Maintaining the proper asset allocation over time is one of the three keys to investing success over the long term. The reason is simple: over time, your ideal portfolio gets out of whack because some investments do better than others.

For example, if you were looking at your portfolio like I did last year, you would have noticed that your large cap U.S. stocks outperformed most other investments in your portfolio. As a result, you could be really out of whack in that sector this year. You may not think it matters - don't sell your winners - right? Well, what happens if the U.S. stock market corrects 10% this year? Then, instead of locking in gains, your new 51% of your portfolio would take a larger hit than necessary.

That's why asset allocation is key!

Why Most Investors Fail At Asset Allocation

But I bet you - even if you are diligent about selecting a proper asset allocation - you are still failing at maintaining a truly balanced portfolio. The problem? Multiple investment accounts. The truth is, over time, most investors simply build up multiple investing accounts, and so true total portfolio asset allocation becomes difficult.

Let's look at what can accumulate over time:

- Traditional Brokerage Account

- Roth IRA (see Best IRA Accounts)

- 401k (and you could have multiple of these as you change employers)

- SEP IRA (or solo 401k, or SIMPLE IRA)

- Real Estate (like RealtyMogul)

Now tell me this - are you really maintaining a solid asset allocation across all of these random accounts? Probably not.

But let's fix that right now.

Using Free Tools To Help

There are two free things that you can do right now to help. I've done both, and I'll share which one I prefer.

You can also check out our guide to portfolio analysis tools here.

Setting Up an Excel Spreadsheet

First, you can use Excel. Typically, if I'm helping someone put together the asset allocation for their portfolio, I'll use an Excel spreadsheet to balance out the various accounts. I was recently helping a family member, and they had a traditional brokerage account, 2 traditional IRAs (one for each spouse), 2 Roth IRAs, a pension for each of them that they would need to roll over, and then the basic checking and savings accounts. It can be daunting.

To illustrate this, I've attached my sample spreadsheet: Asset Allocation Spreadsheet. It's free, so download it and check it out.

The trouble with this method is that mutual funds and ETFs can sometimes be hard to dissect. You really have to dig in and figure out what the allocation is, because many mutual funds and ETFs are a mixed bag. You'll see in my spreadsheet how I split this up.

Using Empower For Your Accounts

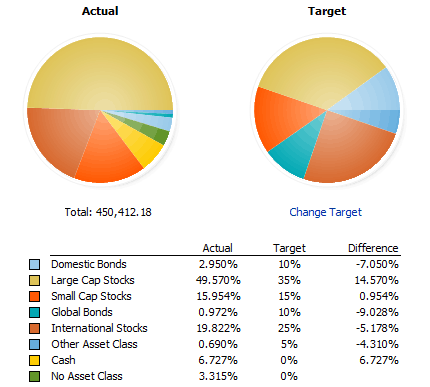

The method I prefer is to use a free program like Empower (you can also use Mint, but it's not as powerful). Empower (formerly called Personal Capital) automatically connects all your accounts into one simple dashboard, and it then sets up what your current asset allocation is automatically. Then, it displays everything in a simple, easy to read dashboard:

From here, you can then look at modifying your portfolio to get to your target asset allocation. The only drawbacks of Empower are that you cannot assign asset classes to investments (that's where the unclassified sections comes from), and you cannot easily setup a target asset allocation. But Personal Capital is free, and it does this painlessly for you.

Read our full Empower review here.

Using Paid Tools To Help

If using Empower isn't enough for you, there are paid tools that can help you. My favorite paid tool is Quicken, which you can use to manage all of your accounts and money in one simple place.

Quicken makes up for everything that Personal Capital doesn't have - you can assign investments to asset classes, and it allows you to setup your personalized asset allocation. Then, it quickly shows you what positions you need to reduce and where you need to add - so that you don't have to do any guess work on your own. It even offers you suggestions on where you can improve your holdings as well:

Now, you can quickly see where you need to rebalance your portfolio and do it in the right way. There is also a calculator available that shows you the specific dollar amounts you need to change - so when it comes time to actually make the trades, you know what you need to sell and what you need to buy.

** It's important to note that Quicken is only helpful if you use the PC version. The Quicken for Mac version is terrible and can't help with this.

Final Thoughts

It's essential that you rebalance your portfolio - I recommend yearly, and use tax season as the prime time to do it so that you don't forget. It can be easy to forget to rebalance your portfolio, especially after a solid year of gains that make you feel a bit flusher. But, if you don't want to be poorer this fall, you need to rebalance now!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller