Facet is a subscription-based financial planning service.

No matter how savvy you are with your finances, sometimes it makes sense to consult a professional for help.

Most small business owners I know pay for an accountant to help at tax time. Generally, working with an insurance broker can help you save money on your homeowners and car insurance. At a certain point, you may want to pay an attorney to help you with estate planning or getting a will in place.

Sure, you could do these things on your own. But the peace of mind, and the advanced knowledge that comes through working with an expert may be worth it in some cases.

But what about your basic financial management and financial life planning? Is it ever worthwhile to pay someone else to do that? I argue that in many cases, it’s a great idea.

But the model where an investment advisor charges 1% of your investment balances to give you financial planning services seems a little crazy. That structure can seriously erode your ability to build wealth, especially if the investment advisor does little more than manage your investments.

Because of that, I am excited to see that more financial planning firms are starting to offer subscription-based models for financial planning. These models allow individuals to pay a flat annual fee for full-service financial planning.

One company offering this model is Facet Wealth. If you’re considering finding a financial planner, I think that looking at Facet Wealth could be a great choice.

Here’s what you need to know about the company in our Facet Wealth review.

What Is Facet Wealth?

Facet Wealth is a financial planning company. It hires CERTIFIED FINANCIAL PLANNER(TM) professionals (who are required to work in your best interest) to provide financial planning services as well as manage most accounts.

Unlike many investment management companies, Facet Wealth doesn’t charge based on the amount of money it manages for you. Instead, it charges on a subscription model.

What Does It Offer?

When you work with Facet Wealth, you’ll have a dedicated CFP(R) professional who works with you on your financial goals. What exactly does a CFP(R) professional do for you? Generally, a CFP(R) professional will review your current spending and income, help you establish a few short-, medium-, and long-term goals, and create a plan that will help you achieve those goals.

As your life changes (and it will), the CFP(R) professional will help you to adjust your plan to reflect your new reality. CFP(R) professionals are also likely to help you determine insurance needs, whether you need to update your will, and will also likely suggest options for making your savings goals more achievable.

What Are The Advisory Fees?

Fees range from $1,200/year ($100/month) - $6,000/year ($500/month)r. Fees are set based on the complexity of financial planning needs.

For example, a young person simply trying to pay off credit card debt and save an emergency fund will probably pay $100 per month or $1,200 per year. A couple with substantial assets, children from prior marriages, and an interest in tax-efficient charitable giving will probably pay $5,000. According to Facet Wealth, most clients fall in the middle of that range.

In terms of whether Facet Wealth is priced competitively, I think it is. Most people with less than $250,000 in assets will struggle to find any financial planner to serve them. Those with assets under $1 million generally pay a 1% fee to financial planners.

So imagine a couple with $250,000 wanting to get help from a financial planner. That couple would pay 1% of their assets, or $2,500 for financial planning. With Facet Wealth, the person would be more likely to pay $1,200 to $2,000 (depending on their financial planning needs).

Some financial planners who are just getting started may offer lower rates, but Facet Wealth seems like a reasonable price given the product.

How Does Facet Wealth Compare?

Interested in subscription-based financial planning, but want to compare a few options first? It may help to know what companies offer a similar model.

One similar company is The Financial Gym which is a New York City-based company that offers proprietary financial training. The financial trainers are not CFP(R) professionals, but they have been trained to help people who aren’t well-served by traditional financial planning models. For example, they explain the best student loan repayment options, work to improve spending habits, and give clients income goals to meet.

Additionally, many financial planners that are aligned with the XY Planning Network offer subscription-based models. However, not all network members offer that fee structure. Be sure to understand the planner’s pricing model before starting a relationship with them.

If you prefer to pay a percentage of your assets rather than a flat subscription fee - but still want access to a dedicated financial advisor - you might want to check out Farther Finance. Or if you don't think that you'll need human advisor support, you could save a lot of money by choosing one of the top robo-advisors instead.

Header | |||

|---|---|---|---|

Rating | |||

Annual Fee | $1,200 to $6,000/yr | 0.35 to 0.80% | 0.25% |

Min Investment | $0 | $100,000 | $500 |

Human Advisors | |||

Cell |

How Do I Open An Account?

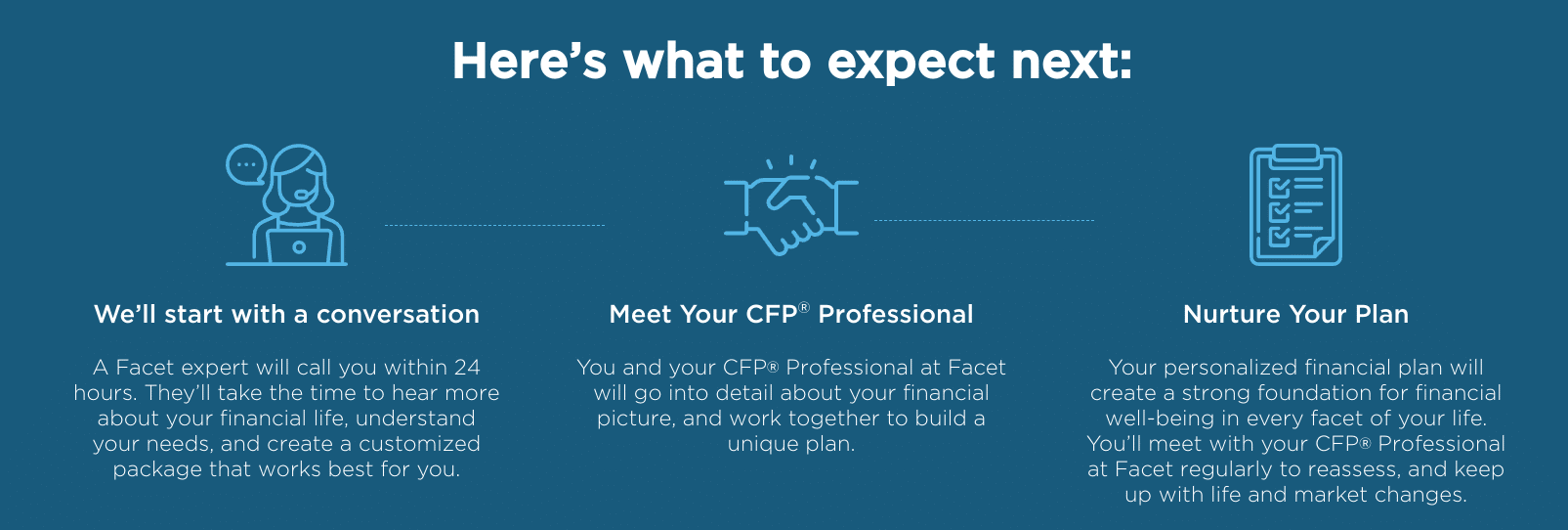

The process of signing up with Facet Wealth involves three main steps. First, you'll provide your basic contact information to set up a phone call with one of the team's experts. You should receive your call within 24 hours of filling out the contact form.

Next, you'll meet your dedicated CFPⓇ Professional and work together to create your plan. Once its in place, your advisor will check in periodically to reassess and to see if you've had any significant life events that could be cause for adjusting your plan. Facet Wealth says that its advisors meet with their clients four times per year on average.

Is My Money Safe?

Facet Wealth is an SEC-registered investment advisor, which should mean that your investments are SIPC-insured up to $500,000. However, that insurance would only protect against Facet Wealth going bankrupt, not against investment depreciation.

The good news is that as fiduciary advisors, Facet Wealth CFP professionals are required to only make investment recommendations that are in your best interest financially. And since the firm charges a flat subscription fee rather than commission-based products, you won't ever be pushed to buy expensive investments from advisors that are just looking to paid their own paychecks.

As far as data privacy goes, Facet Wealth's website is encrypted and they have a detailed privacy policy that you can review here.

How Do I Contact Facet Wealth?

To set up your initial consultation, you can call 443-376-6222 or email the Facet Wealth team at info@facetwealth.com. Once you've set up your account, you'll receive separate contact information for the specific advisor that you're assigned.

Facet Wealth doesn't currently have any customer reviews on Trustpilot. But the firm is rated A+ by the Better Business Bureau (BBB).

Is It Worth It?

Generally, I think Facet Wealth has the right business model for financial planning. With low-cost “robo-advisors,” and easy DIY investment solutions, asset management by itself doesn’t offer a huge value. However, I think that great financial planning and personalized financial advice is worth the cost.

At the end of the day, you’ll have to evaluate your personal needs. Can you DIY your financial plan, or are the complexities starting to add up? Do you think a professional would provide the knowledge and accountability to take your finances to the next level or are you making enough progress on your own?

If you’re looking into financial planning services, I think it’s worth speaking to a representative from Facet Wealth. In the right circumstances, I think the benefits could be tremendous.

Facet Wealth FAQs

Here are the answers to some common questions that people ask about Facet Wealth.

Are Facet Wealth financial advisors fiduciaries?

Yes, Facet Wealth only hires CFPs as advisors which means that they're held to a strict duty to work as fiduciaries on their clients' behalf.

Does Facet Wealth have local offices?

No, all of Facet Wealth's advisors work virtually with their clients.

Can you meet with a Facet Wealth advisor at night?

Yes, your advisor will work around your schedule whether that means meeting in the morning, evening, or afternoon.

How many clients does Face Wealth have?

Facet Wealth currently has more than 7,500 clients.

Facet Wealth Features

Account Types |

|

Minimum Investment | $0 |

Set Up Fees | None |

Annual Management Fees | $1,200 to $1,600/yr |

Socially Responsible Investments | Yes |

Access to Human Advisor | Yes, included in management fee |

Rebalancing | Yes |

Tax-Loss Harvesting | Yes |

Customer Service Number | 443-376-6222 |

Customer Service Email | info@facetwealth.com |

Social Media | |

Web/Desktop Availability | Yes |

Mobile App Availability | None |

Promotions | None |

Facet Wealth Review

-

Commission and Fees

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Personalization

Overall

Summary

Facet Wealth is a hybrid financial advisor that provides subscription-based financial planning services.

Pros

- Unlimited access to a dedicated CFP

- “Pay for what you use” model

- No minimum investment requirement

- User-friendly account management platform

Cons

- Flat fee could be expensive for small accounts

- Not good if you prefer to meet in person

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller