Source: The College Investor

Gemini is a cryptocurrency exchange and digital asset custodian.

Finding a cryptocurrency exchange that is secure and has never been hacked can be a tall order.

And if you also prefer for the company to be based in the United State, you might already be thinking about Coinbase. But you might be surprised to learn that Coinbase isn’t the only game in town that meets all of those requirements.

Gemini is a U.S.-based company with FDIC protection for USD and has never been hacked (that we're aware of as of publication). It’s a straightforward platform that is easy to use and puts security at the highest level. In this article, we’ll do a detailed review of Gemini.

New Customer Promo: Open a new account and earn $10 in BTC when you trade $100 within the first three days. Open a new account here >>

Gemini Details | |

|---|---|

Product Name | Gemini |

Features | Cryptocurrency exchange, digital wallet, interest accounts, rewards credit card (coming soon) |

Supported Currencies | 50+ |

Fees | Convenience Fee: 0.50% above market rate Transaction fee: $0.99 to 1.49% |

Promotions | $10 worth of free Bitcoin (after buying or selling $100) |

Who Is Gemini?

Gemini is a cryptocurrency exchange. It was started by the Winklevoss twins (Cameron Winklevoss and Tyler Winklevoss). You might recognize those names. They created ConnectU, which was the predecessor to Facebook.

Gemini was started in 2014 and is based in New York, New York, which means it is one of a few cryptocurrency exchanges that is regulated in the U.S. Specifically, it is regulated by the New York State Department of Financial Services (NYSDFS).

What Do They Offer?

Gemini has over 20 cryptocurrencies, including its own currency called Gemini dollars (GUSD). You can trade and store cryptocurrencies with Gemini.

Through a partnership with Samsung, Gemini powers the Samsung Blockchain. Customers in the U.S. and Canada can connect their Samsung Blockchain Wallet to the Gemini app to trade currencies.

Funding Your Account

You’ll have to fund your account from a bank account. It can’t be funded using a debit or credit card. The maximum daily funding limit is $500 USD and $15,000 USD monthly. The daily withdrawal limit is $100,000 USD.

If you have cryptocurrencies in another off-site wallet and want to fund your Gemini account using those currencies (crypto-to-crypto), you can do that as long as the currencies are BTC, ETH, BCH, LTC, or ZEC.

Gemini Earn - Crypto Savings

Important Update: Gemini announced on November 16, 2022 that it was pausing Gemini Earn due to issues with the lender as a result of the FTX crisis.

Gemini recently launched their Gemini Earn, which is the ability to earn interest on your crypto. Right now you can earn up to 4.86% on various tokens or 2.53% if you want to earn with your Bitcoin.

You can see how Gemini compares to the best crypto savings accounts here.

Mobile Trading

Like many crypto exchanges, Gemini has a mobile app that you can trade from. You’ll find that it’s easy to use and comparable to the desktop platform. If you want to execute complex trades, it’s probably best to do those on the desktop platform. Complex trades can get a bit tedious on the mobile app.

Credit Card

The Gemini Credit Card is one of the best cryptocurrency rewards cards available. Those who get the Gemini Credit Card™ will earn up to 4% back on their transactions with no annual fee. Here's how the rewards break down:

- Gas and Ev Charging: 4% back

- Restaurants: 3% back

- Grocery stores: 2% back

- Everything else: 1% back

You'll earn your rewards in crypto and you'll have 50+ different options to choose from including Bitcoin, Ether, and more. In addition to no annual fee, this card won't charge foreign transaction fees and cardholders won't be charged any crypto purchase fees for the rewards they earn.

Gemini Dollar

The Gemini dollar™ is a stablecoin that can be used in all kinds of transactions from spending to lending to investing. Its backed by US dollars held at State Street Bank and Trust Company and offers 1:1 transferability back to US dollars at any time. And Gemini has partnered with BlockFi to offer savings accounts for your Gemini dollars with interest rates of up to 7.4% APY.

Flexa

Would you rather spend your cryptocurrency directly from your wallet? With Gemini, you can. Through a partnership with Flexa, you can purchase products at participating retailers using cryptocurrencies. Retailers include Nordstrom, GameStop, Whole Foods, and Home Depot. You’re able to spend Gemini dollars (GUSD), Bitcoin, Bitcoin Cash, and Ether.

Nifty Marketplace

The Nifty Marketplace is Gemini's recently launched platform where you can buy and sell digital art and collectibles. Digital artistic assets can also be stored in the marketplace, which increases trust and security for both the buyer and the seller.

Related: What Is An NFT?

Gemini Trust Center

The Gemini Trust Center is a dashboard of metrics on their platform as well as other important data and information. They launched this center to help build transparency around the following metrics:

- Total Crypto on our Platform

- Total Fiat held on your behalf

- Gemini dollar (GUSD) Float

- Fiat Net Flows (24hrs)

Are There Any Fees?

Yes, Gemini does charge commission rates for trading on its platform. There is a convenience fee of 0.50% above the market rate. To figure out the convenience fee amount, multiply 0.50% (1.005) by the amount of currency you want to buy.

There is also a flat transaction fee for orders placed via their web or mobile applications. The fee ranges from $0.99 to 1.49% of your order value, as shown in the chart below.

Order Amount | Fee |

|---|---|

≤ $10.00 | $0.99 |

> $10.00 but ≤ $25.00 | $1.49 |

> $25.00 but ≤ $50.00 | $1.99 |

> $50.00 but ≤ $200.00 | $2.99 |

> $200.00 | 1.49% of order value |

ActiveTrader fees are more involved. You can view the ActiveTrader fee schedule here.

For people who want to custody (i.e., cold storage) crypto with Gemini, there is a 0.40% charge for customers with assets greater than $1million. There is a $125 administration withdrawal fee as well.

How Does Gemini Compare?

Gemini's fees are very similar to Coinbase, but it supports less than half the number of coins. But of the two platforms, only Gemini currently offers interest accounts. That could make Gemini a great choice if you're primarily an investor/HODLer.

But if you're an active trader, you might want to consider another platform that charges lower transaction fees. Check out how Gemini compares in this quick chart:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Transaction Fee | Up to 1.49% | Up to 1.49% | 0.20% to 3.95% |

Extra Fee For Card Purchases | 3.99% | 3.49% | N/A |

Supported Currencies | 50+ | 100+ | 200+ |

Interest Rates | Up to 4.86% | Up to 1.50% | Up to 25% |

Mobile App | |||

Cell |

Contact

Gemini does not have much in terms of customer service options. You must create a support ticket via their app or website, and wait for a resolution.

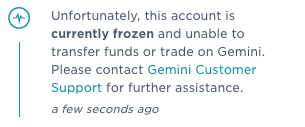

Editor's Note: We recently downgraded our review of Gemini due to poor customer service and account resolution issues. Be advised that Gemini has been locking accounts and providing no resolution to customers. We had our test account locked without any notification (discovered on July 31, 2021), and we could not even get a response until August 8, 2021. The only reason we believe Gemini even responded was due to multiple tweets from our verified Twitter account, along with support from other verified users. We also filed a complaint against Gemini via the New York Department of Financial Services.

As such, we urge readers to be cautious as we've seen an uptick in similar complaints from readers here, on Reddit, and Twitter.

Is My Money Safe?

As long as it’s been in operation, Gemini has not been hacked. Like Coinbase, USD stored in your Gemini account is FDIC-insured.

Gemini started with a “security-first” mentality. They utilize security and compliance by being compliant in SOC 1 Type 1, SOC 2 Type 1 and Type 2. (SOC refers to System and Organization Controls, which is a report generated by an independent audit of a company's information security systems.)

All of that compliance means you’ll need to be prepared to give up some of your personal information such as email address, bank account details, phone number, and some form of ID when opening an account.

If you go to the Gemini Trust Center, they display relevant information about their security controls and regulatory registrations, including:

- SOC 1 and SOC 2 exam dates

- Licenses and registrations they've obtained

However, like many other cryptocurrency exchanges, if you don't own your keys, you don't really own your crypto, and you run the risk of loss by investing in cryptocurrency.

How Do I Open An Account?

The account sign-up process for Gemini is simple and straightforward. You will need to verify your identity using a form of ID. You'll also need to connect your phone for two-factor authentification.

Finally, you'll need to fund your account. Gemini uses Plaid to connect with your bank account or card issuer. Once your application has been accepted and your account has been funded, you can start making trades! Get started with Gemini and earn $10 in free Bitcoin!

Why Should You Trust Us?

We have been writing and researching cryptocurrency since 2016. We have been reviewing and testing all of the major cryptocurrency exchanges since 2017. Our team understands the crypto and NFT space, but also understands the intersection with TradFI (traditional finance). Our goal is to help bridge the gap between those in the cryptocurrency space, with those curious about it in the traditional finance space.

Furthermore, we have a compliance team that checks the accuracy of rates and service offerings regularly.

Who Is It For And Is It Worth It?

Gemini is one of the most secure cryptocurrency exchanges out there. Security is its main selling point. It is a U.S. based company and the platform is easy to use.

If your crypto trading is mostly in popular currencies such as Bitcoin, Ethereum, Litecoin, Bitcoin Cash, or Zcash, you’ll probably enjoy using Gemini. For all of those reasons, Gemini is certainly worth checking out as a cryptocurrency platform.

However, before you rush into cryptocurrency investing, keep in mind that digital currencies are often volatile investments and should only receive a small portion of your total investing capital. To start building a diversified stock market portfolio, see our favorite stock brokers.

Common Questions

Here are a few of the most common questions that people ask about Gemini:

What is Gemini's custody fee?

Gemini charges an annual fee of 0.40% (40bps) for storing your digital assets and it also charges $125 per withdrawal.

Can I close my Gemini account from the mobile app?

No, Gemini currently only allows customers to close their accounts from the web or a mobile browser.

Are Binance Chain (BEP20/BEP2 tokens) transfers supported by Gemini?

No, only ETH and ERC-20 token transfers sent over the main Ethereum network are accepted by Gemini.

Does Gemini have a signup bonus?

Yes, currently new customers can earn $10 in free Bitcoin after they've bought or sold at least $100 worth of cryptocurrencies on the platform in the first three days.

Features

Services | Cryptocurrency exchange, digital wallet, interest accounts, crypto-back credit card |

Supported Currencies | BTC, ETH, LTC, BCH, ZEC, GUSD, LINK, OXT, DAI, BAT, AMP, COMP, CTX, PAXG, ZRX, BAL, CRV, MANA, KNC, MKR, REN, STORJ, SNX, UMA, UNI, YFI, AAVE, FIL, SKL, GRT, BNT, 1INCH, ENJ, LRC, SAND, CUBE, BOND, INJ, LPT, MATIC, SUSHI, DOGE, ANKR, MIR, FTM, ALCX, XTZ, AXS, SLP, LUNA, UST, MCO2 |

Fees |

|

Debit Card Fee | 3.49% |

Interest Rates | Up to 4.86% |

Supported Areas | US: All states except Hawaii International: Canada, Hong Kong, Singapore, South Korea, and the UK |

Minimum Deposit | None |

Trading Minimums | Varies by token |

Transfer Methods And Fees |

|

Deposit Fees |

|

Withdrawal Fees | Varies by token |

Customer Service Phone Number | 1-866-240-5113 |

Mobile App Availability | iOS and Android |

Promotions | $10 worth of free Bitcoin (with referral link and after buying or selling $100 or more) |

Gemini Review

-

Liquidity

-

Fees

-

Products and Services

-

Supported Currencies

-

Security

-

Customer Service

Overall

Summary

Gemini is a cryptocurrency exchange that makes it easy to buy, sell, or store crypto with tools to help both beginner and advanced traders.

Pros

- Security-first mentality (first exchange to become SOC 1 Type, SOC 2 Type 1, and Type 2 compliant).

- Mobile apps available for trading on the go

- ActiveTrader™ offers professional-level trading features

Cons

- Limited payment methods (no debit card or credit card payments)

- Limited international availability

- Poor customer service and issue resolution

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves