Affirm is a company that offers installment plans for consumer purchases and may help keep people from accumulating unwanted debt. It may be useful for those who want more options to make purchases without falling into credit card debt.

After all, 40% of consumers with credit card debt also stay in debt. Another survey revealed that revolving balances topped an average of $6,500.

So, what can Affirm do for you? Here’s what you need to know before you decide if it's right for you.

Affirm Details | |

|---|---|

Product Name | Affirm |

Monthly Fee | None |

Debit Card Option | Debit+ Card (only available to Affirm customers) |

Interest Fee | 0% to 30% |

Promotions | None |

What Is Affirm?

Affirm is a consumer credit company that offers an alternative to credit cards. It extends credit to shoppers who want to pay off big-ticket items in three-, six-, or 12-month installments. Affirm claims to be a consumer-friendly company that doesn’t charge late fees and is transparent about any charges before you make the purchase.

The interest rates it charges are slightly lower than rates charged by credit card companies, and the payoff period is a year or less. Compare this to potential years it would take to pay off large credit card bills if you only paid the monthly minimum.

What Does It Offer?

Affirm is a consumer financing company, but it doesn’t offer credit cards or other traditional debt products. The company is upfront about interest fees and timelines to debt payoff.

Interest-free Financing May be Available

If you’re seeking interest-free financing, Affirm may interest you. The company’s three-month payment plan often carries a 0% interest rate. If you can afford to pay off the purchase in three months, you may not have to pay a cent in interest or fees.

Not everyone qualifies for interest-free financing, as you need to have a reliable source of income and decent credit. If you qualify, you can make interest-free payments on your new refrigerator, couch, or computer.

Clear Terms for Payment Plans

If you don’t qualify for interest-free financing, you have the option of choosing Affirm payment plans. You will pay interest on these, but the plans will allow you to pay off your new purchase in 12 months or less. The current rates (between 0%-30%) are modestly lower than typical credit card rates, which are nearly 21%.

Even though making payments can reserve liquid cash in your savings, it will eat into your future cash flow.

Payments for these plans will typically be reported to the credit bureaus, so it’s important to make payments on time, as it will affect your credit history.

No Late Fees

Affirm doesn’t charge late fees, annual fees, or any other form of fee. It does charge interest and failing to make a payment will affect your credit score and your ability to get credit from Affirm and other lenders.

Debit+ Card with Purchase Splitting

Affirm recently rolled out its Debit+ Card and only existing Affirm customers are eligible to apply. This card allows you to split all your purchases over $100 into four bi-weekly payments with no interest. This could be helpful if you have a major necessary purchase that you want to pay off over four paychecks instead of all at once.

Purchase splitting is not reported to any of the major credit bureaus, so it does not affect your credit score.

Are There Any Fees?

Affirm doesn’t charge fees, but you will pay interest on most of its payment plans. The interest rates range from 0% to 30%. The rate you’ll pay depends on your credit history, your income, and other factors. Most of its three-month plans are interest-free.

How Do I Contact Affirm?

Affirm’s Customer Care Center is located at 30 Isabella Street, Floor 4, Pittsburgh, PA 15212.

You can also email the Customer Care team at help@affirm.com. The company website has a more detailed contact form for people seeking specific details.

How Does Affirm Compare?

Affirm is one of the best-known companies when it comes to buy-now-pay-later platforms. It’s on par with competitors like Perpay and Zebit.

Although Affirm’s transparency is refreshing compared to a credit card company’s fine print, their interest rates aren’t that great. This is especially true since credit card issuers have rolled out their own form of BNPL, known as an installment payment plan. They allow you to split up payments in monthly installments.

Top 10 Best Rewards Credit Cards

Here are important features to look for in a credit card. Go through our list of the most rewarding credit cards for miles, points, and cash back.

The catch is that you’d pay interest on it, but some installment plans have 0% or low interest rates—this is because credit card companies want you to spend. With more credit cards offering this installment loan option, it’s hard to see value in a product like Affirm, unless of course, your credit card doesn’t have this option.

Overall, a credit card that offers installment payment plans with a lower interest rate makes more sense than choosing Affirm.

How Do I Open An Account?

