There are no FAFSA income limits, and even wealthy families should likely fill out the FAFSA every year. In fact, it may actually be required by law in your state.

There is a difference, though, between filling out the FAFSA versus receiving need-based financial aid through your college. Need-based aid may have set limits.

It's no secret that the cost of attending college has increased rapidly over the past several years and decades. And while there are many scholarships and programs available to help with the cost of higher education, it can be cost-prohibitive for many people.

So it makes sense to try and minimize the cost you have to pay. Some ways to do this include choosing a lower-priced college, living at home and getting financial aid.

However, to qualify for any form of financial aid, you must fill out the FAFSA each year. Keep in mind there are income limits to qualify. Here’s what you need to know.

If you're worried about not qualifying for financial aid, watch our YouTube video that covers some options that will help you pay for college.

What is the FAFSA?

FAFSA is an acronym for the Free Application for Federal Student Aid. As the name suggests, the FAFSA is a government form run by the Department of Education that helps to allocate various forms of financial aid for higher education.

The FAFSA opens each year on Oct. 1 and closes on June 30 of the year in which you are applying for aid. That gives you nearly two full years to apply.Academic Year | Open Date | Deadline |

|---|---|---|

2024 - 2025 | December 28, 2023 | June 30, 2025 |

2025 - 2026 | October 1, 2024 | June 30, 2026 |

2026 - 2027 | October 1, 2025 | June 30, 2027 |

The FAFSA asks for a variety of different financial information. This includes information from:

- Federal tax forms

- Balances of checking, savings, and investment accounts

- Other records of money you've earned, both taxable and non-taxable

- W-2 information

If you’re filling out the FAFSA and you’re a dependent, you'll need both your information and your parents' financial information.

Is There a FAFSA Income Limit?

There is no FAFSA income limit. Anyone can fill out the FAFSA, and it's a good idea to fill out the FAFSA every year. While there are many grants and certain types of loans that have income limits, you may be eligible for certain opportunities even if you or your family have a high income.

And since there is no downside to filling out the FAFSA, you should plan to fill it out for each college student in your family, every year.

What Kinds of Financial Aid Are Available?

While the FAFSA is used for many forms of financial aid, it's not the only way to get money for college. There are other scholarships and grants that can help you pay for college.

But the FAFSA is the application that helps to determine the following forms of financial aid:If You're a High-Income Earner

Even if you think you make too much money to get any financial aid, it still makes sense to fill out the FAFSA each year.

Yes, it is true that you're unlikely to get a Pell Grant or any of the financial aid that is targeted to lower-income students, but that doesn't mean that you won't get anything. There are many different types of financial aid that use the FAFSA form.

Many colleges use FAFSA information to determine who qualifies for school-specific loans, grants, scholarships, and other types of financial aid.

By not filling out the FAFSA, your school's financial aid may not even consider you for any of those programs. This is yet another reason to make sure that you fill out the FAFSA each year, no matter your income.

Plus, filling out the FAFSA is a requirement to get Federal student loans. So if you will need (or want) loans, you need to fill this form out.

The Bottom Line

While many forms of financial aid are needs-based and targeted to those with lower incomes, there is not any form of FAFSA income limit. Instead, anyone can (and should) apply for aid every year they are enrolled in school.

There are many different types of financial aid available, and you never know what you might qualify for. Also, many schools use the information from the FAFSA to allocate their own scholarships and aid packages.

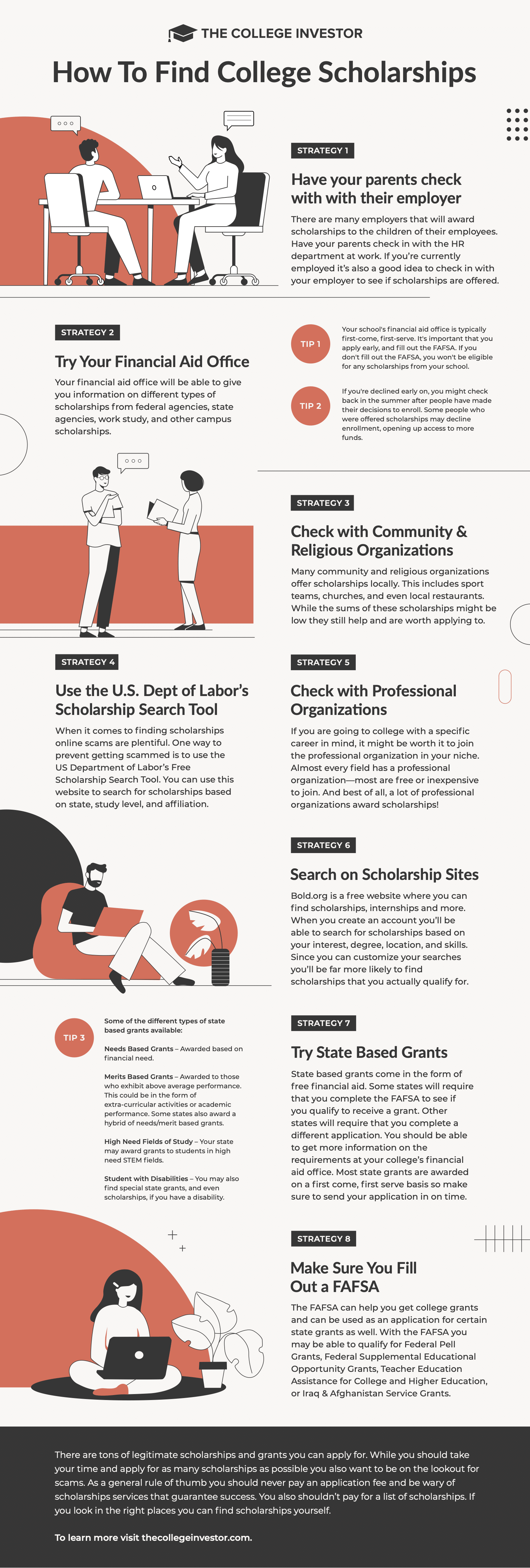

Check out our helpful infographic that shows you what steps to take to find more free money in the form of scholarships!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak Reviewed by: Colin Graves