can help you manage the apps you grant financial account access to.

When you’re ready to create an account:

- Go to the Plaid website

- Review the security notifications and privacy policy when prompted

- Add a phone number to verify your account (and provide an added layer of security)

- Create a login and password to set up your account

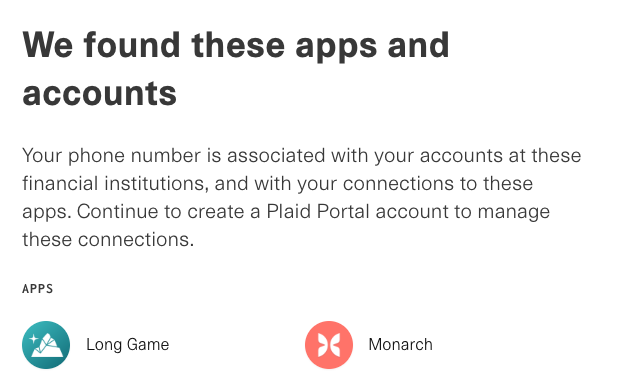

Before you finish the sign up process, Plaid will provide you with a list of matched connections that are associated with the phone number you provide. You can review the list and determine whether or not it makes sense for you to proceed with creating a Plaid Portal account.

Can You Disconnect Plaid From Your Financial Accounts?

If you stop using an app or switch your accounts to a different bank, you can disconnect or delete a connection from Plaid.

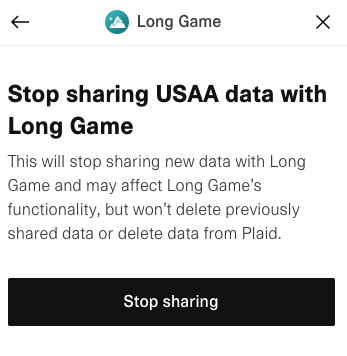

In the Plaid Portal, find the app or service you’d like to disconnect from. Plaid will share information about what will happen when you decide to sever a connection between a financial institution and an app. If you’d like to proceed, continue with the prompts to disconnect.

When you do this, Plaid will no longer transmit data between the financial institution and the app. Data that was already shared, however, will still exist.

If you want to go one step further, you can delete your stored data permanently. When you delete a connected app from Plaid it will remove saved data from Plaid’s system. To make sure all your data is eliminated, you will also want to reach out to the app directly to make sure it’s eliminated from their systems too.

Tips for Protecting Your Data Using Money Management Apps

As more and more financial transactions move online, it’s important to know what data is being shared and how to protect it. Neglecting apps that you no longer use can open you up to fraud or identity theft.

Here are some best practices to follow to protect your data when you use money management apps:

- Manage your passwords. Aside from coming up with a password that’s impossible to guess, you also want to make sure you’re regularly managing them. Change your passwords often and use a password manager to store them all in one place.

- Check your accounts regularly. Make it a habit to review all of your financial accounts. This includes bank accounts, investment accounts, credit cards, and a hot wallet if you use one. Check your accounts against your credit report to see if there’s any suspicious activity that you need to take action on.

- Have a backup. Money management apps are great, and Plaid makes it easy to connect financial institutions to those apps, but they aren’t perfect. If you use third-party apps to manage all of your financial accounts, consider putting a backup system in place in case something happens. This could be as simple as downloading your data in a .CSV file or printing hard copies of important bank information.

- Use a VPN. The more you rely on connections through third-party apps, the more susceptible your information is to being hacked and stolen. You might not realize it, but anytime you use a money management app on a public WiFi network, your data could be at risk. Use a VPN or limit your access to private networks to protect your privacy.

The Bottom Line

Many apps and services make it easy to manage your money from your phone. The problem is the existing financial system hasn’t quite caught up with the large influx of digital money management tools and services available.

Plaid makes it possible to not only share data across different financial institutions and apps, but you can also monitor who you give access to, helping you keep your financial information secure.

Amanda Claypool is a writer, entrepreneur, and strategy consultant. She’s lived in the Middle East, Washington, DC, and a 2014 Subaru Outback but now calls Asheville home. Amanda writes about money, crypto, emerging tech, and the future of the economy on Medium.

Editor: Colin Graves Reviewed by: Robert Farrington