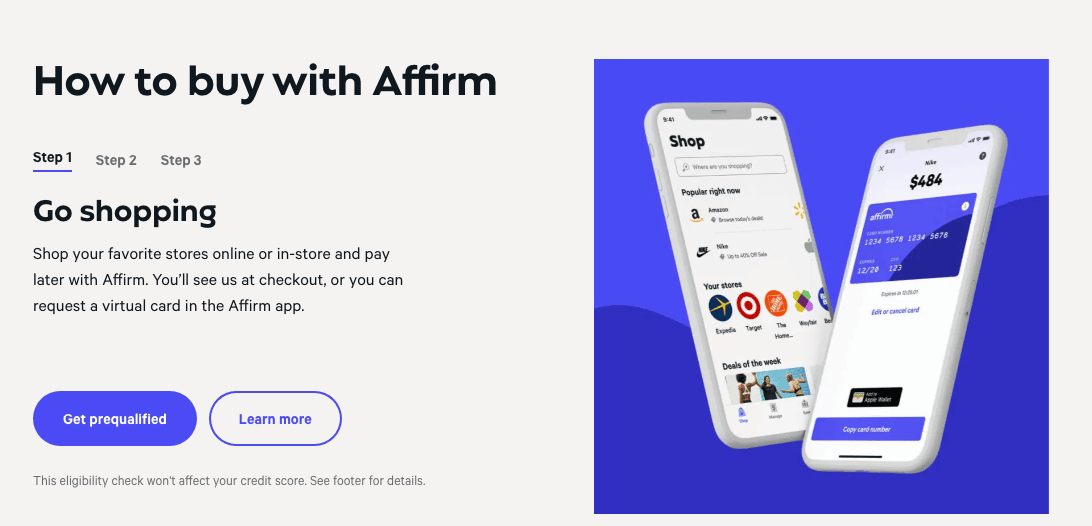

You can create an Affirm account through Affirm.com, or any of its online partner stores.

To open an account, you must be at least 18 years old, have a Social Security Number, and a valid U.S.-based cell phone number.

Each time you apply for a payment plan through Affirm, you need to qualify for the plan. This depends on your income, your credit history, and your history with Affirm.

Is It Safe And Secure?

Affirm is a banking company, so it follows all banking standards to protect your data and money. All personal data is encrypted and the Affirm team has security training to help prevent data breaches. While any data that is online is at risk, Affirm has protocols and technologies designed to minimize lost or stolen data.

Is It Worth It?

Affirm is a consumer debt company that makes money when people make online purchases with a repayment plan. It offers interest-free financing options, which could be helpful if money is tight. Ironically, the reason why money is sometimes tight is because people overspend.

Having a payment plan with Affirm is like taking on credit card debt. It’s typically best to avoid debt if you can.

If you have cash flow challenges, consider 0% introductory rate credit cards before taking on payment plans with Affirm.

Affirm plans may have end dates, but credit cards offer more flexibility. Whether you choose Affirm or a credit card, it’s still debt, so it makes sense to find the best interest rate.

Are you a part of the 40% of Americans who have revolving credit card debt? Consider Tally, an app that helps you:

- Pay down your credit card debt faster

- Get multiple credit cards organized in one place

- Never pay late fees again

- Lower your APR

Affirm's Features

Products |

|

Monthly Fees | None |

Interest Rates for Installment Repayments | 0% for the first 3 months only |

Current Rates | 0% to 30% |

Customer Service Number | 888-483-2645 |

help@affirm.com | |

Affirm's Contact Form | |

Address | 30 Isabella Street, Floor 4, Pittsburgh, PA 15212 |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Promotions | None |

Affirm Review: Is It Worth It To Buy Now Pay Later?

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Interest Rates for Repayment

Overall

Summary

Affirm is a company that offers installment plans for consumer purchases and may help keep people from accumulating unwanted debt. It may be useful for those who want more options to make purchases without falling into credit card debt.

Pros

- Spread payments out over 3, 6, or 12 months

- Interest rates and total costs are clearly disclosed

Cons

- High-interest rates on consumer debt

- Adds future payment obligations that may decrease opportunities to save in the future

- Can’t earn cash-back or points for purchases

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington