Source: The College Investor

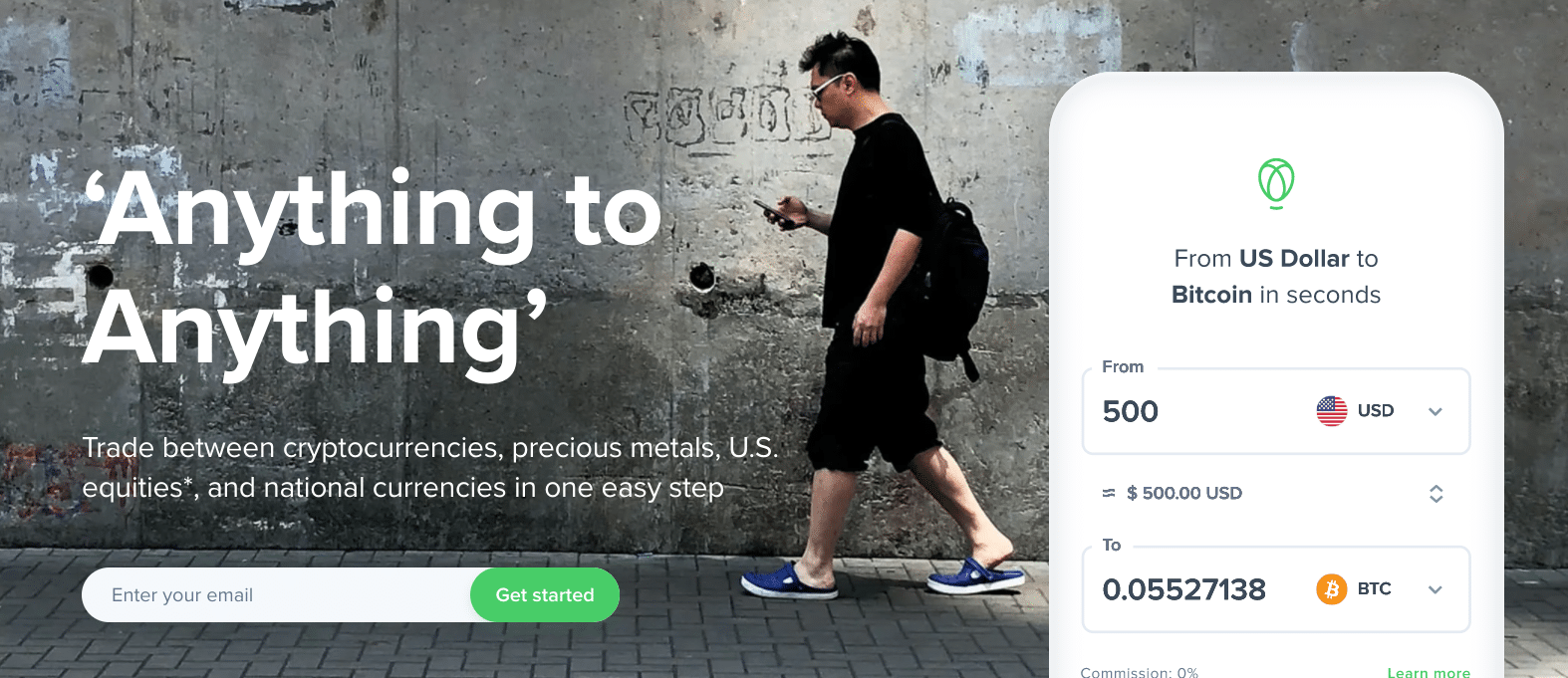

Uphold is a cryptocurrency exchange for those who are interested in multiple asset classes know cash is often the only way to go from one asset to another.

Once you fund a brokerage account with cash, you can buy gold, silver, and more. But if you also want to trade cryptocurrencies, you have to fund a crypto exchange account. And if you want to trade national currencies, you may need to open an account with a third provider. It’s a bit of a disparate system.

Uphold has a simple solution to trading multiple assets — open one account and trade multiple assets without making a trip back to cash. This means trading directly across assets. In this article, we’ll see what Uphold offers and the costs that are involved.

Uphold Disclaimer: Assets available on Uphold are different per region. All investments and trading are risky and may result in the loss of capital. Cryptoassets are largely unregulated and are therefore not subject to protection

Uphold Details | |

|---|---|

Product Name | Uphold |

Min Deposit | $10 |

Supported Assets (In The U.S.) | Cryptocurrencies: 250+ Fiat Currencies: 27 Precious Metals: 4 |

Typical Spread | Fiat Currencies: 0.20% Cryptocurrencies: 0.65% to 3.95% Precious Metals: 3% |

Promotions | Free BTC Trading |

Who Is Uphold?

Uphold (formerly Bitreserve) is a trading platform that allows cross-asset trading. It was founded in 2014 (i.e., name changed) and is based in San Francisco, CA. Its founder is Halsey Minor, who is no longer with the company. The CEO is J.P Thieriot. Uphold has raised $15.5 million through a Series B.

Uphold is a global platform that allows users to convert between fiat currencies, cryptocurrencies, and a handful of commodities. "Think about it. If you’re a Venezuelan, you’ve probably never had access to those securities in the past" Thieriot said in an interview with The Politic. "Now, you’ll be able to access them from your mobile device, pretty much anywhere but the OFAC countries."

At the time of the interview, Thieriot said that Uphold had 1.5 million clients in 182 countries and was growing at a rate of about two thousand users per day.

What Do They Offer?

Uphold provides a trading platform that lets users go directly from one asset class to another. For example, users can trade from gold to Bitcoin or DASH to XRP.

Automated trading is another feature of Uphold. This just means that you can invest on a schedule, buying pre-selected assets. Automated trading results in a dollar-cost averaging approach.

Uphold also allows limit orders for trading. This allows you to buy or sell an asset at a defined target price. You can also set how long you want to keep the limit order open for, or cancel it at any time.

Uphold recently introduced a new feature called Take Profit, which enhances the functionality of standard limit orders. With Take Profit, you can automate the selling of an asset you're buying when its price increases by a predetermined percentage.

When that happens, Uphold will automatically sell the asset, and you get to "take the profit." This saves you from having to constantly monitor the market, and you can trust that the asset will be sold at your desired percentage.

Uphold has another trading tool, called a Trailing Stop Loss Order. Unlike a standard Stop Order which only protects you from losses based on the purchase price, a Trailing Stop Order readjusts to the highest price after you buy.

According to Uphold, they are the only major crypto trading platform in the U.S. to offer a Trailing Stop Loss Order.

One of Uphold's big selling features is that they never lend out your assets, and they maintain at least 100% of customer assets in reserves. You can see their full transparency report here.

Screenshot of the Uphold Website. Source: The College Investor

Supported Assets

One of Uphold's biggest selling points is the variety of assets that it's able to support. As of writing, Uphold clients are able to trade the following:

Asset | Available In The U.S. | Available In The U.K. And Europe |

|---|---|---|

Cryptocurrencies | 250+ | 60+ |

National Currencies | 25+ | 3 |

Precious Metals | 4 | 4 |

Effective February 1, 2023, Uphold is discontinuing supporting equities.

Interest Account

Uphold recently launched their Interest Account, which earns 4.65% APY on USD. This account is FDIC-insured at partner banks up to $2.5 million USD.

The great thing about this account is that there are no fees, no lock-ups, and no subscriptions required.

You can earn the 4.65% APY on balances over $1,000 USD.

Debit Card

The Uphold Debit Card rewards you with 2% cashback paid in XRP.

Uphold has also increased their monthly rewards limit. You can now earn up to £100 in cashback per month, up from £50. That's as much as £1200 in cashback rewards per year. There are no foreign transaction fees and the card is accepted anywhere that MasterCard is accepted.

Unfortunately, the Uphold Card is only currently available to users in the U.K.

You’ll get both a chipped physical card and a virtual card. Even though Uphold converts an asset into cash behind the scenes, the transaction is instant. You won't have to wait when swiping your cart at the checkout. Note that ACH deposits take up to three business days to settle.

Uphold Debit Card. Source: The College Investor

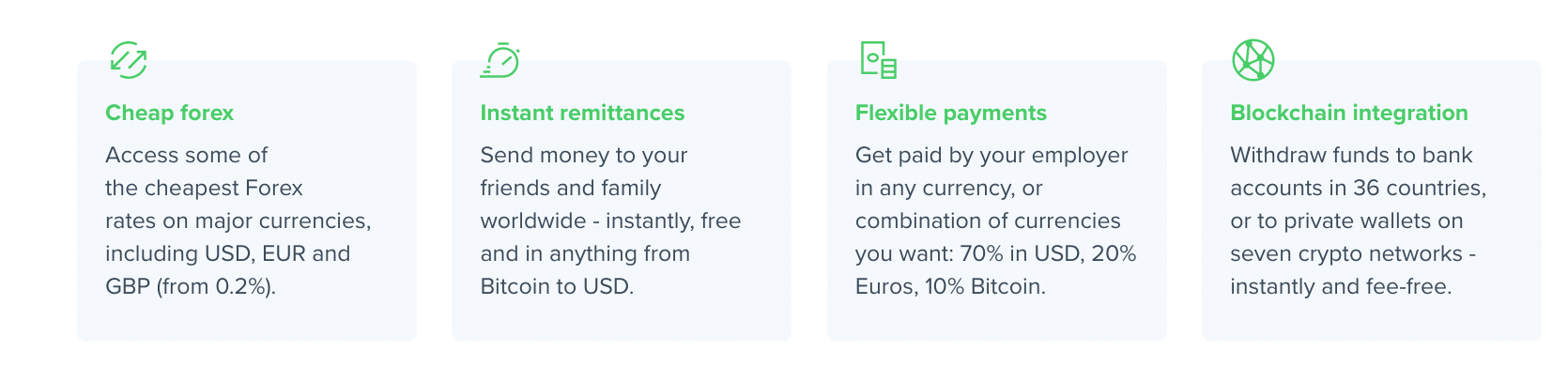

Financial Services

Uphold also provides a few services that often are unavailable with traditional banks. These include:

Uphold also says that the rates it charges on Forex are some of the most affordable that you'll find anywhere (starting at 0.2%).

Source: The College Investor

New! Vault On-Chain Storage

In December 2023, Uphold launched a beta version of Vault, their new self-custody platform for digital assets. According to Uphold, Vault represents "a reimagining of what custody solutions look like for digital assets."

Vault blends the security of complete self-custody (on-chain asset storage) with the convenience of a centralized cryptocurrency exchange platform. Here are five key features:

Multi-Signature Wallet: Vault users maintain full control of their funds by holding two of three keys. The third key is kept by Uphold and is only used to co-sign user-initiated transactions and for its key replacement service.

Key Replacement: Speaking of key replacement, Vault allows you to recover access to your assets, even if you lose your keys. Usually, if you lose private keys, you lose the underlying assets they are protecting.

Quick Trading: Uphold allows you to move assets from the Vault to the trading platform with one click, allowing you to trade instantly, 24/7.

Always Accessible: If the Uphold app goes down for any reason, Vault allows you to transfer your funds on-chain using the two keys you're provided with.

Value Price: Vault is currently priced at only $50/yr, making it very affordable for all users.

At the time of launch, Vault only supports one token (XRP). However, the company plans to offer more chains in the near future.

Are There Any Fees?

The spread is how Uphold makes money on transactions. It's the difference between the bid x ask. Uphold says its spread is typically 0.8% to 1.2% on BTC and ETH and 1.8% in the U.S. and Europe.

For other digital currencies, Uphold warns that "Spreads can be significantly higher for low-liquidity cryptos and tokens...Check rates at Preview before you trade." Currently, spreads for these other currencies and commodities range from 0.65% to 3.95%.

It does offer a "typical" spread for its other supported assets. These are:

- Precious metals: 3% (on top of the bid-ask spread of Uphold's supplier)

- Fiat currencies: 0.2% (between major currencies such as USD, EUR, and GBP

In addition to the spread, there will be a $1 transaction fee on all transactions between assets where the amount transacted is under $100 in value (with a few exceptions, such as using the Uphold Debit Card).

Uphold doesn't charge any fees for bank deposits or withdrawals (for US-users using ACH). However, a 3.99% fee is charged whenever funds are added using a credit card, and 2.49% fee on deposits using a debit card.

The Uphold debit card has a one-time fee of $9.95. Withdrawals are $2.50. The daily cash withdrawal is $1,500 and $500 per transaction.

Promo: Until January 5, 2023, users can now buy and sell Bitcoin (BTC) for free on Uphold! That's unlimited trading, $0 fees, 0% spreads, $0 commissions.

How Does Uphold Compare?

Uphold's secret sauce is most certainly the wide variety of assets that it supports. But if you're only looking to trade cryptocurrency, another platform may offer lower fees or support more tokens. Here's a quick look at how Uphold compares:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Trading Fees | 0.20% to 3.95% | Up to 1.49% | $0 |

Supported Cryptocurrencies (In The U.S.) | 250+ | 100+ | 7 |

Supported Fiat Currencies (In The U.S. | 27 | 3 | 1 |

Supported Precious Metals | 4 | 0 | 0 |

Mobile App | |||

Cell |

What Others Are Saying About Uphold

In the first half of this video from a frustrated Uphold client, he says that he's been unable to withdraw funds for almost 70 days and there’s also a $3.99 withdrawal fee. I’ve read similar complaints about funds being held.

Uphold doesn’t have anything about this in their FAQ. The video also references withdrawal fees but Uphold shows there are no withdrawal fees. I’m not sure how some people are running into holds on their funds or withdrawal fees.

In our testing, we found it difficult to get our account approved by passing the KYC and AML screenings - which is something they don't make you do until after you sign up. So, you could theory end up depositing money and then having it trapped due to how they setup their system to make it "easy to open an account".

For whatever reason, we've found Uphold to have the most cumbersome and unreliable process for KYC and AML versus other popular cryptocurrency exchanges.

How Do I Open An Account?

You can visit the Uphold website to open an account. For individuals, the sign-up process is simple and should only take a few minutes to complete. You'll have the option to open a business account as well. However, business account creation can take longer as you may need to provide additional verification documents.

How To Create Uphold Account. Source: The College Investor

Is My Money Safe?

Funds deposited with Uphold are not FDIC or SIPC insured. If you run into problems trying to get your money out of Uphold, it isn’t clear who else you should contact for help.

Uphold does use encryption on its website. Bank accounts are connected to Uphold through Plaid, which is a financial services industry standard.

While the company shows it is based in San Francisco, the website footer shows it's registered in London. Uphold is licensed in a number of states, which means U.S. laws apply rather than the U.K.

Important Note: Uphold clearly says that they don't lend out customer assets. This is a big contrast to other crypto savings firms that did lend out customer assets and caused their customers to lose money. This is a good sign from Uphold.

How Do I Contact Uphold?

Like most cryptocurrency platforms, Uphold does not put a strong emphasis on customer service. It doesn't publish a phone number anywhere on its site.

If you do need assistance regarding your account, you'll probably want to start by visiting its Help Center or FAQ page. You can also submit a support ticket here or email them at hello@uphold.com.

Uphold's currently has a "Average" customer service rating on Trustpilot of 3.3/5. And that's not from just a few reviews. Over 8,800 customers have reviewed the company on Trustpilot as of writing.

The company also has a 4.4 star rating on the Apple App Store, and a 4.7 star rating on the Google Play Store.

Why Should You Trust Us?

We have been writing and researching cryptocurrency since 2016. We have been reviewing and testing all of the major cryptocurrency exchanges since 2017. Our team understands the crypto and NFT space, but also understands the intersection with TradFI (traditional finance). Our goal is to help bridge the gap between those in the cryptocurrency space, with those curious about it in the traditional finance space.

Furthermore, we have a compliance team that checks the accuracy of rates and service offerings regularly.

Who Is Uphold For And Is It Worth It?

As we alluded to earlier, there are several Youtube videos claiming that Uphold is a scam. We won't go that far. But what we will say is that the Uphold experience may not be as hassle-free as promised -- especially when it comes time to withdraw your funds. As we mentioned, in our testing, we found some frustrating things as well.

Some people, however, have had good experiences with Uphold. Like all cryptocurrency exchanges, customer service is mostly absent. But for those who can look past these issues and want direct cross-asset trading, Uphold is the platform to use.

If minimizing fees is a priority, you may be better off dealing with the hassle of using a different trading account for each asset type. And several popular cryptocurrency exchanges offer lower (and clearer) crypto trading fees.

Uphold Disclaimer: Cryptocurrency investing within the EU/UK by Uphold Europe Limited and USA by Uphold HQ Inc.

You should be aware that the risk of loss in trading or holding cryptoassets can be very high. As with any asset, the value of cryptoassets can go up or down and there can be a substantial risk that you lose all your money buying, selling, holding or investing in cryptoassets. Your cryptoassets are not subject to protection. You should carefully consider whether trading or holding cryptoassets is suitable for you in light of your financial condition.

Uphold FAQs

Here are a few questions that people often ask about Uphold.

Does Uphold report to the IRS?

Yes, as a centralized cryptocurrency exchange, Uphold is required by law to provide an annual report to the IRS regarding the cryptocurrency transactions of its U.S. users.

Is Uphold still allowing users to trade Ripple (XRP)?

Yes, until the SEC's lawsuit (that has accused Ripple of being a security) has reached a court judgment, Uphold will continue to support XRP on its platform.

Does Uphold offer crypto interest accounts?

No, users aren't currently able to earn interest on any of their crypto holdings.

Does Uphold have a sign-up bonus?

No, but it does have a referral program. Eligible users receive $10 in Bitcoin per qualified referral.

Uphold Features

Account Type | Individual or Business |

Minimum Deposit | $10 |

Supported Cryptocurrencies (In the U.S.) | Over 250 |

Supported Cryptocurrencies (In the U.K. and Europe) | Over 60 |

Typical Trading Fees |

|

Automated Trading Tools | Yes |

Digital Wallet | Yes |

Deposit Fees |

|

Withdrawal Fees |

|

Minimum Withdrawal |

|

Uphold Card Issuance Fee | $9.95 |

Uphold Card Usage Fees |

|

Uphold Card Limits |

|

Availability | 180+ countries |

Customer Service Options | Email or support ticket |

Mobile App Availability | iOS and Android |

Promotions | None |

DISCLAIMER

Uphold offers Cryptoasset investing within the EU/UK (by Uphold Europe Limited) and USA (by Uphold HQ Inc).

Capital at risk. As with any asset, the value of cryptoassets can go up or down and there can be a substantial risk that you lose all your money buying, selling, holding or investing in cryptoassets. Your cryptoassets are not subject to protection. You should carefully consider whether trading or holding cryptoassets is suitable for you in light of your financial condition. Uphold makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about Uphold.

Uphold Review

-

Supported Assets

-

Fees

-

Availability

-

Security

-

Customer Service

Overall

Summary

On the Uphold platform, customers can trade between cryptocurrencies, fiat currencies, precious metals, and more.

Pros

- Easily convert between asset classes

- Spend your funds with the Uphold Card

- Schedule recurring buy or sell orders

Cons

- Transaction fees are on the high side

- Some customers have complained about withdrawal delays

- Limited customer service

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves