Front-loading of financial aid like grants and scholarships is a form of bait-and-switch, where a college gives a better financial aid offer to freshmen than to sophomores, juniors and seniors.

When a college practices front-loading of financial aid, the average grant per recipient decreases after the first year and/or the percentage of students receiving grants decreases.

This means students get smaller grants and/or fewer students get grants. Even if a college keeps the grants unchanged, the net price will increase as college costs increase.

Front-loading of grants causes the mix of grants vs. loans to become less favorable after the freshman year. The family’s share of college costs increases significantly for upperclassmen, even if their ability to pay for college remains unchanged.

Statistics Concerning Front-Loading of Grants

More than four-fifths of colleges practice front-loading of grants, based on an analysis of data from the 2021 Integrated Postsecondary Education Data System (IPEDS). IPEDS data is provided by the colleges and is published by the National Center for Education Statistics (NCES) at the U.S. Department of Education.

IPEDS data provides two sets of statistics, one for full-time first-time undergraduate students (i.e., freshmen) and one for all undergraduate students. These statistics include:

- The number of students awarded federal, state, local, institutional or other sources of grant aid

- The total amount of federal, state, local, institutional or other sources of grant aid awarded

- The total number of students

One can subtract the figures for full-time first-time undergraduate students from the figures for all undergraduate students to calculate the figures for upperclassmen.

The ratio of the number of students awarded grants to the total number of students yields the percentage of students receiving grants.

The ratio of the total amount of grants to the number of students awarded grants yields the average grant per recipient.

More than half (54%) of 4-year colleges reduce the average grant by at least $1,000. More than three-fifths (62%) of 4-year colleges reduce the percentage receiving grants of at least 5% percentage points. More than four-fifths (82%) of 4-year colleges satisfy either or both of these definitions.

Public colleges are more likely to practice front-loading of grants. Among public 4-year colleges, 88% satisfy either or both of these thresholds. Among private non-profit 4-year colleges, 80%. Among private for-profit 4-year colleges, 75%.

The most selective colleges are less likely than less selective colleges to practice front-loading of grants, although it is still a high percentage. Among 4-year colleges that admit less than 40% of applicants, 70% satisfy either or both of these thresholds. Among 4-year colleges that admit more than 40% of applicants, 83% satisfy either or both of these thresholds.

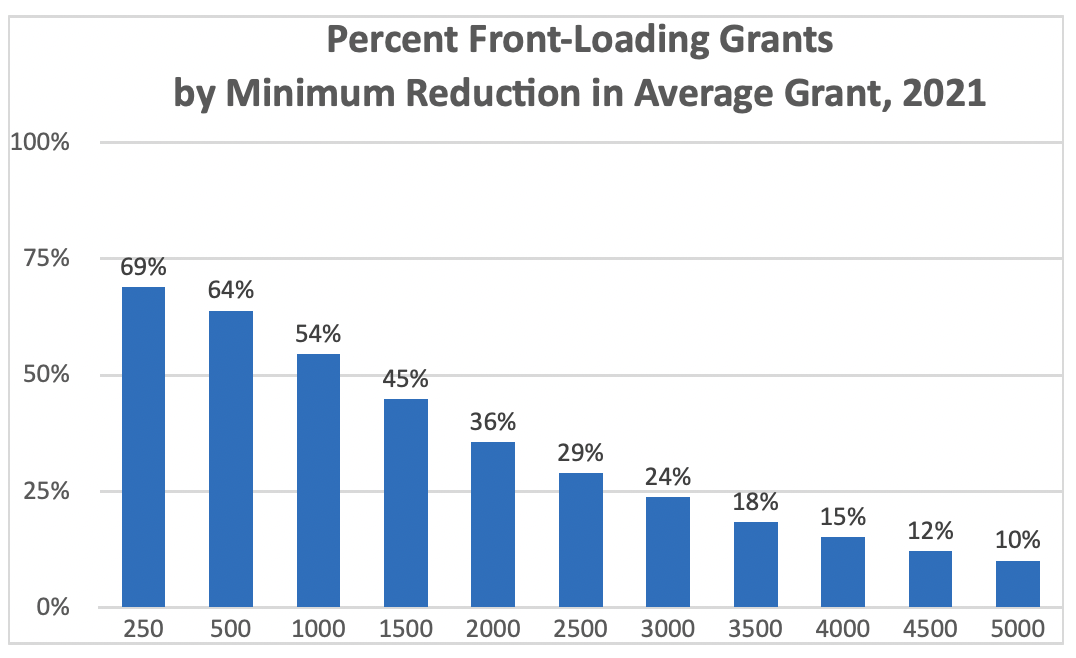

This chart shows the percentage of 4-year colleges reducing average grants by at least each specific dollar amount.

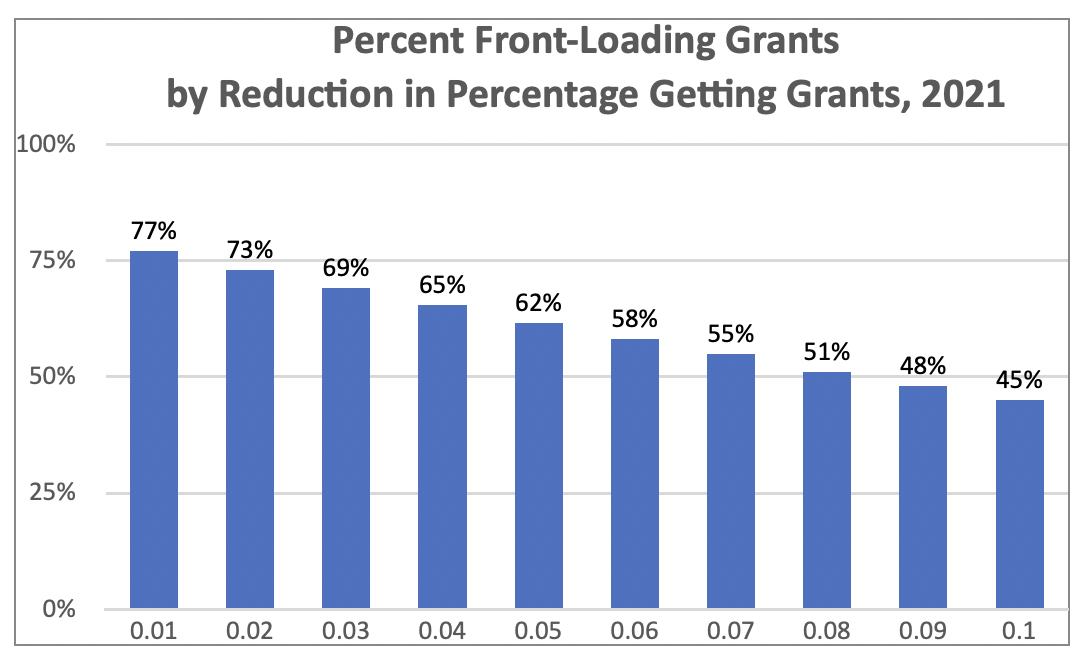

This chart shows the percentage of 4-year colleges reducing the percentage of students receiving grants by at least a specific percentage point.

MIT, Swarthmore, Amherst, Bowdoin, Tulane, Harvey Mudd, UCLA, Georgetown, USC, Carnegie Mellon University, UC Berkeley, University of Michigan at Ann Arbor and UNC Chapel Hill do not practice front-loading of grants. For example, at MIT there is no change in the percentage receiving grants, and the average grant increases by about $2,000 for upperclassmen.

Among the Ivy League colleges, only Princeton and Cornell do not practice front-loading of grants. The others all practice front-loading of grants.

One Ivy League institution, who shall remain unnamed, has a 16% percentage point reduction in the percentage of students receiving grants, and the average grant decreases by about $12,500 for upperclassmen. This same college has one of the lowest graduation rates among the Ivy League colleges.

How to Tell If a College Practices Front-Loading of Grants

You can’t use a college’s net price calculator to determine whether a college practices front-loading of grants, since net price calculators are limited to just the freshman year in college.

Instead, you can use the U.S. Department of Education’s College Navigator tool to determine whether a college practices front-loading of grants.

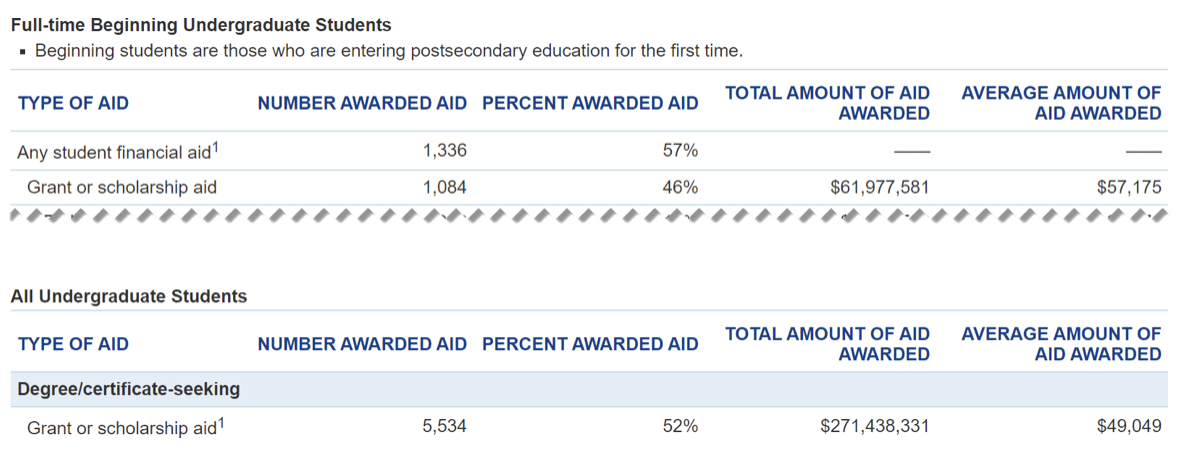

Search for the name of the college, then click on the Financial Aid tab in the search results. There will be two sets of numbers, labeled Full-time Beginning Undergraduate Students and All Undergraduate Students. Look at the Percent Awarded Aid and Average Amount of Aid Awarded columns for the Grant or scholarship aid rows. A little arithmetic will yield the average grant for upperclassmen for comparison with the figure for freshmen.

For example, consider a college with the following figures shown in College Navigator. Subtract the Total Amount of Aid Awarded and Number Awarded Aid for Full-Time Beginning Undergraduate Students from All Undergraduate Students, yielding $209,460,750 and 4,450. Divide the latter into the former, yielding an Average Amount of Aid Awarded of $47,070 for upperclassmen. That’s more than $10,000 lower than the average grant aid for freshmen. This college clearly practices front-loading of grants.

Note that you don’t need to do the math to tell that the average grant awarded to freshmen is higher than the average grant awarded to all undergraduate students. It is less precise than calculating the figures for upperclassmen, but it still shows that the college practices front-loading of grants.

Impact of Front-Loading on Outcomes

Front-loading of grants may have an initial positive impact on college enrollment, since the grants make college seem to be more affordable. Front-loading of grants helps colleges recruit more students.

But, college retention may fall due to increased costs after the first year. The increased costs will disrupt the student’s academic progress, as they are forced to find other ways to cover the college costs. They may, for example, have to work longer hours to earn more money to pay for college. But, students who work a full-time job are half as likely to graduate within six years as compared with students who work 12 hours or less per week.

They may also have to borrow more, increasing student loan debt at graduation.

The increase in the net price will have a negative impact on college graduation rates. More students will drop out when they can’t afford to pay the college bills or when working longer hours takes too much time away from academics.

Front-loading of grants has a negative impact on transfer students, who receive less aid than students who started as freshmen.

Colleges Can’t Justify Front-Loading of Grants

Front-loading of grants cannot be explained by changes in family financial circumstances. Although some students may qualify for less financial aid because of increased family income, most students experience flat family income. Overall, changes in family income do not explain the decrease in average grants, nor do they explain the shift from grants to loans.

Likewise, front-loading of grants cannot be explained by non-renewable scholarships, as the net impact is relatively small, especially when one considers the impact of scholarship displacement. Also, unmet need exceeds $10,000 on average nationwide.

Some colleges argue that a very high percentage of their enrollment comes from transfer students, and they are less generous to transfer students. That may be true, but that’s hardly something to be proud of. Only 4% of 4-year colleges have more than a quarter of their undergraduate enrollment from transfer students.

Mark Kantrowitz is an expert on student financial aid, scholarships, 529 plans, and student loans. He has been quoted in more than 10,000 newspaper and magazine articles about college admissions and financial aid. Mark has written for the New York Times, Wall Street Journal, Washington Post, Reuters, USA Today, MarketWatch, Money Magazine, Forbes, Newsweek, and Time. You can find his work on Student Aid Policy here.

Mark is the author of five bestselling books about scholarships and financial aid and holds seven patents. Mark serves on the editorial board of the Journal of Student Financial Aid, the editorial advisory board of Bottom Line/Personal, and is a member of the board of trustees of the Center for Excellence in Education. He previously served as a member of the board of directors of the National Scholarship Providers Association. Mark has two Bachelor’s degrees in mathematics and philosophy from the Massachusetts Institute of Technology (MIT) and a Master’s degree in computer science from Carnegie Mellon University (CMU).

Editor: Colin Graves Reviewed by: Robert Farrington