Source: The College Investor

Why Do I Need A Cosigner For My Student Loans?

This question is about private student loans.

90% of private student loan borrowers require a cosigner, according to the Consumer Finance Protection Bureau (CFPB). You will need a cosigner for your student loans if you don't have a good credit score or history, a strong income, or low debt-to-income ratio.

When you're a college student, you typically don't have enough income or a strong enough credit history to qualify for a private student loan.

Parents are the most common cosigners for private student loans. With their credit history and income, a private student loan is much more likely to be approved.

Requirements For A Cosigner For Your Student Loans

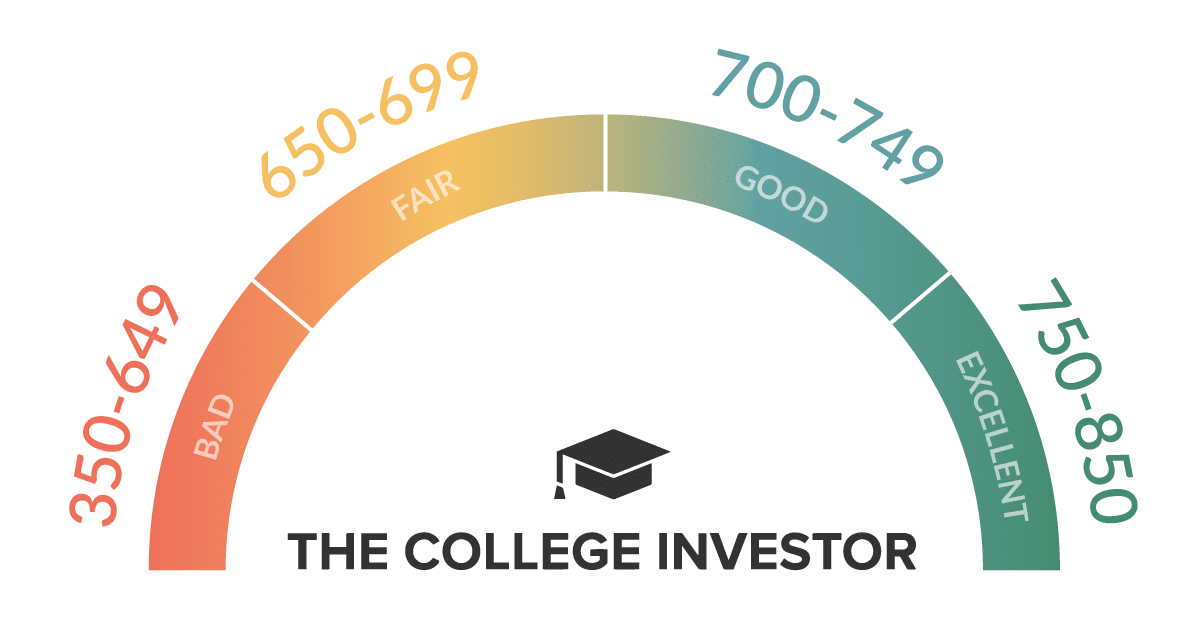

In order to qualify for a private student loan, you need to have a good income and debt-to-income ratio. You also need to have a good credit score.

Lenders will typically want to see a total debt-to-income ratio of less than 50%. What this means is that your total debt payments each month should not exceed 50% of your income.

This is an overly simply example, but say you earn $3,000 per month, your total debt payments should not exceed $1,500 per month.

A private student loan lender will look at the monthly cost of your future loan, and see if you can afford it.

Also, to get a student loan, you typically need to have a credit score above 700. To get the best rates, you need a credit score above 800.

If you, as a college student, don't meet the above criteria, you'll need a cosigner that does meet the criteria. The cosigner is just as responsible for the student loan as the main borrower. This is how lenders protect themselves.

Source: The College Investor

Cons Of Being A Cosigner

Being a cosigner is a financial risk. You are just as responsible for the student loan as the original borrower. If the student doesn't pay the loan, the cosigner has to pay the loan.

Should the loan go into collections and default, the cosigner is also at risk of being sued.

Some student loans offer "cosigner release", which is a program that if the borrower makes 24-36 months of on-time payments, and they meet the above lending criteria (good income, DTI, and credit score), the cosigner can be released from the loan.

However, cosigner release is very rare.

People Also Ask

Can I Get A Student Loan Without A Cosigner?

You can get a student loan without a cosigner, but it's rare. You must have a good income, low debt-to-income ratio, and good credit score. For a young student in college, this can be hard to achieve.

How Can I Get A Student Loan If My Parents Won't Cosign?

Anyone can cosign a student loan. While parents are the most common, you can ask other relatives (such as grandparents, aunts, uncles, older siblings, etc.) or even friends.

What Percentage Of Student Loans Have a Cosigner?

According to the CFPB, 90% of private student loans have a cosigner. Federal student loans never require a cosigner.

Related Articles

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Colin Graves Reviewed by: Mark Kantrowitz