Are you ready to start investing in college? Maybe you worked all summer and now you have some extra cash on hand, maybe $1,000 or more. If so, nice job! Now, do you take that $1,000 and spent it on beer all year? Or do you take that money and invest in college?

Well, if you spent it on beer, you will drink fine all year. But if you invest it, by the time you retire, assuming you do nothing with that initial investment, it could be worth around $13,000. So, was the beer worth $13,000?

Investing is a great way to save for the future, as long as you are responsible and disciplined. It doesn't require a huge up-front investment, and it doesn't require a lot of time or effort. All it requires is a small tolerance for risk, a dedicated time horizon, and an up-front time investment of an hour.

If you're not in college, check out our other guides in this series:

Why Start Investing In College?

Let's first talk about why you should start investing in college. The big reason is TIME.

Time in the market beats timing the market.

What this means is that the best way to grow your money is simply time. The earlier you start investing, the more time your money has to grow.

Sadly, too many college students are impatient - and it's not sexy to see your $1,000 investing grow to just $1,080 by the end of the year. While seeing your money grow $80 is great - it's not life changing, and that can be discouraging.

But where you really see the gains is in the future. By starting to invest at 18 versus 30, you have a 12 year lead over that same individual. Check this out: how much you need to invest per year to make it to $1,000,000 by 62 years old.

Age | Amount To Invest Per Year To Reach $1,000,000 |

|---|---|

18 | $2,100 or $175 per month |

19 | $2,292 or $191 per month |

20 | $2,520 or $210 per month |

21 | $2,772 or $231 per month |

As you can see, if you get started investing at 18 years old, you only need to invest about $2,100 per year to be a millionaire by age 62. That number starts to go up a lot the older you get. If you wait until 30, that number becomes $6,900 per year you need to invest - over 3x the amount per year. All because of time.

I'm also a firm believer that most college students can come up with $175 per month, through side hustling in college or working while in school.

Related: The Rule Of 72 For Investing

Where To Open An Account

Over the last decade, technology has made investing available to everyone for a low price - even free. Gone are the days when you had to sit down with an "investment advisor" and plan out your investments (for a high cost).

Today, there are a lot of places that you can invest and buy stocks for free. There are also mobile apps that allow you to invest for free.

We have a few recommendations about where to open an account based on how you want to invest.

M1 Finance

M1 Finance is a revolutionary platform that allows you to invest in stocks and ETFs for free. With M1, you can build a portfolio, and the automatically invest into your portfolio for free! It's a great way to get started at no cost to you. Check out M1 Finance here.

Robinhood

Robinhood is great if you want to invest in individual stocks or trade options. This isn't recommended for investors starting out, but their platform is free - and that's awesome. The drawback of Robinhood versus M1 is that Robinhood doesn't allow fractional share investing, which can make it hard for beginner investors with not a lot of money to get started. Check out Robinhood here.

Fidelity

Fidelity is one of our favorite brokers because they are a full service firm that can grow with you as you invest and gain more assets. Fidelity does offer some free investing options - including no minimum IRAs and commission free ETFs. Check out Fidelity here.

If you want other options, check out this great comparison chart of the best brokers for you.

What Type Of Account To Open

If you are new to investing, the first thing that you need is a brokerage account. Investing cannot be done at a bank, but must be done at a separate entity (even though some banks do have brokerages within them). We recommend M1 Finance or Fidelity to get started.

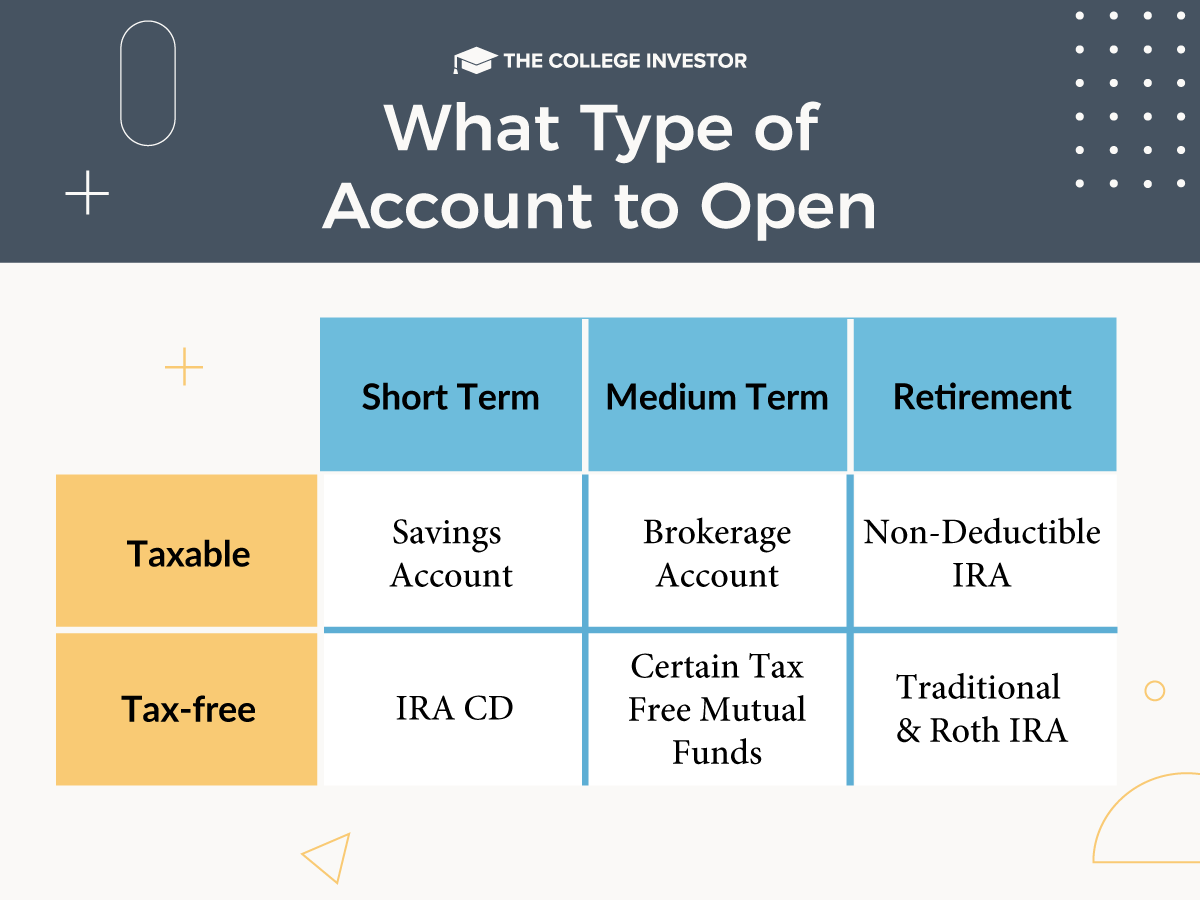

When you sign up on the platform you want, you have several options:

Cash Account: This is the most basic account. It allows you to purchase any type of security you want with your cash on hand. This option is suitable for most investors, especially ones starting out, and ones who don't want their money locked up until retirement.

Margin Account: This account is similar to the cash account, except that you can borrow money to invest. This account enables some features a cash account doesn't, such as shorting investments, and selling uncovered options.

Traditional IRA: This is the traditional retirement account vehicle. It is similar to the cash account in that you can purchase securities with the cash you have available. However, this account places a limitation that you cannot withdraw that money inside it until you are at least 59 1/2. However, you get a tax benefit for all money invested up to the limit (which is $5,000, or $6,000 if over 50). You will have to pay taxes on any money you withdrawal once you do retire.

Roth IRA: This is similar to the Traditional IRA, except that you do not receive a tax benefit in the year you invest, but, at retirement, all of your withdrawals are tax-free.

So, what is the best option? If you want to save for retirement now, and you earned your income (meaning it came from work and not Mom and Dad), a Roth IRA is the way to go. The reason is the tax you pay on your income now is so low, that you get huge savings in taxes when you retire. However, if you don't want to tie up your money for 40 years, a cash account is a great way to start. If you want a more detailed guide, check out What Type of Investment Account Do I Open?

So I Opened My Account, Now What?

Once you have opened you account, the money is just sitting there not doing anything for you. This is where a little time is involved to educate yourself, and a little discipline about your time horizon comes into play.

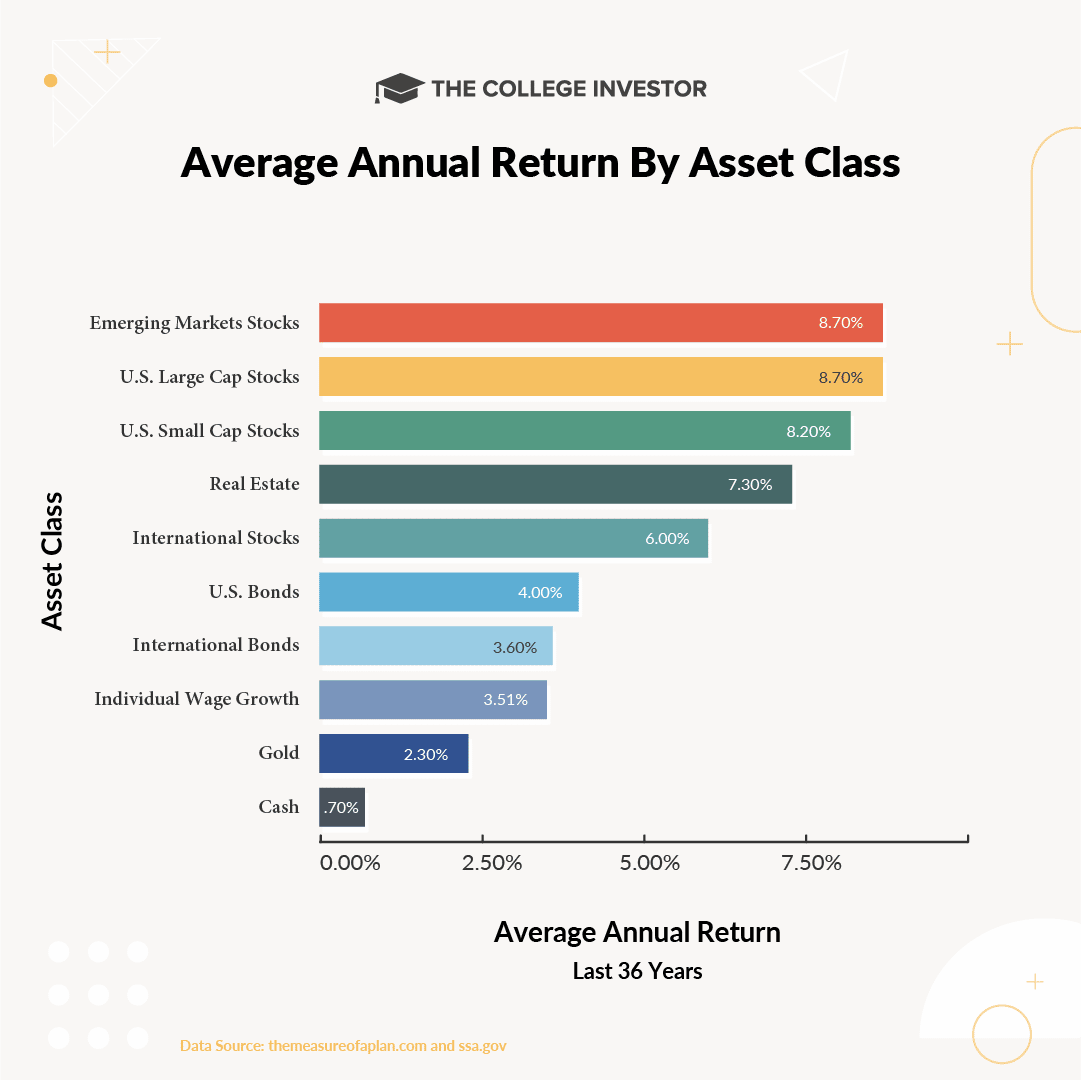

I want to start by saying you can, and may for short periods of time, lose money. For example, the S&P 500 (the largest 500 companies in the United States) returned a nice 27.11% in 2009. That is awesome. However, it lost a huge 37.22% in 2008. There are huge swings in the market. However, the reason people invest is because the return on the S&P 500 annualized for the past 20 years has been 8.12%. There were up years and down years, but if you just did nothing, you would have gained 8.12% annually. This beats the standard for a savings account, which grew by only 2.81% annually.

So, taking that into consideration, it is highly recommended that if you are investing for the long term, you look at index funds. Index funds come as either mutual funds or ETFs, and they track an index, such as the S&P500 or Dow Jones Industrial Average. The most common and highly recommended Mutual Funds and ETFs out there are here:

- iShares S&P500 Index (IVV)

- Schwab S&P500 Index (SWPPX)

- Vanguard 500 Index (VFINX)

- Vanguard Total Stock ETF (VTI)

- Vanguard Total Stock Market (VTSMX)

When you go to purchase these funds, you will pay a commission to buy it (unless you use a service like M1 Finance). This is paid each time you make a trade. If you read the post above about where to invest, you can see that commission vary widely, and there are often specials or promotions you can take advantage of.

Also, you will most likely be asked if you want to reinvest your dividends or take them as cash. Most large companies in the U.S. pay dividends to their shareholders. As a small owner in each company in the fund you purchased, you get your dividends too. The fund will usually pay these out quarterly or annually.

If you are investing for the long term, I recommend reinvesting your dividends, as it will boost you return.

If all of this sounds a bit much, check out this guide: The Beginners Guide To Investing In The Stock Market.

I Did It! Now What?

So, now you have invested your $1,000 in a good index fund. Congratulations. Now, just wait it out and add more money every month or year. Setup an automated deposit and investing option so that you can keep growing your portfolio.

The stock market will go up and down. The worst possible thing you can do is panic if the market drops, and sell your investments. The market will recover, and if you are invested for the long term, you will reap the gains.

Always remember, it's important to start investing early. If you can start investing in college, you'll have a huge leg up on everyone you know!

Does anyone else have any tips or advice on getting started? Any great fund ideas for beginners?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Danny Cieniewicz, CFP®, CCFC